Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Hemming Co. reported the following current-year purchases and sales for its only product.

Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Hemming Co. reported the following current-year purchases and sales for its only product.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2MC: The following information is available for Cooke Company for the current year: The gross margin is...

Related questions

Topic Video

Question

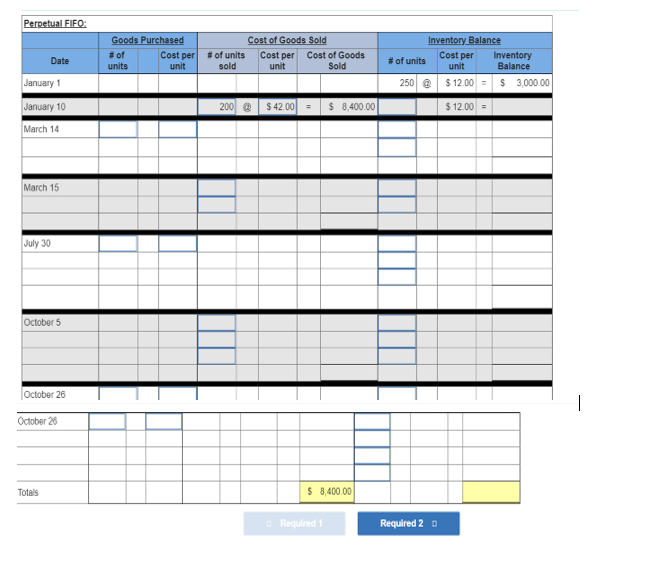

Determine the costs assigned to ending inventory and to cost of goods sold using FIFO.

Hemming Co. reported the following current-year purchases and sales for its only product.

Transcribed Image Text:Perpetual FIFO:

Goods Purchased

Cost of Goods Sold

Cost per Cost of Goods

unit

Inventory Balance

#of

units

Cost per

unit

#of units

sold

# of units

Cost per

unit

Inventory

Balance

Date

Sold

January 1

January 10

March 14

250 e

$ 12.00 =

S 3,000.00

200 e $ 42.00 =

$ 8,400.00

$ 12.00-

March 15

July 30

October 5

October 26

October 26

Totals

$ 8,400.00

O Required 1

Required 2 o

![[The following information applies to the questions displayed below.]

Hemming Co. reported the following current-year purchases and sales for its only product.

Activities

Units Acquired at Cost

250 units @ $12.00 = $ 3,000

Date

Units Sold at Retail

Jan. 1 Beginning inventory

Jan. 10 Sales

200 units @ $42.00

Mar.14 Purchase

400 units @ $17.00

6,800

Mar.15 Sales

360 units @ $42.00

450 units @ $22.00

July30 Purchase

Oct. 5 Sales

9,900

420 units @ $42.00

Oct. 26 Purchase

150 units @ $27.00

4,050

Totals

1,250 units

$23,750

980 units](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F6a02b260-ff6c-4d5e-84bc-57397ca3f648%2Ff534bf1b-441b-4ca5-bf51-571a6c0ec5be%2Fs4ncgx8_processed.png&w=3840&q=75)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Hemming Co. reported the following current-year purchases and sales for its only product.

Activities

Units Acquired at Cost

250 units @ $12.00 = $ 3,000

Date

Units Sold at Retail

Jan. 1 Beginning inventory

Jan. 10 Sales

200 units @ $42.00

Mar.14 Purchase

400 units @ $17.00

6,800

Mar.15 Sales

360 units @ $42.00

450 units @ $22.00

July30 Purchase

Oct. 5 Sales

9,900

420 units @ $42.00

Oct. 26 Purchase

150 units @ $27.00

4,050

Totals

1,250 units

$23,750

980 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning