REQUIRED: a. Compute cost of goods sold and gross profit using an inventory schedule b. Compute the cost of the building and the annual depreciation expense using the straight-line method. c. Prepare a depreciation schedule for the equipment, clearly showing the annual depreciation expense, accumulated depreciation and net book value for each of its useful life.

REQUIRED: a. Compute cost of goods sold and gross profit using an inventory schedule b. Compute the cost of the building and the annual depreciation expense using the straight-line method. c. Prepare a depreciation schedule for the equipment, clearly showing the annual depreciation expense, accumulated depreciation and net book value for each of its useful life.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 18CE: CORNERSTONE 2.1 Four statements are given below. Pewterschmidt Company values its inventory reported...

Related questions

Question

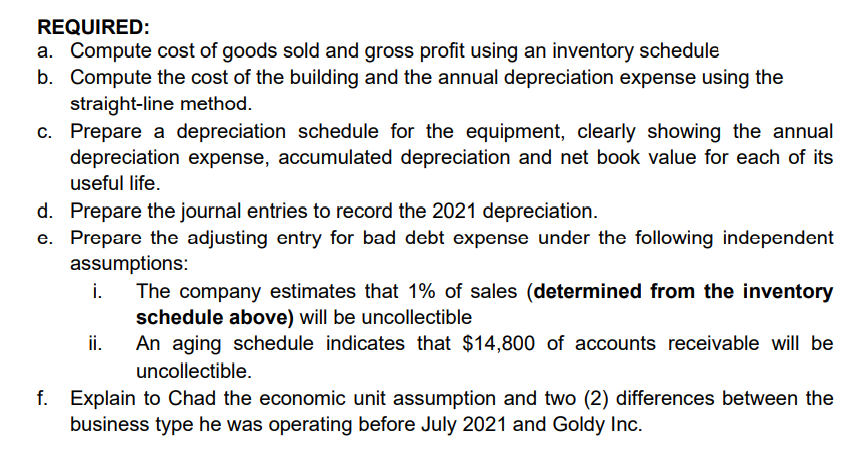

Transcribed Image Text:REQUIRED:

a. Compute cost of goods sold and gross profit using an inventory schedule

b. Compute the cost of the building and the annual depreciation expense using the

straight-line method.

c. Prepare a depreciation schedule for the equipment, clearly showing the annual

depreciation expense, accumulated depreciation and net book value for each of its

useful life.

d. Prepare the journal entries to record the 2021 depreciation.

e. Prepare the adjusting entry for bad debt expense under the following independent

assumptions:

i.

The company estimates that 1% of sales (determined from the inventory

schedule above) will be uncollectible

An aging schedule indicates that $14,800 of accounts receivable will be

ii.

uncollectible.

f. Explain to Chad the economic unit assumption and two (2) differences between the

business type he was operating before July 2021 and Goldy Inc.

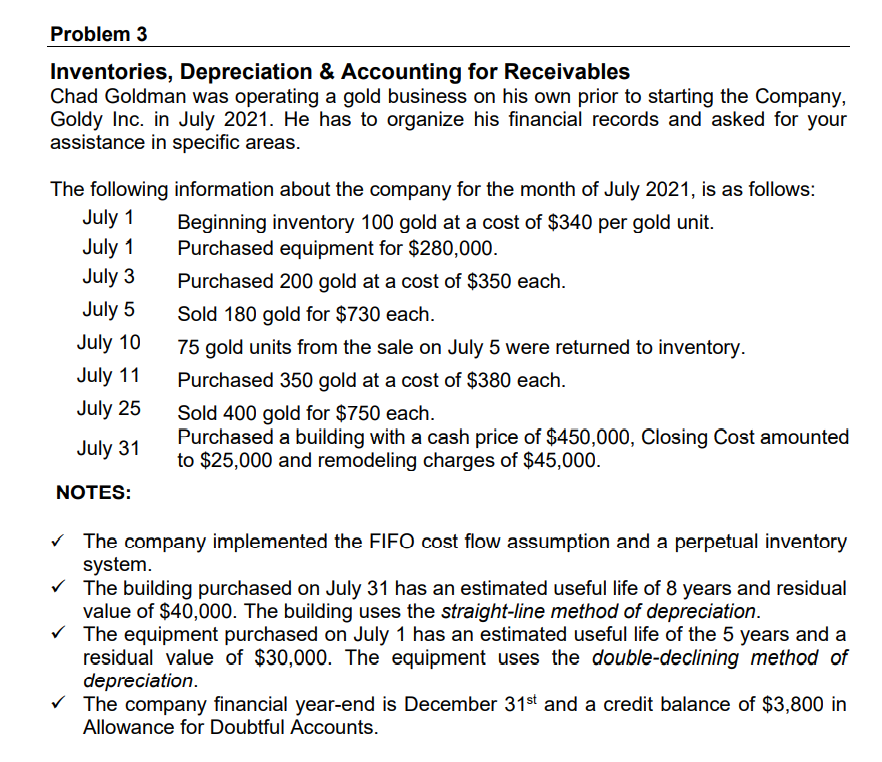

Transcribed Image Text:Problem 3

Inventories, Depreciation & Accounting for Receivables

Chad Goldman was operating a gold business on his own prior to starting the Company,

Goldy Inc. in July 2021. He has to organize his financial records and asked for your

assistance in specific areas.

The following information about the company for the month of July 2021, is as follows:

July 1

July 1

Beginning inventory 100 gold at a cost of $340 per gold unit.

Purchased equipment for $280,000.

July 3

Purchased 200 gold at a cost of $350 each.

July 5

Sold 180 gold for $730 each.

July 10

75 gold units from the sale on July 5 were returned to inventory.

July 11

Purchased 350 gold at a cost of $380 each.

July 25

Sold 400 gold for $750 each.

Purchased a building with a cash price of $450,000, Člosing Cost amounted

to $25,000 and remodeling charges of $45,000.

July 31

NOTES:

v The company implemented the FIFO cost flow assumption and a perpetual inventory

system.

V The building purchased on July 31 has an estimated useful life of 8 years and residual

value of $40,000. The building uses the straight-line method of depreciation.

V The equipment purchased on July 1 has an estimated useful life of the 5 years and a

residual value of $30,000. The equipment uses the double-declining method of

depreciation.

V The company financial year-end is December 31st and a credit balance of $3,800 in

Allowance for Doubtful Accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning