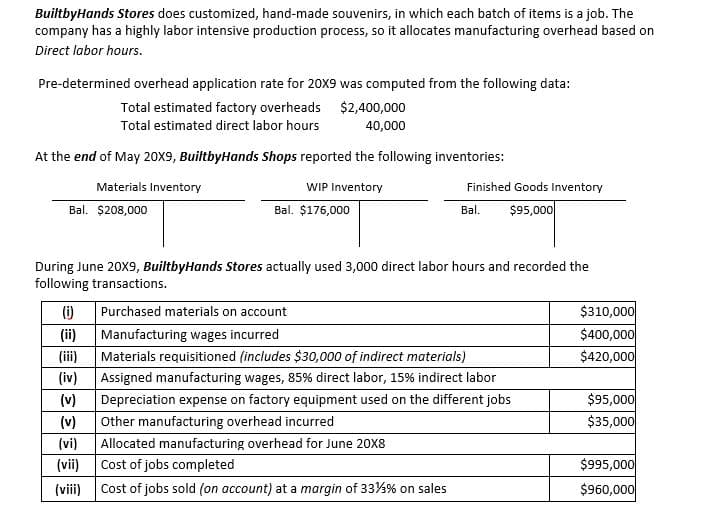

Required: (a) Compute, BuiltbyHands Stores predetermined manufacturing overhead rate for 20X8. (b) State the journal entries necessary to record the above transactions in the general journal. Assume that, BuiltbyHands Stores uses the perpetual inventory system. (c) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account and state the Balance on the account before performing end of period closing entries. Show the journal entries Necessary to dispose of the variance. (d) What is the balance in the Cost of Goods Sold account after the adjustment? (e) Compute, BuiltbyHands Stores‘gross profit earned on the jobs completed. (f) Open T-accounts for Materials Inventory, Work in Process Inventory and Finished Goods Inventory. Post the appropriate entries to these accounts & determine the ending account balances.

Required:

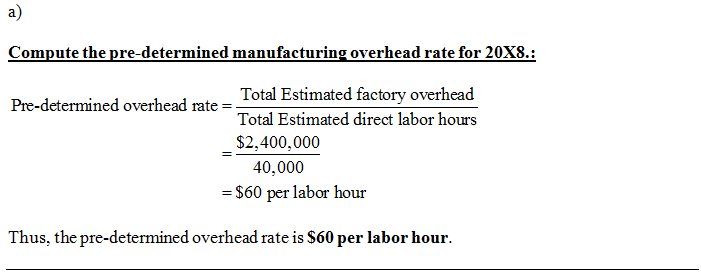

(a) Compute, BuiltbyHands Stores predetermined manufacturing

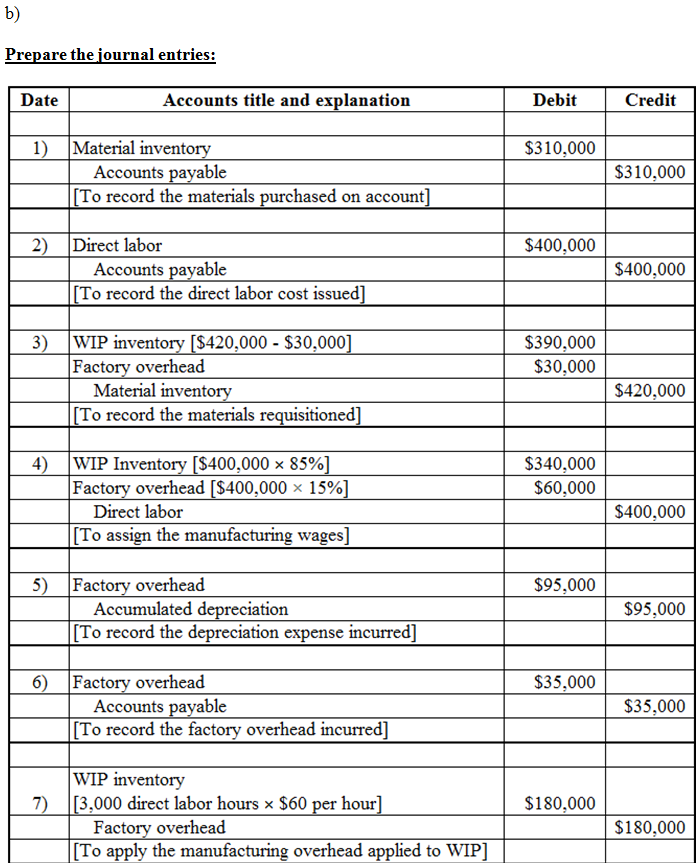

(b) State the

(c) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account and state the

Balance on the account before performing end of period closing entries. Show the journal entries

Necessary to dispose of the variance.

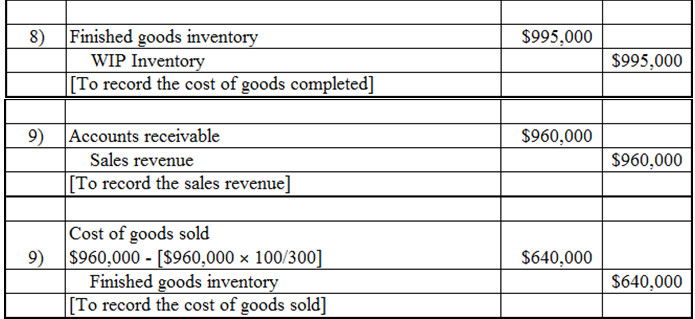

(d) What is the balance in the Cost of Goods Sold account after the adjustment?

(e) Compute, BuiltbyHands Stores‘gross profit earned on the jobs completed.

(f) Open T-accounts for Materials Inventory, Work in Process Inventory and Finished Goods Inventory.

Job costing: It is a method of costing where in all the costs like direct material, direct labor and manufacturing overhead are accumulated to a particular job. This method is suitable for jobs where the work is to be performed according to the specifications of a customer and in separate batches.

Pre-determined overhead allocate rate: It the rate of allocating the expected overheads to the actual units or hours for a specific accounting period.

Raw materials: It is the basic input required to manufacture the finished products. The raw materials are processed by incurring conversion costs and other overhead to convert them into finished products.

Manufacturing overhead: It is the indirect cost incurred as a part of manufacturing the products. These costs are not directly related to the units manufactured. So they are allocated to the manufactured units based on estimated cost drivers.

Work-in process: This is the cost of units which were semi-finished in a particular period. Further work should be done and cost should be incurred to make them into finished products.

Finished goods: These are the units which were completed by the manufacturing process and were ready to sale.

Under/over applied overhead: If the overhead applied is more than the actual overhead, then the overhead is said to be over applied. If the overhead applied is less than the actual overhead then the overhead is said to be under applied.

Step by step

Solved in 4 steps with 6 images