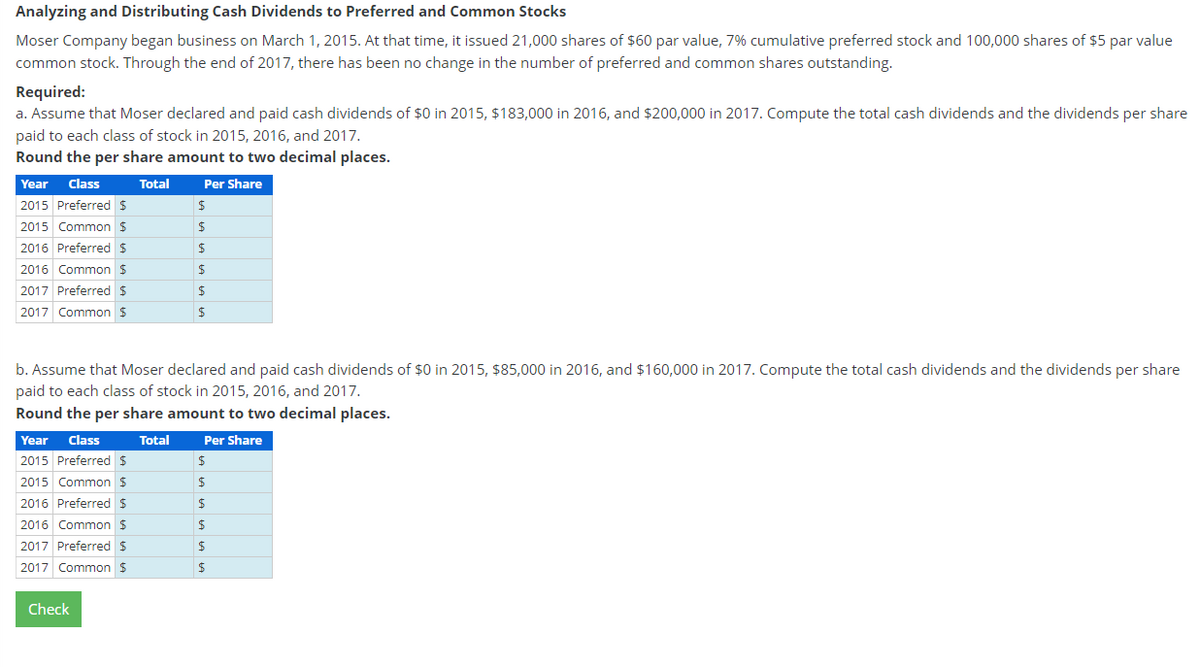

Required: a. Assume that Moser declared and paid cash dividends of $0 in 2015, $183,000 in 2016, and $200,000 in 2017. Compute the total cash dividends and the dividends per share paid to each class of stock in 2015, 2016, and 2017. Round the per share amount to two decimal places. Total Per Share Year Class 2015 Preferred $ 2015 Common S 2016 Preferred $ 2016 Common $ 2017 Preferred S 2017 Common S $ $ $ $ $ $

Q: Jasper Junction Corporation (JJC) is an accrual basis, calendar-year entity that was created by…

A: For the purposes of federal taxation, S corporations are businesses that choose to pass through to…

Q: Marigold Corporation was organized on January 1, 2025. It is authorized to issue 11,000 shares of…

A: Journal Entries - Journal Entries are the records of the transactions entered into by the company…

Q: Evaluating data reliability is a critical part of the audit process. Explain the differences among…

A: Internal data is internal to the company as the name suggests. It gives an insight on company's…

Q: Which of the following best identifies the purpose of the government-wide financial statements?…

A: Financial Statement comprises of Income Statement, Balance Sheet, cash flow statement and Notes to…

Q: Sunland Corporation, a private company, began operations on January 1, 2020. During its first three…

A: Introduction: A statement of retained earnings is a part financial statement that shows the changes…

Q: A local financial consulting firm employs 20 full-time staff. The estimated compensation per…

A: Direct Cost :— It is the cost that are directly incurred in the manufacturing of particular product…

Q: Altira Corporation provides the following information related to its merchandise inventory during…

A: Inventory valuation method includes: FIFO Method LIFO Method Average cost method FIFO Method- As…

Q: On 31st March 2021, the following estimates were made: [Pada 31 Mac 2021, anggaran-anggaran berikut…

A: Financial statements are those statements which are prepared at the end of accounting period for the…

Q: Slapshot Company makes ice hockey sticks. During the month of June, the company purchased $128,000…

A: Cost of goods manufactured is the amount that has been incurred by the company on the manufacturing…

Q: Required information [The following information applies to the questions displayed below.] Calvin…

A: Answer:- Adjusted gross income:- Gross income less adjustments to income is known as adjusted gross…

Q: Identifythebasicrightsinherentinownershipofcommonstockandexplainhowownersexercisethem

A: Common stock is a type of ownership in a corporation that represents a share of its equity. Owners…

Q: ABC Co makes all sales on credit. At 30 November 20X9, the total receivables balance amounted to…

A: IAS 10 deals with the events arising after the reporting period. It determines whether the…

Q: Imagine that you have been tasked with evaluating the future investment of equipment for a company.…

A: The most commonly used method to evaluate future investments is the net present value (NPV) method.…

Q: On October 1 , Benji's Bicycle Store had an inventory of 20 ten speed bicycles at a cost of $200…

A: “Since you have posted a question with multiple sub parts, we will provide the solution only to the…

Q: considering an investment of $383,000 in an asset with an economic life of 5 years. The firm…

A: Cash flow from assets is the operating cash flow and considering the capital expenses and working…

Q: Sales Cost of goods sold. Accounts receivable 2021 $ 424,322 214,661 20,580 Numerator: 2020 $…

A: Working : (1) Trend percent for net sales = Current year net sales / Base year net sales (2) Trend…

Q: Required information [The following information applies to the questions displayed below.] Raphael…

A: The dividend is a method of distributing profits among shareholders. The preference shareholders…

Q: S Quantum Moving Company has the following data. Industry information also is shown. Company Data…

A: Ratio Analysis -The ratio is the technique used by the prospective investor or an individual or…

Q: K&C Ltd. is working on a budget for the current year. The following information is linked to budget…

A: Lets understand the basics. Management prepare various budgets in order to set a standard and…

Q: How does the income statement and balance sheet of a merchandising company differs from a service…

A: An income statement for a merchandising company includes Cost of Goods Sold (COGS) as a line item,…

Q: 1. What is the Gross Profit under Multiple Step Income Statement a. 389816 b. 505526 c. 446773 d.…

A: A single-step income statement reports the company's net income by using a single computation and…

Q: fixed costs

A: The break-even point in business, specifically cost accounting means the point at which total…

Q: Listed below are several transactions that took place during the second and third years of…

A: Introduction: Net income is the total revenue minus the total expenses for a given period of time.…

Q: Consolidated financial statements are required by GAAP in certain circumstances. This information…

A: Consolidated financial statements are statements prepared by parent company . Parent company is a…

Q: For the fiscal year ending December 31, 2023, Oriole Ltd. reported sales revenue of $7,295,000 and…

A: Answer to Question:- Oriole Ltd…

Q: 7. An entity makes a formal plan to sell its building that has no value in use. The building has a…

A: Hi student Since there are multiple questions, we will answer only first question. Non current…

Q: Inventories, November 1 Raw materials and supplies Work in process (Job X-50) Finished goods…

A: Lets understand the basics. Predetermine ovehead rate is calculated by the management in order to…

Q: What are the total Expenses under the single-step income statement? a. 389,816 b. $85,710 c.…

A: The single step income statement represents the total expenses at the one place. The income is…

Q: Description Willie Nelson, Jr., controller for Jenkins Corporation, is preparing the company's…

A: Disclaimer : Since you have asked multiple sub-part questions, we will solve the first three…

Q: Dece 20, 2021, and 2022. The tax payable column is her combined federal and provincial tax e amounts…

A: Option Value: The difference between the option price and the projected excess is referred to as the…

Q: Materiality is driven by __________ of the financial statements and their needs. Question 1…

A: Financial statements are defined as the records that are prepared by the business entities as per…

Q: 2. Find the proceeds of Php 45,600 due at the end of 18 months if the discount interest rate is 10½…

A: Answer:- Discount interest meaning:- When a loan's interest is paid upfront, it's referred to a…

Q: Persimmon Designs provides consulting services related to home decoration. Persimmon Designs…

A: Answer to Question 1:- PERSIMMON DESIGNS…

Q: On December 31, 2015, Martin Corp invested in Marlin’s 5-year, $200,000 bond with a 5% interest rate…

A: Bonds - Bonds are fixed-income securities that reflect loans from investors to borrowers (typically…

Q: What is the role of depreciation allowance?

A: Depreciation seems to be an allowance on physical assets bought and used, not really an expense,…

Q: What are the main reasons for an audit, and what actions result in an audit being conducted?

A: 1. Compliance with laws and regulations: Audits are conducted in order to ensure that an…

Q: need correct help in detail

A: A ledger is a log or list of accounts that keeps track of account transfers.

Q: Astro Corporation was started with the issue of 4,400 shares of $12 par stock for cash on January 1,…

A: Statement of Stockholders' equity is an essential part of the financial statements of the company.…

Q: Directions: Create a % Change and Yr. 2 Common Size Income Statement for Dana Point. Use excel to…

A: Horizontal analysis is one of the financial statement of the business under which increase or…

Q: ou graduated college six years ago with an undergraduate degree in Finance. Although satisfied with…

A: MBA stands for Master of Business Administration which is a degree that provide the person with the…

Q: COSO's 2013 Internal Control - Integrated Framework does NOT include the following as one of the key…

A: Internal control is defined as a procedure that requires a company to provide true results through…

Q: Dandy's Dandy Dandelion Wine Watering Hole Income Statement For Years-Ended 12.31.12 and 12.31.13…

A: Ratio analysis is quantitive method of getting inside review of an organisation. This able to…

Q: 1. What was the trade discount rate if merchandise with a list price of $14,200 was sold at a net…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Juarez Company acquired $1,200 from the issue of common stock. Which of the following shows how this…

A: Accounting equation is fundamental equation under double entry accounting system. Where liabilities…

Q: Salaries expenses Marketing Expenses A/R A/P Total Sales Cost of goods sold Cash Retained earnings…

A: Lets understand the basics. Financial statement is divided into two major sections. (1) Income…

Q: PQ Company currently sells a piece of equipment for $150 per unit. It plans on lowering the price…

A: Sales depends on the price of products and sales increases with decreases in the prices and hence…

Q: MANUAL SOLUTIONS NOT EXCEL DOWNVOTE IF EXCEL Determine the difference between the capitalized cost…

A: Capitalized cost refers to the present value of cash outflow related to the asset. we discount the…

Q: Turner Company started its business by issuing $14,000 of common stock on January 1, Year 1. The…

A: The cash is the current asset of the business. The cash budget is prepared to estimate the cash…

Q: Prepare the journal entries to record the reacquisition (recall) of Hill’s bonds.

A: A callable bond which bond issuer can redeem before it reaches its stated maturity date. Redemption…

Q: At the time of Mateo's death, he was involved in the transactions described below: Mateo was a…

A: Gross estate refers to all of the assets used to calculate whether an estate is subject to federal…

Do not give answer in image formate

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. In the space provided below, prepare the stockholders equity section of Chen Corporations balance sheet as of December 31, 2012. Use proper headings and provide full disclosure of all appropriate information. Chens corporate charter authorizes the issuance of 1,000 shares of preferred stock and 100,000 shares of common stock.The following selected transactions and events occurred during 2013: a. Issued 200 shares of preferred stock for 20,000. b. Sold 800 shares of treasury stock for 2,800. c. Declared and issued a 4% common stock dividend. The market value on the date of declaration was 5 per share. d. Generated a net loss for the year of 16,000. e. Declared and paid the full years dividend on all the preferred stock and a dividend of 15 per share on common stock outstanding at the end of the year. Enter beginning balances for 2013 on STOCKEQ2. Then erase all 2012 entries and enter the transactions for 2013. Save the results as STOCKEQ4. Print the results.Treasury Stock, Cost Method Bush-Caine Company reported the following data on its December 31, 2018, balance sheet: The following transactions were reported by the company during 2019: 1. Reacquired 200 shares of its preferred stock at 57 per share. 2. Reacquired 500 shares of its common stock at 16 per share. 3. Sold 100 shares of preferred treasury stock at 58 per share. 4. Sold 200 shares of common treasury stock at 17 per share. 5. Sold 100 shares of common treasury stock at 9 per share. 6. Retired the shares of common stock remaining in the treasury. The company maintains separate treasury stock accounts and related additional paid-in capital accounts for each class of stock. Required: 1. Prepare the journal entries required to record the treasury stock transactions using the cost method. 2. Assuming the company earned a net income in 2019 of 30.000 and declared and paid dividends of 10,000, prepare the shareholders equity section of its balance sheet at December 31, 2019.

- Preferred Stock Dividends Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value, cumulative preferred stock. In 2017 and 2018, no dividends were declared on preferred stock. In 2019, Seashell had a profitable year and decided to pay dividends to stockholders of both preferred and common stock. Required: If Seashell has $200,000 available for dividends in 2019, how much could it pay to the common stockholders Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value, cumulative preferred stock. In 2017 and 2018, no dividends were declared on preferred stock. In 2019, Seashell had a profitable year and decided to pay dividends to stockholders of both preferred and common stock. Required: If Seashell has S200,000 available for dividends in 2019, how much could it pay to the common stockholdersCash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?