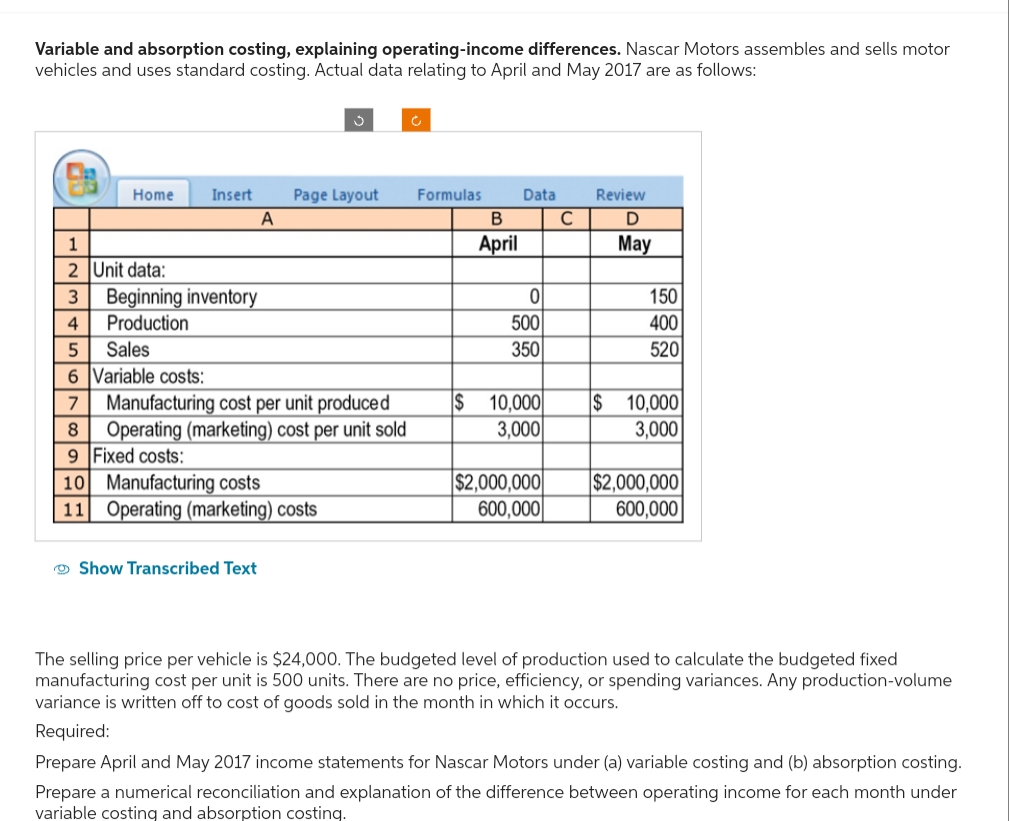

Variable and absorption costing, explaining operating-income differences. Nascar Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2017 are as follows: Home Insert Page Layout 3 A Show Transcribed Text 1 2 Unit data: 3 Beginning inventory 4 Production 5 Sales 6 Variable costs: 7 Manufacturing cost per unit produced Operating (marketing) cost per unit sold 8 9 Fixed costs: 10 Manufacturing costs 11 Operating (marketing) costs Formulas B April Data 0 500 350 $ 10,000 3,000 $2,000,000 600,000 C Review D May 150 400 520 $ 10,000 3,000 $2,000,000 600,000 The selling price per vehicle is $24,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 500 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. Required: Prepare April and May 2017 income statements for Nascar Motors under (a) variable costing and (b) absorption costing. Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing.

Variable and absorption costing, explaining operating-income differences. Nascar Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2017 are as follows: Home Insert Page Layout 3 A Show Transcribed Text 1 2 Unit data: 3 Beginning inventory 4 Production 5 Sales 6 Variable costs: 7 Manufacturing cost per unit produced Operating (marketing) cost per unit sold 8 9 Fixed costs: 10 Manufacturing costs 11 Operating (marketing) costs Formulas B April Data 0 500 350 $ 10,000 3,000 $2,000,000 600,000 C Review D May 150 400 520 $ 10,000 3,000 $2,000,000 600,000 The selling price per vehicle is $24,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 500 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. Required: Prepare April and May 2017 income statements for Nascar Motors under (a) variable costing and (b) absorption costing. Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 28P: The following information pertains to Vladamir, Inc., for last year: There are no work-in-process...

Related questions

Question

Dd2.

Transcribed Image Text:Variable and absorption costing, explaining operating-income differences. Nascar Motors assembles and sells motor

vehicles and uses standard costing. Actual data relating to April and May 2017 are as follows:

Home

Insert Page Layout

A

1

2 Unit data:

3 Beginning inventory

4 Production

5

Sales

6 Variable costs:

7 Manufacturing cost per unit produced

8 Operating (marketing) cost per unit sold

9 Fixed costs:

10

Manufacturing costs

11 Operating (marketing) costs

Show Transcribed Text

Formulas

B

April

Data

0

500

350

$ 10,000

3,000

$2,000,000

600,000

с

Review

D

May

150

400

520

$10,000

3,000

$2,000,000

600,000

The selling price per vehicle is $24,000. The budgeted level of production used to calculate the budgeted fixed

manufacturing cost per unit is 500 units. There are no price, efficiency, or spending variances. Any production-volume

variance is written off to cost of goods sold in the month in which it occurs.

Required:

Prepare April and May 2017 income statements for Nascar Motors under (a) variable costing and (b) absorption costing.

Prepare a numerical reconciliation and explanation of the difference between operating income for each month under

variable costing and absorption costing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning