1. How would you describe Sunset Boards's cash flows for 2021? Write a brief discussion. 2. In light of your discussion in the previous question, what do you think about Tad's expansion plans?

1. How would you describe Sunset Boards's cash flows for 2021? Write a brief discussion. 2. In light of your discussion in the previous question, what do you think about Tad's expansion plans?

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 1lM

Related questions

Question

Transcribed Image Text:Cash Flows and Fil

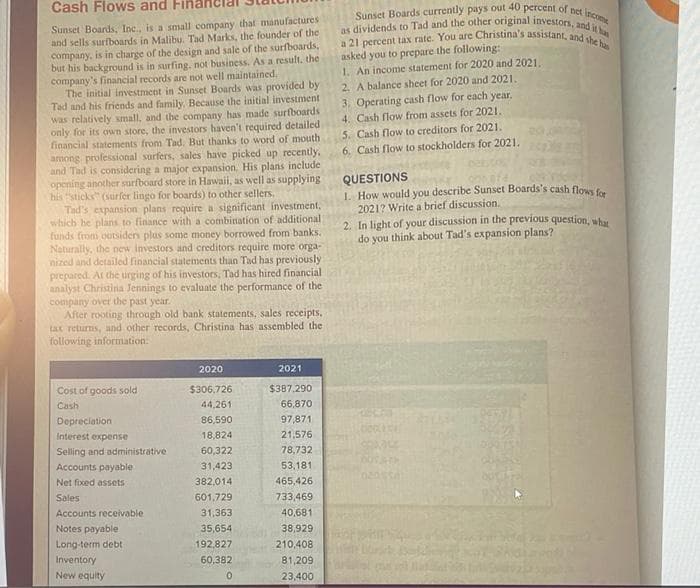

Sunset Boards, Inc., is a small company that manufactures

and sells surfboards in Malibu. Tad Marks, the founder of the

company, is in charge of the design and sale of the surfboards,

but his background is in surfing, not business. As a result, the

company's financial records are not well maintained.

The initial investment in Sunset Boards was provided by

Tad and his friends and family. Because the initial investment

was relatively small, and the company has made surfboards

only for its own store, the investors haven't required detailed

financial statements from Tad. But thanks to word of mouth

among professional surfers, sales have picked up recently,

and Tad is considering a major expansion. His plans include

opening another surfboard store in Hawaii, as well as supplying

his "sticks (surfer lingo for boards) to other sellers,

Tad's expansion plans require a significant investment,

which he plans to finance with a combination of additional

funds from outsiders plus some money borrowed from banks.

Naturally, the new investors and creditors require more orga-

nized and detailed financial statements than Tad has previously

prepared. At the urging of his investors, Tad has hired financial

analyst Christina Jennings to evaluate the performance of the

company over the past year.

After rooting through old bank statements, sales receipts.

tax returns, and other records, Christina has assembled the

following information:

Cost of goods sold

Cash

Depreciation

Interest expense

Selling and administrative

Accounts payable

Net fixed assets

Sales

Accounts receivable

Notes payable

Long-term debt

Inventory

New equity

2020

$306,726

44,261

86,590

18,824

60,322

31,423

382,014

601,729

31,363

35,654

192,827

60,382

0

2021

$387,290

66,870

97,871

21,576

78,732

53,181

465,426

733,469

40,681

38,929

210,408

81,209

23,400

Sunset Boards currently pays out 40 percent of net income

as dividends to Tad and the other original investors, and it has

a 21 percent tax rate. You are Christina's assistant, and she has

asked you to prepare the following:

1. An income statement for 2020 and 2021.

2. A balance sheet for 2020 and 2021.

3. Operating cash flow for each year.

4. Cash flow from assets for 2021..

5. Cash flow to creditors for 2021.

6. Cash flow to stockholders for 2021.

QUESTIONS

1. How would you describe Sunset Boards's cash flows for

2021? Write a brief discussion.

2. In light of your discussion in the previous question, what

do you think about Tad's expansion plans?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT