Required: 1. Prepare a schedule of expected cash collections for April, May, and June, and for the quarter in total. 2. Prepare the following for merchandise inventory: a. A merchandise purchases budget for April, May, and June. b. A schedule of expected cash disbursements for merchandise purchases for April, May, and June, and for the quarter in total. 3. Prepare a cash budget for April, May, and June as well as in total for the quarter.

Required: 1. Prepare a schedule of expected cash collections for April, May, and June, and for the quarter in total. 2. Prepare the following for merchandise inventory: a. A merchandise purchases budget for April, May, and June. b. A schedule of expected cash disbursements for merchandise purchases for April, May, and June, and for the quarter in total. 3. Prepare a cash budget for April, May, and June as well as in total for the quarter.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter13: Budgeting And Standard Costs

Section: Chapter Questions

Problem 13.2.6P: Budgeted income statement and supporting budgets The budget director of Jupiter Helmets Inc., with...

Related questions

Question

Please help with 1-3 Thank you!!

![Problem 8-24 (Algo) Cash Budget with Supporting Schedules [LO8-2, LO8-4, LO8-8]

Garden Sales, Incorporated, sells garden supplies. Management is planning its cash needs for the second quarter. The company

usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following

information has been assembled to assist in preparing a cash budget for the quarter:

a. Budgeted monthly absorption costing income statements for April-July are:

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses:

Selling expense

Administrative expense*

Total selling and administrative expenses

Net operating income

"Includes $29,000 of depreciation each month.

April

$ 690,000

483,000

207,000

87,000

48,500

135,500

$ 71,500

May

$ 860,000

602,000

258,000

106,000

65,600

171,600

$ 86,400

June

$ 570,000

399,000

171,000

Next

68,000

42,200

110,200

$ 60,800

July

$ 470,000

329,000

141,000

47,000

45,000

92,000

$ 49,000

b. Sales are 20% for cash and 80% on account.

c. Sales on account are collected over a three-month period with 10% collected in the month of sale; 70% collected in the first month

following the month of sale; and the remaining 20% collected in the second month following the month of sale. February's sales

totaled $265,000, and March's sales totaled $280,000.

d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F4d6fa1e9-36c0-4861-8dbf-8c72fa6219f2%2F62a0fd3c-50b9-49eb-8782-54ca2239fc50%2Fsx6cs2_processed.jpeg&w=3840&q=75)

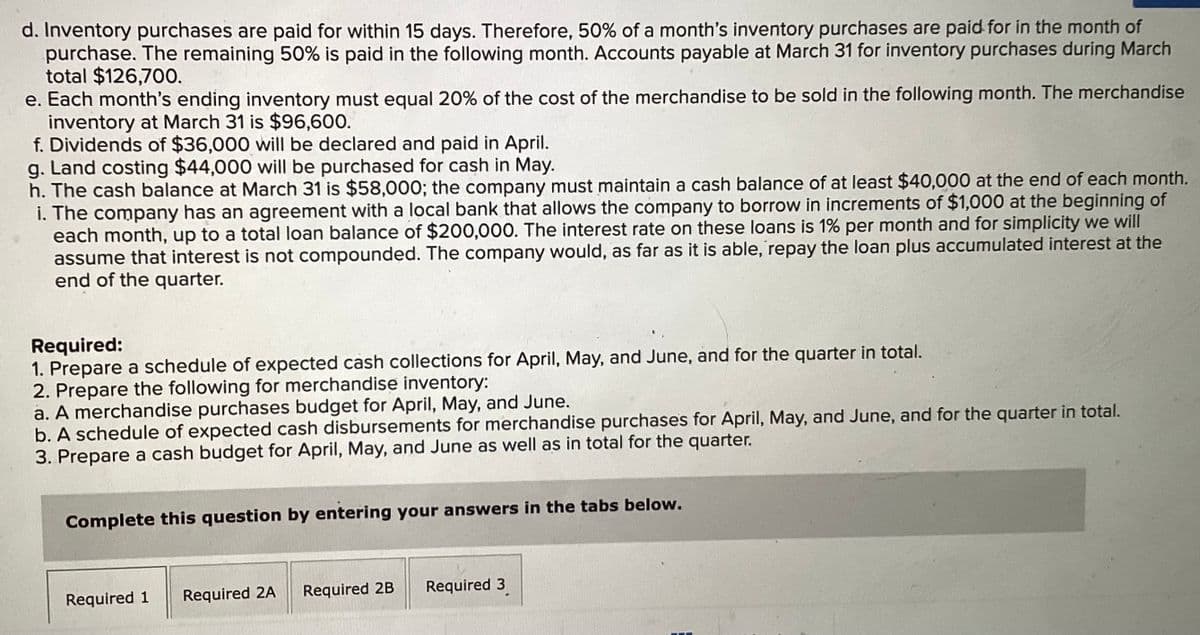

Transcribed Image Text:Problem 8-24 (Algo) Cash Budget with Supporting Schedules [LO8-2, LO8-4, LO8-8]

Garden Sales, Incorporated, sells garden supplies. Management is planning its cash needs for the second quarter. The company

usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following

information has been assembled to assist in preparing a cash budget for the quarter:

a. Budgeted monthly absorption costing income statements for April-July are:

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses:

Selling expense

Administrative expense*

Total selling and administrative expenses

Net operating income

"Includes $29,000 of depreciation each month.

April

$ 690,000

483,000

207,000

87,000

48,500

135,500

$ 71,500

May

$ 860,000

602,000

258,000

106,000

65,600

171,600

$ 86,400

June

$ 570,000

399,000

171,000

Next

68,000

42,200

110,200

$ 60,800

July

$ 470,000

329,000

141,000

47,000

45,000

92,000

$ 49,000

b. Sales are 20% for cash and 80% on account.

c. Sales on account are collected over a three-month period with 10% collected in the month of sale; 70% collected in the first month

following the month of sale; and the remaining 20% collected in the second month following the month of sale. February's sales

totaled $265,000, and March's sales totaled $280,000.

d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of

Transcribed Image Text:d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of

purchase. The remaining 50% is paid in the following month. Accounts payable at March 31 for inventory purchases during March

total $126,700.

e. Each month's ending inventory must equal 20% of the cost of the merchandise to be sold in the following month. The merchandise

inventory at March 31 is $96,600.

f. Dividends of $36,000 will be declared and paid in April.

g. Land costing $44,000 will be purchased for cash in May.

h. The cash balance at March 31 is $58,000; the company must maintain a cash balance of at least $40,000 at the end of each month.

i. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of

each month, up to a total loan balance of $200,000. The interest rate on these loans is 1% per month and for simplicity we will

assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the

end of the quarter.

Required:

1. Prepare a schedule of expected cash collections for April, May, and June, and for the quarter in total.

2. Prepare the following for merchandise inventory:

a. A merchandise purchases budget for April, May, and June.

b. A schedule of expected cash disbursements for merchandise purchases for April, May, and June, and for the quarter in total.

3. Prepare a cash budget for April, May, and June as well as in total for the quarter.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2A

Required 2B

Required 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning