lain 5 of t

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 12P

Related questions

Question

IV. Please prepare a vertical and horizontal analysis for the following statement of

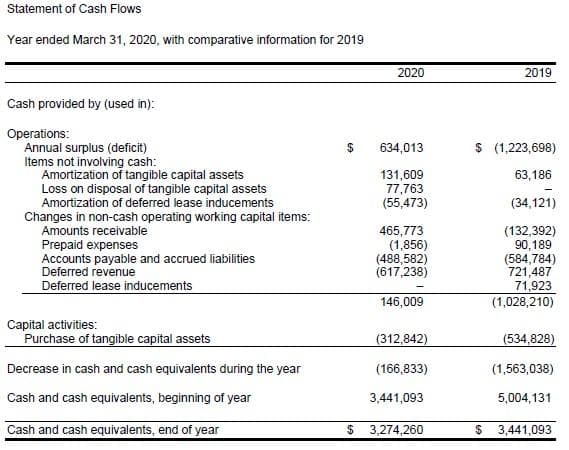

Transcribed Image Text:Statement of Cash Flows

Year ended March 31, 2020, with comparative information for 2019

2020

2019

Cash provided by (used in):

Operations:

Annual surplus (deficit)

Items not involving cash:

Amortization of tangible capital assets

Loss on disposal of tangible capital assets

Amortization of deferred lease inducements

Changes in non-cash operating working capital items:

Amounts receivable

Prepaid expenses

Accounts payable and accrued liabilities

Deferred revenue

Deferred lease inducements

2$

634,013

$ (1,223,698)

131,609

77,763

(55,473)

63,186

(34,121)

465,773

(1,856)

(488,582)

(617,238)

(132,392)

90,189

(584,784)

721,487

71,923

(1,028,210)

146,009

Capital activities:

Purchase of tangible capital assets

(312,842)

(534,828)

Decrease in cash and cash equivalents during the year

(166,833)

(1,563,038)

Cash and cash equivalents, beginning of year

3,441,093

5,004, 131

Cash and cash equivalents, end of year

$ 3,274,260

$ 3,441,093

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning