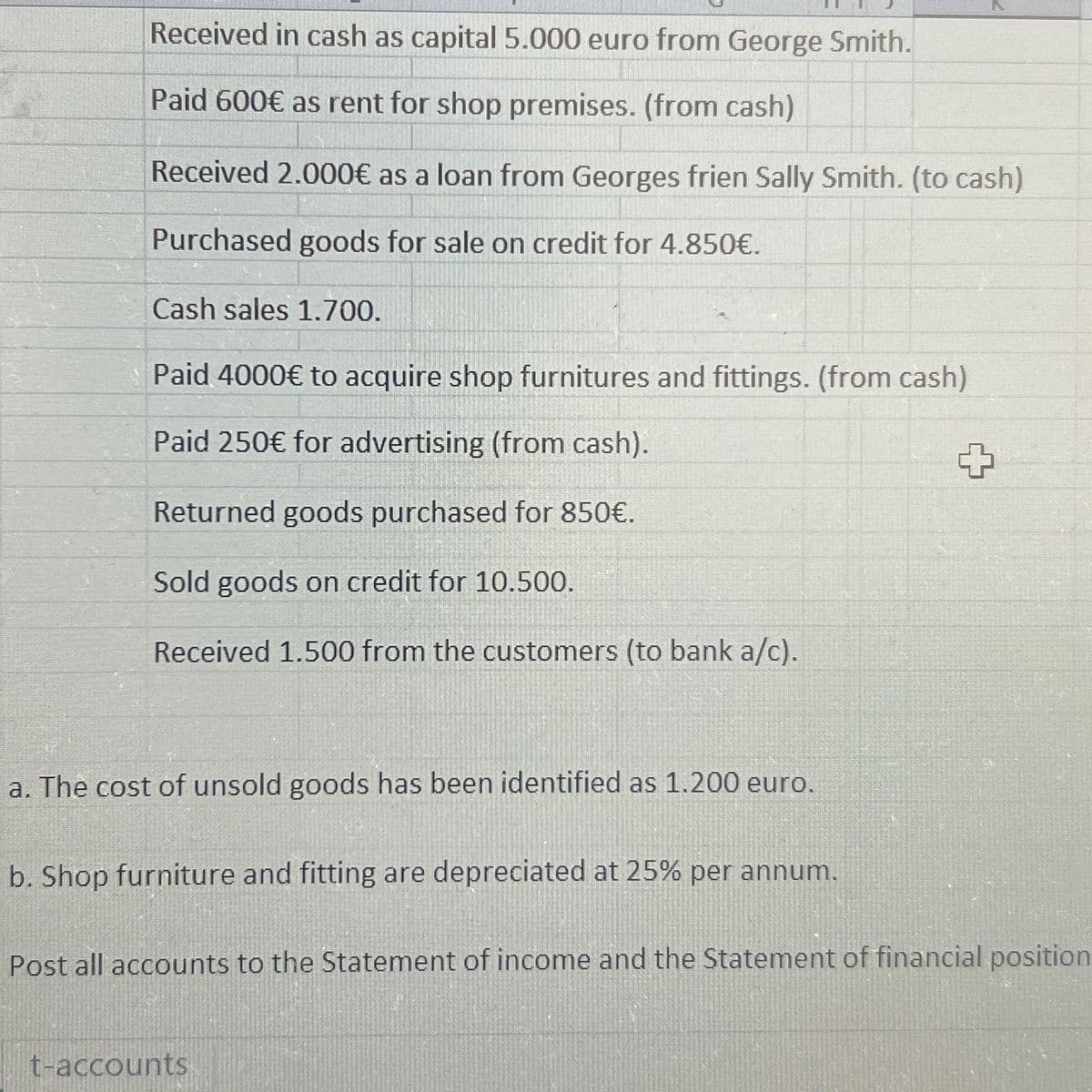

Paid 600€ as rent for shop premises. (from cash) Received 2.000€ as a loan from Georges frien Sally Smith Purchased goods for sale on credit for 4.850€. Cash sales 1.700.

Q: 7 cept special order. BE7-3 (LO 2) Waterloo Co. sells product P-14 at a price of $48 a unit. The…

A: Special order decision refers to all those decisions or situation of the management in which they…

Q: Fool Proof Kitchens manufacturers custom made self-cleaning professional grade food processors. The…

A: The product costs comprises of direct and indirect costs. The direct costs are direct materials and…

Q: Marx Supply uses a sales journal, purchases journal, cash receipts journal, cash payments journal,…

A: Cash Payment journal records all cash payments transactions done by business. In the given case,…

Q: Activity-Based Supplier CostingLevy Inc. manufactures tractors for agricultural usage. Levy…

A: Activity Based Costing By tying each cost to an activity that takes place during the manufacturing…

Q: Physical Units Method Alomar Company manufactures four products from a joint production process:…

A: Introduction: A joint cost is an expenditure that helps and over one product and it can be split…

Q: The fixed budget for 21,000 units of production shows sales of $462,000; variable costs of $63,000;…

A: The benchmark is established in advance, and actual performance is assessed against it. Management…

Q: A company reports the following beginning inventory and two purchases for the month of January. On…

A: Goods Purchased No. of Units Cost per Unit Jan 1 390 3.8 Jan 9 90` 4 Jan 25 120…

Q: Finch Airline Company is considering expanding its territory. The company has the opportunity to…

A: In order to determine the payback period, the Initial investments are required to be divided by the…

Q: Graydon and Logan formed the GL Partnership on January 1, 2020, by combining the separate assets of…

A: A merger takes place when two or more businesses combine together to form a new business. This is…

Q: Calculate the total engineering fees including taxes based on the following:

A: Fees :- Fees include all receipt from the Customer or party. It include All Direct cost, Service…

Q: United Apparel has the following balances in its stockholders' equity accounts on December 31, 2021:…

A: The balance sheet of the company means a financial statement that records all the assets and…

Q: The trial balance of The White Ribbon failed to agree, and the difference was posted to a…

A: In the context of the given question, we are required to prepare the rectification entries, the…

Q: On January 1, 2016, Fiona sold some land to another company and immediately leased it back again.…

A: Calculation of Present value of lease payment Year Lease Payment PVF @ 8% Present Value 1 $…

Q: Compute Payroll Floatin Away Company has three employees-a consultant, a computer programmer, and an…

A: Gross pay of the employees means regular earnings made by the employee and all overtime earnings…

Q: Finer Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal,…

A: Special Journals are used by the accountants to record the journal entries into the specific…

Q: Donovan Consulting became a public company on March 1, 2022, Below is its trial balance before…

A: 1. Income Statement 2. Balance Sheet The first statement shows the income earned and loss incurred…

Q: Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions.

A: A Journal entry is a primary entry that records the financial transactions initially. The…

Q: True or False? All states differentiate residential and commercial/industrial property in their…

A: The property tax is the tax that is charged by the government on the properties. The property tax is…

Q: Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. Ratio…

Q: You MUST use the TI BA II calculator features (N, I/Y, PV, PMT, FV, AMORT) to solve questions…

A: Comment- We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: QS 2-3 Reading a chart of accounts LO C3 A chart of accounts is a list of all ledger accounts and an…

A: Assets are the rights and resources being held by the business. Liabilities are the obligations, of…

Q: Auditors make materiality judgments during the planning/risk assessment phase of the audit to be…

A: Introduction: An auditor verifies the authenticity of commercial transactions that have been…

Q: Prepare the journal entry necessary to record the depreciation expense on the building in 2021. (If…

A: The depreciation means the decrease in the value of the machine by constant use or wear and tear.…

Q: Preble Company manufactures one product. Its variable manufacturing overhead is applied to…

A: Solution: Variable overhead variable variances depends on standards set for variable overhead costs…

Q: On January 15, the end of the first pay period of the year, North Company's employees earned $32,000…

A: Payroll: The act of paying workers of a firm is referred to as payroll. This process involves…

Q: Fair value is a more relevant measure to use in Financial Reporting than Historical Cost. Discuss

A: Introduction: Fair value accounting refers to the practice of valuing your company's liabilities and…

Q: Current assets Cash Trading investments Accounts receivable, net Inventory Prepaid expenses Total…

A: "Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Situation D: Controls satisfying managemen assertions: Sales Order does not have a control that…

A: Internal controls are implemented by the management for prevention of fraud and intentional…

Q: Jamieson Ltd is preparing to set up business on 1/7/2022 and has made the following forecast for the…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: Head-First Company plans to sell 5,000 bicycle helmets at $75 each in the coming year.Variable cost…

A: Break even point (BEP): Breakeven is the point where total expenses are equal to total revenue. at…

Q: On January 1, 2024, Cat Company purchased the following investments: 1) 20,000 shares (representing…

A: Introduction: If an investor company makes an investment between 20 to 50% in the investee company…

Q: Following is information from Jesper Company for its first month of business. Credit Purchases Jan.…

A: Accounts Payable Subsidiary Ledger: It is the accounting ledger that provide transaction history…

Q: Compute the 2022 return on assets and the return on common stockholders’ equity for both companies.…

A: According to the given question, we are required to compute the return on assets and return on…

Q: Ace Company reported the following information for the current year: Sales $ 416,000 Cost of…

A: The cost of goods sold includes the total cost of goods that are sold during the period. Cost of…

Q: The cost of direct materials transferred into the Filling Department of Ivy Cosmetics Company is…

A: Direct Material Cost - It is the cost incurred by the company on the direct materials transferred…

Q: Rolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is…

A: Here discuss about the details of the translation adjustment which are incurred for the parent…

Q: he trial balance of The White Ribbon failed to agree, and the difference was posted to a suspense…

A: Statement of net income shows the statement of income earned and loss incurred during the year. when…

Q: Worley Company buys surgical supplies from a variety of manufacturers and then resells and delivers…

A: Solution:- 1)Calculation of the total revenue that Worley would receive from University and Memorial…

Q: Determine the amount of overall materiality for the audit based on these preliminary amounts.

A: A Transaction can be material Due to its :— Mainly related party transactions eg, the company rent…

Q: The Production Department of Hruska Corporation has submitted the following forecast of units to be…

A: Cost of labor is the amount of cost incurred on the wages of the laborers involved in the process of…

Q: Advances to supplier: 600,000 currently collectible: 300,000 Advances to officers AFDA: (100,000)…

A: Current liabilities are those liabilities and obligations which needs to be paid or settled within…

Q: In the Why It Matters feature “Examples of Theft and FinancialReporting Frauds” at the beginning of…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Exercise 12-14 (Algo) Comparison of Projects Using Net Present Value [LO12-2] Labeau Products,…

A: Net Present Value=(Present Value of Cash Inflows-Present Value of Cash Outflows)

Q: Use the following information to compute each department’s contribution to overhead. Which…

A: Overhead cost refers to the cost or amount incurred by the company in production of its goods and…

Q: Rayya Sdn. Bhd. produces two types of cakes: butter cake and chocolate cake. Of the two, chocolate…

A: Familiarize yourself with the concept of segment income. It is calculated by using this formula:…

Q: differential costs where you had to choose between two alternatives

A: Differential cost refers to the difference between the cost of two or more alternative options. It…

Q: Calculate all possible solvency ratios for 2021 and 2020. (Round answers to 1 decimal place e.g.…

A: Solvency Ratios :— These are the ratios which are calculated to measure the ability of the…

Q: Briefly explain the ethical rules to be followed by an auditor in handling client’s money.

A: Introduction: The client money audit report focuses on the procedures and controls that a business…

Q: Question 4 Garland limited makes four components. A, B, C, and D, for which costs in the forthcoming…

A: Making the decision to manufacture a product internally versus buying it from a third-party provider…

Q: please answer in detail with all work thanks no copy paste Tammy realizes that she has charged…

A: Introduction: APR The cost of taking loans annually, including fees, is stated as a percentage and…

Step by step

Solved in 3 steps

- On 1-1-2020, Mr. A started business of dealing in electric fans by investing cash Rs. 200000 and equipment at fair value of Rs. 20000 from his personal sources. The other transactions of the business for the month were as under:2-1-2020, purchased furniture for Rs. 20000 on account/on credit from Mr. B.5-1-2020, sold furniture for Rs. 22000 on cash.10-1-2020, purchased computer for cash Rs. 30000.16-1-2020, borrowed cash Rs. 50000, an interest free from HBL.20-1-2020, make partial payment to bank of Rs.30000.25-1-2020, purchased TV for cash Rs. 10000..31-1-2020, paid rent of the office Rs. 2000 for the month of January.Required: Make Accounting equation.On 1-1-2020, Mr. A started business of dealing in electric fans by investing cash Rs. 200000 and equipment at fair value of Rs. 20000 from his personal sources. The other transactions of the business for the month were as under: 2-1-2020, purchased furniture for Rs. 20000 on account/on credit from Mr. B. 5-1-2020, sold furniture for Rs. 22000 on cash. 10-1-2020, purchased computer for cash Rs. 30000. 10-1-2020, company purchased Rs. 450 worth of office supplies on credit. 16-1-2020, borrowed cash Rs. 50000, an interest free from HBL. 20-1-2020, make partial payment to bank of Rs.30000. 25-1-2020, An advertisement was run in the newspaper at a total cost of Rs. 250. Cash was paid when the order was placed. 31-1-2020, paid rent of the office Rs. 2000 for the month of January. Required: Make Accounting equation. Question: For each of the following items, indicate whether a debit or a credit applies. increase in retained earnings decrease in prepaid rent increase in dividends decrease…01 On 1 April, the owner decided to start a laundry business. He withdrew R200 000 from personal savings account and deposited it directly into HI-Lo traders bank account 03 HI-Lo Traders obtained a loan of R30 000 with a repayment period of 12 months from invest Bank account 05 Hi-Lo Traders bought equipment from Blue Furnishers for R16 000. Hi-Lo made a payment of 16 000 directly into Hi-Lo bank account 09 A Cash sale amounting to R45 000 was made, the good were originally purchased at a cost of 35 000 13 Hl-Lo traders bought equipment on credit from Risk Furniture for R9000 15 HI-Lo Traders made a direct payment into the bank account of Risk Furnisher to pay their amount of 9000 18 The owner withdrew 1200 from the business to buy his daughter a birthday present 19 Hl-Lo Traders offered a service worth R5000 to Mr Bogus on credit 27 Hl-Lo Traders placed an advertisement in a local newspaper for R350 Payment was only due in…

- A business was started on March 1, 2020 with the investment of cash Rs. 50,000 and office equipment worth Rs. 50,000 and the following transactions were completed during the month: March 2 : Purchased merchandise for cash Rs. 25,000 and on account Rs. 15,000. March 3 : Purchased office supplies for cash Rs. 2,000 and on account Rs. 7,000March 12: Purchased furniture on account Rs. 5,000. March 18: Sold merchandise for cash Rs. 20,000 and on account Rs. 15,000 March 20: Paid to suppliers Rs. 10,000 after discount Rs. 1,000 March 30: Paid rent for the month Rs. 1,500. REQUIRED: Post the transactions to "T" accounts.Complete the columns to show the effect of the following transactions: Transaction Asset Liability Capital (a) Bought a motor Van on credit $500 (b) Repaid by cash a loan owed to P Smith $1,000 (c) Bought goods for $150 paying by cheque (d) The owner puts a further $5,000 cash into the business (e) A debtor returns to us $80 goods. we agree to make an allowance for them (f) Bought goods on credit $220 (g) The owner takes out $100 cash for his personal use.October 1 - Invested P250,000 to start the businessOctober 2 - Paid P30,000 cash for various service equipmentOctober 5 - Paid P7,500 for the monthly rental of the shop.October 6 - Purchased various supplies from Lean Merchandising on credit for P18,500October 7 - Bought additional service equipment for P65,000, with cash downpayment ofP30,000 and balance on credit.October 8 - Completed repair works and collected P45,000 cash.October 10 - Purchased additional supplies for cash amounting to P9,200.October 13 - Billed J. Lumaban for the repair of the car amounting to P15,000 on credit.October 15 - Paid the helper salaries for P12,000.October 18 - Paid the amount due to Lean Merchandising.October 23 - Collected from J. Lumaban.October 25 - Collected cash from a customer for the repair of car amounting to P32,000.October 28 - The owner withdraws cash for P16,000.October 30 - Paid light and water for P7,500 Paid telephone bill for 13,200.October 31 - Paid salaries to shop helper for…

- October 1 - Invested P250,000 to start the businessOctober 2 - Paid P30,000 cash for various service equipmentOctober 5 - Paid P7,500 for the monthly rental of the shop.October 6 - Purchased various supplies from Lean Merchandising on credit for P18,500October 7 - Bought additional service equipment for P65,000, with cash downpayment ofP30,000 and balance on credit.October 8 - Completed repair works and collected P45,000 cash.October 10 - Purchased additional supplies for cash amounting to P9,200.October 13 - Billed J. Lumaban for the repair of the car amounting to P15,000 on credit.October 15 - Paid the helper salaries for P12,000.October 18 - Paid the amount due to Lean Merchandising.October 23 - Collected from J. Lumaban.October 25 - Collected cash from a customer for the repair of car amounting to P32,000.October 28 - The owner withdraws cash for P16,000.October 30 - Paid light and water for P7,500 Paid telephone bill for 13,200.October 31 - Paid salaries to shop helper for…October 1 - Invested P250,000 to start the businessOctober 2 - Paid P30,000 cash for various service equipmentOctober 5 - Paid P7,500 for the monthly rental of the shop.October 6 - Purchased various supplies from Lean Merchandising on credit for P18,500October 7 - Bought additional service equipment for P65,000, with cash downpayment ofP30,000 and balance on credit.October 8 - Completed repair works and collected P45,000 cash.October 10 - Purchased additional supplies for cash amounting to P9,200.October 13 - Billed J. Lumaban for the repair of the car amounting to P15,000 on credit.October 15 - Paid the helper salaries for P12,000.October 18 - Paid the amount due to Lean Merchandising.October 23 - Collected from J. Lumaban.October 25 - Collected cash from a customer for the repair of car amounting to P32,000.October 28 - The owner withdraws cash for P16,000.October 30 - Paid light and water for P7,500 Paid telephone bill for 13,200.October 31 - Paid salaries to shop helper for…Mr. Steve Persian hired Elizabeth to prepare the Statement of Financial Position of his business. To prepare the statement, Elizabeth identified the following assets and liabilities of Mr. Persian: a. Cash deposited in YKY Bank amounting to P100, 000 b. He has uncollected sales from customers amounting to P50, 000 c. The total amount of merchandise left inside the warehouse is P35, 000 d. Steve paid in advance the rent amounting to P15, 000 for one year. e. The machineries and equipment amounted to P150, 000 f. He bought the materials from his suppliers amounting to P30, 000 and promised to pay the said amount one month after the end of the year. g. He paid the contributions of his employees such as SSS, Philhealth and Pag ibig amounting to P6, 500 h. Outstanding balance to Meralco is amounting to P3, 500 i. He acquired a 2 year loan from YKY Bank amounting to P45, 000.

- With the invoice number 18, 18% VAT excluded commercial goods of 40.000 TL were sold with a credit card.A.Ş, which is in the portfolio of the enterprise, a commission of 250 TL was paid to the intermediary institution.The company rented a shop with a monthly rent of 5,000 TL to be used as a store, and a one-year rent was paid.80,000 TL severance pay was paid for those working in accounting.The enterprise purchased a plot of land with an investment of 150,000 TL, and 1,250 TL title deed costs and fees were paid.A commercial vehicle was purchased with four school bank loans for 180,000 TL excluding 18% VAT, and 1,500 TL was paid for trading.In the accounting department, a total of 200 TL, excluding 18% VAT, was purchased with 10 credit cards.A fixture with a settlement of 12.000.-TL in its assets is being renewed and sold in cash for 18% VAT 6.000.-TL.Microsoft Office software for 5 users was purchased for 4,000.-TL excluding 18% VAT.Up to 10,000 TL will be paid from the buyers, with a…Below are the transaction for Sintokish Enterprise as October 2020: Oct 1 Contributed RM30,000 of cash and RM20,000 of equipment to start the business. Oct 3 Borrowed RM80,000 from the bank by signing a notes payable. Oct 15 Purchased a van by paying cash for RM75,000. Oct 17 Paid January rent of RM1,500 for the office space by credit. Oct 22 Performed services for customers and received cash immediately for RM20,000. Oct 23 Purchased RM600 in supplies on account. Oct 25 Performed services for customers and will collect next month of RM123,000 Oct 26 Withdrew of cash RM700 and equipment RM300. Oct 28 Paid RM1000 to the bank for notes payable. Oct 30 Paid half of amount for Oct 23 transaction. REQUIRED: Prepare the relevant journal entries to record the above transactions. Omit the explanations.Omer provides the following data of his company Cargowings Pvt. ltd. for the month of December 2020. Following transaction took place during the month: ` Omer further invested in business with cash $5,000, bank $10,000, and Motor Vehicle $8,000 Received a cheque from Mathew in respect of goods sold at invoice price $500 deducting discount of 5%. Omer brought his house furniture into the business which he purchased for $3,000 Commission received as referral fee $1,300 Sold goods to Danial worth $500 and the balance was written in his account.