ease with the following provisions: 'IL

Q: (Learning Objective 3: Compute partial year depreciation, and select the best depreciation method)…

A: Depreciation Expense - Depreciation is the cost incurred by the company for the purpose of using…

Q: For each of the above independent scenarios, prepare the journal entry necessary to record the…

A: IFRS :— It is defined set of standards for reporting of transaction in financial statement. It is…

Q: Up to how much should the company be willing to pay for one additional minute of milling machine…

A: Limiting Factor :— It is the factor that restrict the organisation to produce upto their…

Q: Plant Expansion $162,000 132,000 114,000 103,000 33,000 $544,000

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Palmona Co. establishes a $200 petty cash fund on January 1. On January 8, the fund shows $99 in…

A: Petty cash is maintained to incur the pretty expenses without bothering the main cash balance. All…

Q: rking capital required for the business is equal to Operating Expenses Raw Material and Finished…

A: Working capital is very necessary for business and working of business and it must be sufficient to…

Q: What is the difference between accrued liabilities an unearned Revenue accounts?

A: Accrued Liabilities :— An expenses of a Business or an Organization incurred during a specific…

Q: Cost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the…

A: Lets understand the basics. For calculating total manufacturing costs and cost of goods…

Q: Merchant Company found themselves in need of cash. In an effort to shore up their financial…

A: Lease - Lease agreements are contracts or instruments that transfer property from one person to…

Q: In January of year 0, Justin paid $5,400 for an insurance policy that covers his business property…

A: a. In this case, the insurance premium paid belongs to 12 months of the current year and it does not…

Q: Fool Proof Kitchens manufacturers custom made self-cleaning professional grade food processors. The…

A: The product costs comprises of direct and indirect costs. The direct costs are direct materials and…

Q: Statement 1: Depreciation expense error will self correct in the next year after the moment of…

A: Hi student Since there are multiple questions, we will answer only first question. Retained…

Q: Estimating Allowance for Doubtful Accounts Kirchhoff Industries has a past history of uncollectible…

A: Allowance for doubtful accounts is considered as a contra asset account. It is prepared against the…

Q: Situation D: Controls satisfying managemen assertions: Sales Order does not have a control that…

A: Internal controls are implemented by the management for prevention of fraud and intentional…

Q: Current assets Cash Trading investments Accounts receivable, net Inventory Prepaid expenses Total…

A: "Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: A company reports the following beginning inventory and two purchases for the month of January. On…

A: No. of Units Cost per unit Jan 1 250 2.30 Jan 9 60 2.50 Jan 25 100 2.64

Q: Calculate all possible solvency ratios for 2021 and 2020. (Round answers to 1 decimal place e.g.…

A: Solvency Ratios :— These are the ratios which are calculated to measure the ability of the…

Q: Kingbird, Inc. had the following transactions involving notes payable. July 1, 2022 Nov 1, 2022 Dec.…

A: Notes are referred to as the promissory notes which are issued by the entity for an amount that is…

Q: Following is information from Jesper Company for its first month of business. Credit Purchases Jan.…

A: 1. ACCOUNTS PAYABLE LEDGER Bailey Company Date Debit Credit Balance Jan. 9 $17,200…

Q: 1. prepare an income statement for Year 1 2. Prepare a statement of changes in stockholders’ equity…

A: Journal entries S.No Particulars Debit Credit 1 Cash 41000 To Notes Payable 41000…

Q: The following information is noted on the year end payroll register for an employee employed with a…

A: RL -1 is the one which states the contribution made to the private health services plan for the…

Q: he largest form of defalcation (both in dollars and frequency) is: a. Theft of cash directly from…

A: Defalcation : Defalcation means misappropriation of funds by a person. In accounting mainly in…

Q: A three-year-old machine has a cost of $65,000, an estimated residual value of $6,000, and an…

A: Under Double Declining Balance Method, the depreciation expense is calculated at the rate that is…

Q: What are the cost estimation methods? What is their importance and can you provide an example of how…

A: Cost Estimation: The process of predicting the financial and other resources required to finish a…

Q: The concept that market forces in the macroeconomy can remedy a recession is referred to as:…

A: Monetary Policy- Monetary policy refers to the actions and communications of the central bank in…

Q: Prepare the journal entry to record North Company's January 15 salaries expense and related…

A: FICA Social Security Tax Payable = $32,000 x 6.2% = $1,984FICA Medicare Tax Payable = $32,000 x…

Q: Waupaca Company establishes a $350 petty cash fund on September 9. On September 30, the fund shows…

A: >Petty Cash fund is created out of cash account to pay off certain small and petty amounts of…

Q: Weighted Average Method, Physical Flow, Equivalent Units, UnitCosts, Cost AssignmentMimasca Inc.…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Compute Payroll Floatin Away Company has three employees-a consultant, a computer programmer, and an…

A: Gross pay of the employees means regular earnings made by the employee and all overtime earnings…

Q: Klamath Company produces a single product. The projected income statement for the comingyear is as…

A: Break even point (BEP): Breakeven is the point where total expenses are equal to total revenue. at…

Q: PA3-3 Preparing a Process Costing Production Report (Weighted-Average Method) [LO 3-2, 3-3, 3-4]…

A:

Q: Debt Investments Classification Cost or Amortized Cost Fair Value at end if 2017 Interest Income in…

A: The income statement represents the net income or net loss that is calculated by the deducted…

Q: [The following information applies to the questions displayed below.] Hemming Company reported the…

A: Under perpetual inventory system, the inventory is valued after every sales and purchase…

Q: Proud Corporation acquired 80 percent of Spirited Company's voting stock on January 1, 20X3, at…

A: The consolation is the accounting process in which the financial results of the parent company and…

Q: What is the equation that shows the relationship between elements of financial data

A: The equation that shows the relationship between the elements of financial data is shown hereunder :…

Q: Assume that management had determined that its organization’saudit committee is not effective. How…

A: Here discuss about the details of weakness of the Audit committee which are affected into the…

Q: Zugar Company is domiciled in a country whose currency is the dinar. Zugar begins 2020 with three…

A: Translation adjustments are those adjustments which are made in the procedure of converting the…

Q: Equivalent Units, Unit Cost, Weighted AverageRefer to the information for Alfombra Inc. on the…

A: Process costing is one of the important costing system being used in business. Under this system,…

Q: beauty supply store expects to sell 120 flat irons during the next year. It costs $1.60 to store one…

A: Economic order quantity = The formula for EOQ is: \begin{aligned} &Q = \sqrt{ \frac{2DS}{H}…

Q: Get Away Resorts had trouble collecting its account receivable from Stephan Stow. On June 19, 2024,…

A: Bad debts expense: Bad debts expense is recognized in the books of the company when a debtor is…

Q: 6/1 7/1 8/30 8/31 9/4 11/30 12/5 12/31 Adj Bal Prepaid Insurance Prepaid Rent Unearned Service…

A: Journal entries :- Recording of Accounting transaction in a proper way. Ledger :- recording of…

Q: ch Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours.…

A: The predetermined overhead rate is calculated as follows: Predetermined overhead rate = Estimated…

Q: What is directional testing? How does directional testing relateto the appropriateness of audit…

A: Auditing means the process in which the books of the company are audited by a person. The person…

Q: At the end of the prior year, Durney's Outdoor Outfitters reported the following IUN Accounts…

A: 1-a. Account…

Q: Required information [The following information applies to the questions displayed below.] Del Gato…

A: Bank reconciliation is the process of matching the cash book and the bank passbook transaction to…

Q: Waupaca Company establishes a $300 petty cash fund on September 9. On September 30, the fund shows…

A: A Journal entry is a primary entry that records the financial transactions initially. The…

Q: Which of the following is correct when, in the same year, beginning inventory is overstated by…

A: The net income is calculated as difference between sales and total costs. Gross profit = Sales -…

Q: Beginning inventory Purchases Freight-in Purchase returns Net markups Net markdowns Normal spoilage…

A: Inventory is one of the important current assets of the business. It includes inventory of raw…

Q: Ground Crew is an airline catering company stationed at O R Tambo International Airport. The company…

A:

Q: $ 32,800 was purchased January 2nd. The machine is expected to 4 years A machine costing have a…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Step by step

Solved in 2 steps

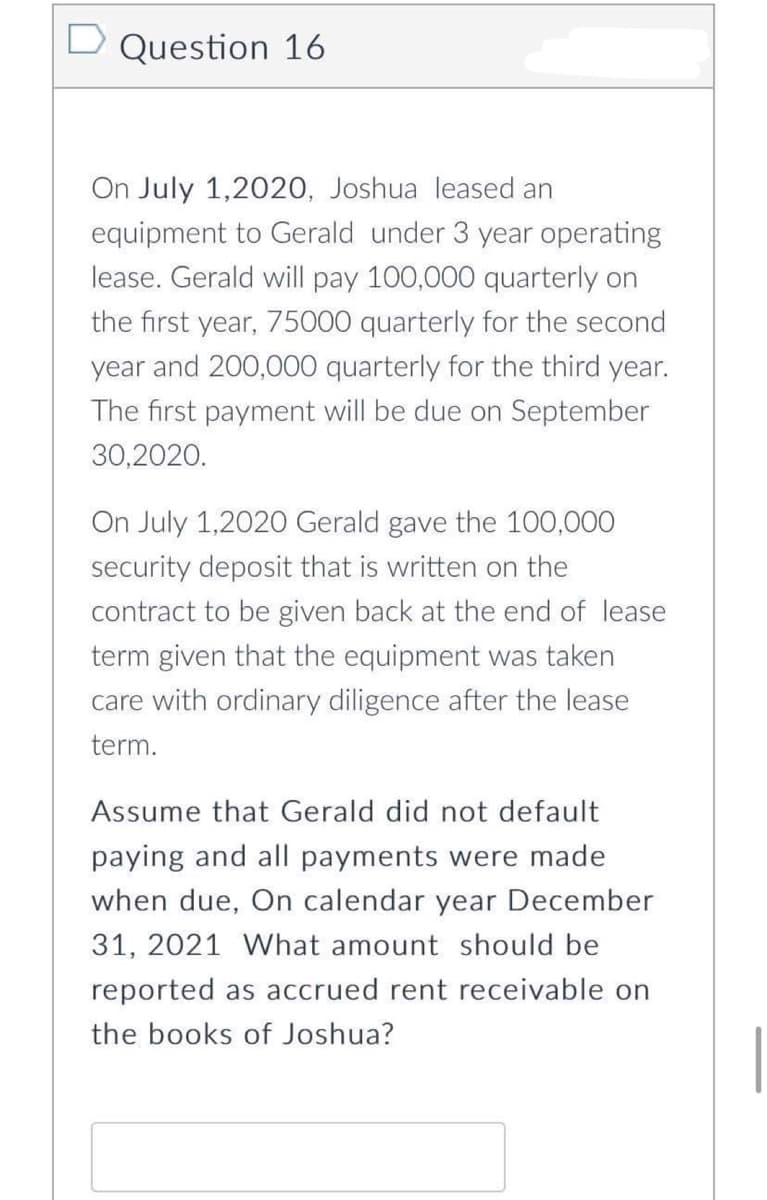

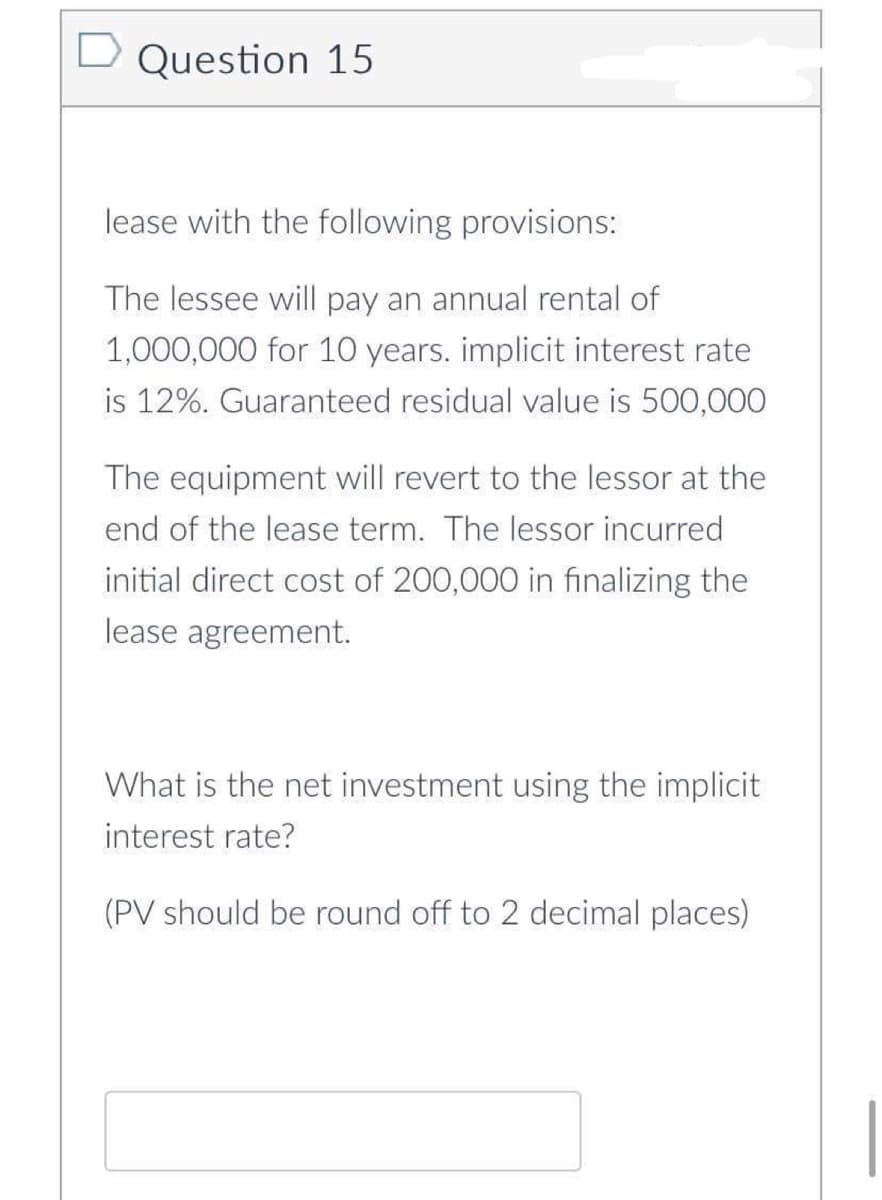

- FISH CHIPS INC, PART I LEASE ANALYSIS Martha Millon, financial manager for Fish it Chips Inc., has been asked to perform a lease-versus-buy analysis on a new computer system. The Computer costs 1,200,000, and if it is purchased. Fish Chips could obtain a term loan for the full amount at a 10% cost. The loan would be amortized over the 4-year life of the computer, with payments made at the end of each year The computer is classified as special purpose; hence, it falls into the MACRS 3-year class. The applicable MACRS rates are 33%. 45%. 15%, and 7%. If the computer is purchased, a maintenance contract must be obtained at a cost of 25,000, payable at the beginning of each year. After 4 years, the computer will be sold. Millons best estimate of its residual value at that time is 125,000. Because technology is changing rapidly however, the residual value is uncertain. As an alternative. National Leasing is willing to write a 4-year lease on the computer, including maintenance, for payments of 340,000 at the beginning of each year. Fish 4c Chipss marginal federal-plus-state tax rate is 40%. Help Millon conduct her analysis by answering the following questions. a. 1. Why is leasing sometimes referred to as "off-balance-sheet" financing? 2. What is the difference between a capital lease and an operating lease? 3. What effect does leasing have on a firms capital structure? b. 1. What is Fish Chips's present value cost of owning the computer? (Hint: Set up a table whose bottom line is a time line" that shows the cash flows over the period t = 0 to t = 4. Then find the PV of these cash flows, or the PV cost of owning.) 2. Explain the rationale for the discount rate you used to find the PV. c. 1. What is Fish Chipss present value cost of leasing the computer? (Hint: Again, construct a time line.) 2. What is the net advantage to leasing? Does your analysis indicate that the firm should buy or lease the computer? Explain. d. Now assume that Millon believes that the computers residual value could be as low as 0 or as high as 250,000, but she stands by 125,000 as her expected value. She concludes that the residual value is riskier than the other cash flows in the analysis, and she wants to incorporate this differential risk into her analysis. Describe how this can be accomplished. What effect will it have on the lease decision? e. Millon knows that her firm has been considering moving its headquarters to a new location, and she is concerned that these plans may come to fruition prior to the expiration of the lease. If the move occurs, the company would obtain new computers; hence, Millon would like to include a cancellation clause in the lease contract. What effect would a cancellation clause have on the risk of the lease?14. A leasing contract calls for an immediate payment of $100,000 and nine subsequent $100,000semiannual payments at six month intervals. What is the PV of these payments if the annual discount rateis 8 percent?Problem 9-3 An owner of the ATRIUM Tower Office Building is currently negotiating a five-year lease with ACME Consolidated Corporation for 20,000 rentable square feet of office space. ACME would like a base rent of $11 per square foot (PSF) with step-ups of $1 per year beginning one year from now. Required: a. What is the present value of cash flows to ATRIUM under the above lease terms? (Assume a 10% discount rate.) b. The owner of ATRIUM believes that base rent of $11 PSF in (a) is too low and wants to raise that amount to $15 with the same $1 step-ups. However, now ATRIUM would provide ACME a $52,600 moving allowance and $126,000 in tenant improvements (TIs). What would be the present value of this alternative to ATRIUM? c. ACME informs ATRIUM that it is willing to consider a $14 PSF with the $1 annual stepups. However, under this proposal, ACME would require ATRIUM to buyout the one year remaining on its existing lease in another building. That lease is $6 PSF for 20,000 SF per…

- Subject: Financial strategy & policy 1) A leasing contract calls for an immediate payment of $100,000 and nine subsequent $100,000 semiannual payments at six month intervals. What is the PV of these payments if the annual discount rate is 8 percent? 2) Siegefried Basset is 65 years of age and has a life expectancy of 12 more years. He wishes to invest $20,000 in an annuity that will make a level payment at the end of each year until his death. If the interest rate is 8 percent, what income can Mr. Basset to receive each year?Exhibit 20-1 On January 1, 2016, Pearson Company signed a lease agreement requiring six annual payments of $60,000, beginning December 31, 2016. Pearson's incremental borrowing rate was 9% and the lessor's implicit rate, known by Pearson, was 10%. The present value factors of an ordinary annuity of $1 for six periods for interest rates of 9% and 10% are 4.48592 and 4.35526, respectively. 37. Refer to Exhibit 20-1 17. What would be the interest expense for 2016 (round answers to the nearest dollar)? a. $21,003 b. $22,746 c. $24,224 d. $26,132Exhibit 20-1 On January 1, 2016, Pearson Company signed a lease agreement requiring six annual payments of $60,000, beginning December 31, 2016. Pearson's incremental borrowing rate was 9% and the lessor's implicit rate, known by Pearson, was 10%. The present value factors of an ordinary annuity of $1 for six periods for interest rates of 9% and 10% are 4.48592 and 4.35526, respectively. 37. Refer to Exhibit 20-1. 18.What would be the balance of the lease obligation for financial reporting purposes on December 31, 2017, after the lease payment (round answers to the nearest dollar)? a- $194,383 b- $167,979 c- $190,192 d- $233,379

- Exhibit 20-1 On January 1, 2016, Pearson Company signed a lease agreement requiring six annual payments of $60,000, beginning December 31, 2016. Pearson's incremental borrowing rate was 9% and the lessor's implicit rate, known by Pearson, was 10%. The present value factors of an ordinary annuity of $1 for six periods for interest rates of 9% and 10% are 4.48592 and 4.35526, respectively. 37. Refer to Exhibit 20-1. 16.What would be the balance of the lease obligation on January 1, 2017, for financial reporting purposes after the lease payment? (Round answers to the nearest dollar) $0 $166,779 $227,447 $233,379Chapter 10 Discussion Q1 A property is sold for $200,000. Typical financing terms are an 85 percent loan with a 10 percent interest rate over 15 years. If the gross income per year is $30,000, what is the overall capitalization rate?Question 1- A $12,000 investment will return annual benefit for six yearswith no salvage value at the end of six years. Assumestraight line depreciation and a 46% tax rate and the inflationrate is 5%. What is the inflation free after tax rate ofreturn on the investment if the annual benefits are $2,918 intoday’s dollars? a. 10.18% b. 4.94% c. 5% d. 8.20%

- 12 . Consider a T-bill that will have a 125 days to maturity at the time of forward contract expiration. The forward in this T-Bill is quoted at a discount of 1.24%. At expiration, the amount the long will pay the short for delivery of T-bill worth $1m par is closest to: A. $995,694.44 B. $995,753.42 C. $987,600Qw.12.a A fully amortizing mortgage loan is made for $104,000 at 6 percent interest for 20 years. Required: a. Calculate the monthly payment for a CPM loan. b. What will the total of payments be for the entire 20-year period? Of this total, how much will be the interest? c. Assume the loan is repaid at the end of eight years. What will be the outstanding balance? How much total interest will have been collected by then? d. The borrower now chooses to reduce the loan balance by $5,400 at the end of year 8. (1) What will be the new loan maturity assuming that loan payments are not reduced? (2) Assume the loan maturity will not be reduced. What will the new payments be?QUESTION 1: A construction company agreed to lease payments of $452.56 on construction equipment to be made at the end of every month for 9.5 years. Financing is at 11% compounded monthly. (a) What is the value of the original lease contract? (b) If, due to delays, the first 9 payments were deferred, how much money would be needed after 10 payments to bring the lease payments up to date? (c) How much money would be required to pay off the lease after 10 payments? (d) If the lease were paid off after 10 payments, what would the total interest be? (e) How much of the total interest would be due to deferring the first 9 payments? Give typing answer with explanation and conclusion