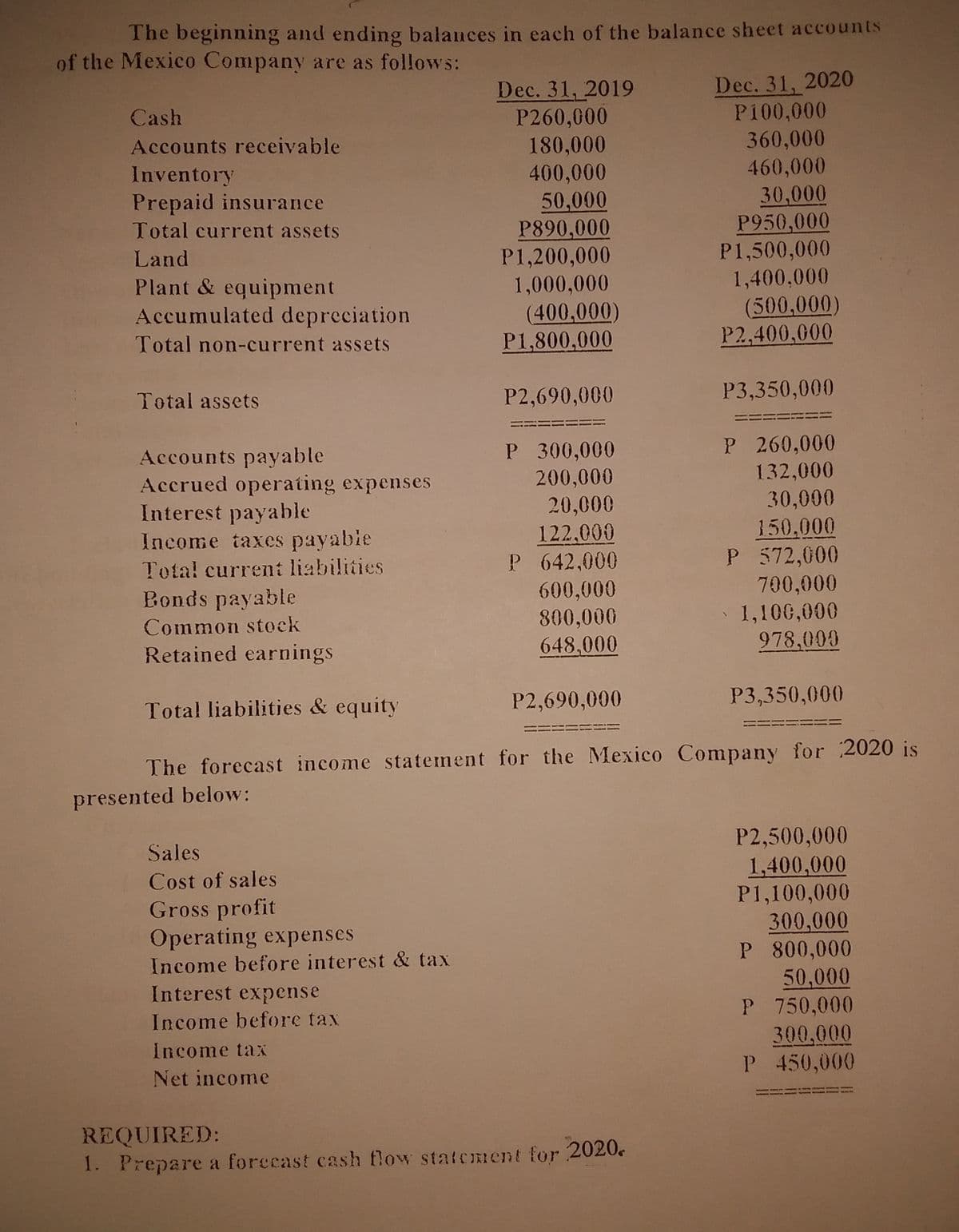

REQUIRED: 1. Prepare a forecast cash flow statoment for 2020,

Q: what is the projected cash flow statement?

A: Cash flow statement: The cash flow statement shows only inflows and outflows of cash. It does not…

Q: Which of the following methods of methods of capital budgeting is base cashflows: Payback NPV…

A: As per Bartleby guidelines, If multiple questions are posted, only the first 1 question will be…

Q: REQUIRED: 1. Prepare a forecast cash flow statement fur 2020,

A: Statement of cash flow represents the cash inflow/outflow from the business while performing three…

Q: Compute the present value for the cash flow diagram shown below if i=6%, compounded annually. $500…

A: Year Cash Flow 1 300.00 2 300.00 3 300.00 4 100.00 5 200.00 6 300.00 7 400.00 8…

Q: Where is the short term investment shown in the Cash flow statement?

A: A short-term investment: It also known as a temporary investment or marketable security. It is a…

Q: 1. How would you describe Sunset Boards's cash flows for 2021? Write a brief discussion. 2. In light…

A: It has been given in the question that there is a 40% dividend paid on each year to the original…

Q: Use the cash flow diagram below to calculate the present amount, which equivalent to all the cash…

A: Present Value(PV) is current value of amount that is due to paid or received in future that us…

Q: Calculate the future equivalent at the end of 2012, at 25% per year, of the following series of cash…

A: Interest rate (r) = 25% Cashflow in year 2008 (CF1) = $1000 CF2 = $1000 - $100 = $900 CF3 = $1000 -…

Q: If an investment may be given by the sequence of cash flows Year (n) Cash Flow (C,) -4000 1 1200

A: Internal rate of return or IRR is the rate at which present value of cash inflows is equal to…

Q: Identify if each of the following would be included or excluded in forecasting cash flows for a…

A: Cash Flows refer out to the increase or decrease in the amount of money that the company or…

Q: Using the indirect method, prepare a statement of cash flow for 2020

A: The cash flow statement is helpful for the stakeholders as they can identify the organization's…

Q: A manufacturer projects the cash flows shown below. Determine the rate of return if the cash flows…

A: Rate of return at which the Present value of future cash flows is 0.

Q: Set up the engineering economics relations to compute the equivalent annual series (A=??) in years 1…

A: We will calculate NPV. NPV or net present value can be calculated by discounting the future cash…

Q: What amount should Allapacan report as investment income for 2020?

A: Statement of computation of investment income: Particulars Note no. Amount(P) Net income 1…

Q: Describe the process to find the mean and variance of the PW for the incremental cash flows?

A: Identify the Rate, project life. Then Incremental cash flows should be computed.

Q: Requirements: (a) What is the cash payback period for this proposal? (b) What is the annual rate of…

A: cash pay back period is the period by which the initial investment is recovered. so it 2 years +…

Q: EQUIRED: Prepare a forecast cash flow statement for the year ended June 30,2020. Show supporting…

A: Cash flow analysis is important for the business since it allows the business to assess the amount…

Q: Below is an equation to compute the present value of a cash flow series. Determine the cash flow…

A: The given equation means that the value of the initial investment is $7000. The revenue from the…

Q: REQUIRED: I. Prepare a forecast cash flow statement for the year ended June 30, 2020. 2 Show…

A: One of the most important financial statement being prepared at the year end to record and show the…

Q: For the arithmatic gradient of cash flow given below, if G= $150 , the value at year 24(V2

A: 'G' refers to the amount by which cash flows increases every year.

Q: lain 5 of t

A: Vertical Analysis of Cash Flow Year ended March 31, 2020 with comparative information of 2019…

Q: Find the uniform annual equivalent for the following cash flow diagram if 10%. Use the appropriate…

A: UNIFORM ANNUAL EQUIVALENT FORMULA: EUAC=r×NPV1-1+r-n where, r = discount rate n = no of years

Q: What is the profitability index for an investment with the following cash flows given a 20 percent…

A: The Profitability Index(PI) is one of the capital budgeting techniques that take into consideration…

Q: Calculate the rate of return to be obtained for the investment to be made in the 1st year ccording…

A: Year Cash Flow 0 $ - 1 $ -80,000.00 2 $ 9,000.00 3 $…

Q: Consider the following timeline detailing a stream of cash flows: Date 1 3 4 $100 $200 $300 $400…

A: A study that proves that the future worth of the money is lower than its current value due to…

Q: Which of the following capital budgeting techniques recognizes noncash revenues and expenses? *…

A: Solution: "Accounting rate of return" recognizes noncash revenues and expenses. This is because…

Q: . If the company’s capital budgeting analyst decidedto show all projected cash flows, both positive…

A: Introduction: Capital budgeting is an investment criterion or decision making mechanism for…

Q: Consider the following cash flow profile and assume MARR is 10%/year. EOY NCF -$80 1 $22 2 $22 3 $22…

A: The question is based on the concept of calculation of External rate of return (ERR). ERR is a…

Q: For the cash flow shown below. Find the external rate of return (EROR) using rate of return approach…

A: Cash Flow Statement is a part of the Financial Statement of a company. It literally means a…

Q: What is an “equivalent annual annuity (EAA)”? When and how are EAAs used in capital budgeting?

A:

Q: An investment has the following cash flows. Use the XIRR function to find the IRR. Date Cash Flow…

A: IRR It is utilized as it is helpful in analyzing the profit and which further helps in making a…

Q: Capital budgeting whose returns are expected to extend beyond one year requires an analysis of some…

A: Capital budgeting : The mechanism by which a company evaluates future major ventures or acquisitions…

Q: IRED: 1. Prepare a forecast cash flow statement for 2020.

A: Cash Flow Statement is prepared by an organisation to show the flow of cash during the accounting…

Q: What is the future worth for the following cash flow using I=10%

A: Interest Rate = 10% Year Cash Flow 1 5.00 2 10.00 3 15.00 4 20.00 5 25.00 6 30.00 7…

Q: For the net cash flow series, find the external rate of return (EROR) using the MIRR method with an…

A: Formula used for calculating EROR using MIRR is:

Q: Suppose an investment has conventional cash flows with positive NPV. How would it impact your…

A: Ratio Analysis- Ratio analysis is a tool for analyzing and evaluating a company's financial status.…

Q: ) For each of the following, determine the expected cash flows. Cash FlowEstimate…

A: Excel Spreadsheet: Excel Workings:

Q: explain how a firm that expect funds during the coming year might make sure the needed funds will be…

A: A firm must judiciously plan all its financing needs and prepare strategies for requirement of…

Q: Calculate the future equivalent at the end of year 2012, at 12% per year, of the following series of…

A: Uniform Arithmetic Factor: The uniform arithmetic factor , is a series of uniform cash flows in…

Q: What is National Co.'s free cash flow for 2022?

A: Free cash flow: = Operating cash flow - Capital Expenditure - preference dividend

Q: the arithmatic gradient of cash flow given below, if G= $150 , the value at year 23(V23) is:

A: 'G' refers to the amount by which cash flows increases every year.

Q: Determine the N PV, NAV, modified I RR, and ERR for the following cash flow diagram if the MARR is…

A: The capital budgeting techniques helps in the evaluation of a project and various proposals to find…

Q: In the accompanying diagram, what is the value of K on the left-hand cash-flow diagram that is…

A: Present value of future amount With interest or discount rate (i), period (n) and future value (FV),…

Q: Find IRR

A: Internal Rate of Return (IRR) is a capital budgeting technique that evaluates the proposed projects…

Q: or the nonconventional net cash flow series shown, the external rate of return per year using the…

A: ERROR is the external rate of return, MIRR is the modified internal rate of return, b is the…

Q: future worth for the above cash flow

A: Future value is the compounding of present value of cash flow at the required rate

Step by step

Solved in 2 steps

- The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.The following information was taken from the books of Newcastle Enterprises.Balances in the general ledger of Newcastle Enterprises for the financial year ended29 February 2020.Account Fol. Debit(R) Credit(R)Capital: M. Manchester(1 March2019)50 000Capital: L. Liverpool (1 March2019)70 000Current: M. Manchester (1 March2019)18 000Current: L. Liverpool (1 March2019)8 000Drawings: M. Manchester 5 000Drawings: L. Liverpool 4 000Replacement Reserve 65 000Profit and Loss 420 000Property, plant and equipment 670 000Appropriations according to the partnership agreement for the financial year ended29 February 2020:1. Interest on capital must be appropriated at 5% per annum. Capital accountbalances remain constant.2. Interest on drawings must be appropriated at 12% per annum. Assumedrawings were made 3 months prior to the end of the financial year.3. Interest on current accounts must be appropriated at 7% per annum (onopening balances).4. Both partners must receive an annual salary at the end…Pleasantville Company had the following balance sheet on January 1. Pleasantville CompanyBalance SheetJanuary 1 1Cash$175,000.00Accounts Payable$57,000.002Inventory157,000.00Notes Payable250,000.003Property, Plant, and Equipment200,000.00Mortgage Payable150,000.004Patent25,000.00Retained Earnings100,000.005$557,000.00$557,000.00 On January 2, Carrs Company came to an agreement to purchase Pleasantville by acquiring all of its outstanding shares for $575,000 in cash. On that date in time, the fair value of their inventory was $150,000, and the fair value of the equipment was $225,000. The book value equals the fair value for all other accounts listed.Required:1. Compute the goodwill associated with the purchase of Pleasantville.2. Prepare the journal entry necessary at January 2, to record the acquisition of Pleasantville.

- On December 31, 2022, the following information were taken from the trial balances of ABC Company and XYZ Company: ABC Company XYZ Company Cash P1,200,000 P200,000 Trade and other receivables 300,000 300,000 Inventories 1,300,000 1,000,000 Noncurrent assets 1,600,000 1,300,000 Current liabilities 300,000 200,000 Noncurrent abilities 600,000 400,000 Ordinary share capital 1,100,000 1,000,000 Share premium 200,000 Retained camings 2,200,000…On December 31, 2022, the following information were taken from the trial balances of ABC Company and XYZ Company: ABC Company XYZ Company Cash P1,200,000 P200,000 Trade and other receivables 300,000 300,000 Inventories 1,300,000 1,000,000 Noncurrent assets 1,600,000 1,300,000 Current liabilities 300,000 200,000 Noncurrent abilities 600,000 400,000 Ordinary share capital 1,100,000 1,000,000 Share premium 200,000 Retained camings 2,200,000…7 On December 31, 2022, the following information were taken from the trial balances of ABC Company and XYZ Company: ABC Company XYZ Company Cash P1,200,000 P200,000 Trade and other receivables 300,000 300,000 Inventories 1,300,000 1,000,000 Noncurrent assets 1,600,000 1,300,000 Current liabilities 300,000 200,000 Noncurrent liabilities 600,000 400,000 Ordinary share capital 1,100,000 1,000,000 Share premium 200,000 - Retained earnings 2,200,000 1,200,000 On January 1, 2023, ABC Company issues 50,000 shares of its P20 par value shares to acquire 70% of the outstanding shares of XYZ. The fair value of the shares of ABC as of January 1 was P29. Contingent consideration that is determined based on the best estimate is P100,000. It was determined that ABC Company had a noncurrent asset that was undervalued by P25,000. The fair value of the non-controlling interest…

- On December 31, 2022, the following information were taken from the trial balances of ABC Company and XYZ Company: Account Title For ABC Company For XYZ Company Cash P1,200,000 P200,000 Trade and other receivables 300,000 300,000 Inventories 1,300,000 1,000,000 Noncurrent assets 1,600,000 1,300,000 Current liabilities 300,000 200,000 Noncurrent liabilities 600,000 400,000 Ordinary share capital 1,100,000 1,000,000 Share premium 200,000 - Retained Earnings 2,200,000 1,200,000 On January 1, 2023, ABC Company issues 50,000 shares of its P20 par value shares to acquire 70% of the outstanding shares of XYZ. The fair value of the shares of ABC as of January 1 was P29. Contingent consideration that is determined based on the best estimate is P100,000 . It was determined that ABC Company had a noncurrent asset that was undervalued by P25,000. The fair value of the no.n-controlling interest is P700,000 ABC Company also incurred the following fees Broker's fees (paid) 190,000…The following is summary of information presented on the financial statements of a company on December 31, 2019. Account 2019 2018 Current Assets $ 69 comma 000$69,000 $ 53 comma 000$53,000 Accounts Receivable 83 comma 00083,000 80 comma 00080,000 Merchandise Inventory 53 comma 00053,000 41 comma 00041,000 Current Liabilities 77 comma 00077,000 49 comma 00049,000 Longminus−term Liabilities 30 comma 00030,000 52 comma 00052,000 Common Stock 54 comma 00054,000 44 comma 00044,000 Retained Earnings 44 comma 00044,000 29 comma 00029,000 Net Sales Revenue $ 527 comma 000$527,000 $ 508 comma 000$508,000 Cost of Goods Sold 405 comma 000405,000 396 comma 000396,000 Gross Profit $ 122 comma 000$122,000 $ 112 comma 000$112,000 Selling Expenses 45 comma 00045,000 58 comma 00058,000 Net Income Before Income Tax Expense $ 77 comma 000$77,000 $ 54 comma 000$54,000 Income Tax…The accounting records of Nettle Distribution show the following assets and liabilities as of December 31,2018 and 2019.December 31 2018 2019Cash . . . . . . . . . . . . . . . . . . . . . . . . $ 64,300 $ 15,640Accounts receivable . . . . . . . . . . . 26,240 19,100Office supplies . . . . . . . . . . . . . . . . 3,160 1,960Office equipment . . . . . . . . . . . . . . 44,000 44,000Trucks . . . . . . . . . . . . . . . . . . . . . . . 148,000 157,000December 31 2018 2019Building . . . . . . . . . . . . . . . . . . . . . $ 0 $80,000Land . . . . . . . . . . . . . . . . . . . . . . . . 0 60,000Accounts payable . . . . . . . . . . . . . 3,500 33,500Note payable . . . . . . . . . . . . . . . . . 0 40,000Required1. Prepare balance sheets for the business as of December 31, 2018 and 2019. Hint: Report only total equityon the balance sheet and remember that total equity equals the difference between assets and liabilities.2. Compute net income for 2019 by comparing total equity amounts for these…

- Choose the correct letter of answer: Company F Statement of Financial Positions at December 31, 2020 shows the following: Cash P4,000.00, Marketable Securities P8,000.00, Accounts Receivable P100,000.00, Inventories P120,000.00, Prepaid Expenses P1,000.00, Notes Payable (short term) P5,000.00, Accounts Payable P150,000.00, Accrued Expenses P20,000.00, Income taxes payable P1,000.00, and long-term liabilities P340,000.00. Determine the following: current ratio and quick ratio. a. 1.32 and 0.64b. 1.52 and 0.82c. 1.82 and 0.86d. 1.98 and 1.54e. 2.2 and 2.1Some selected balances of DD Co. for year ended Dec-31-2019 are as follows with theirnormal balances before adjustments:Cash and Cash Equivalent Br 20,000 Owners’ Capital 40,000Notes Receivables45,000Retained Earnings75,000Office Supplies12,000Sales Revenues640,000Prepaid Insurance72,000Interest Income12,000Inventory (Average Cost)24,000Cost of Goods Sold320,000Fixed Assets120,000Selling Expenses21,000Accum. Depr- Fixed assets36,000Salary and Wages Expense105,000Unearned Rent (Liability)56,000Rent Expense15,000Requireda. Prepare the necessary adjusting entries for the following items as not yet recorded on Dec-31-2019:i. The office supplies consumed during the year is Br 8,000ii. The Unexpired part of insurance is only Br 26,000iii. Br 30,000 is earned sales revenues from the unearned advance collectioniv. Salary and wages accrued as on 31-Dec-2019 amounts to be Br 18,000v. Depreciation Expenses allocated for the year amounts to be Br 15,000vi. There are accrued interest of Br 8,000 on…The following financial statements and additional information are reported. IKIBAN INCORPORATED Comparative Balance Sheets At June 30 2021 2020 Assets Cash $ 87,500 $ 44,000 Accounts receivable, net 65,000 51,000 Inventory 63,800 86,500 Prepaid expenses 4,400 5,400 Total current assets 220,700 186,900 Equipment 124,000 115,000 Accumulated depreciation—Equipment (27,000) (9,000) Total assets $ 317,700 $ 292,900 Liabilities and Equity Accounts payable $ 25,000 $ 30,000 Wages payable 6,000 15,000 Income taxes payable 3,400 3,800 Total current liabilities 34,400 48,800 Notes payable (long term) 30,000 60,000 Total liabilities 64,400 108,800 Equity Common stock, $5 par value 220,000 160,000 Retained earnings 33,300 24,100 Total liabilities and equity $ 317,700 $ 292,900 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 Sales $ 678,000 Cost of goods sold 411,000 Gross profit 267,000 Operating…