REQUIRED: a. Determine the taxable income of Mr. De Guzman. b. Determine the taxable income of Mrs. De Guzman. c. Determine the consolidated income tax payable of Mr. and Mrs. De Guzman

REQUIRED: a. Determine the taxable income of Mr. De Guzman. b. Determine the taxable income of Mrs. De Guzman. c. Determine the consolidated income tax payable of Mr. and Mrs. De Guzman

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 57P

Related questions

Question

REQUIRED:

a. Determine the taxable income of Mr. De Guzman.

b. Determine the taxable income of Mrs. De Guzman.

c. Determine the consolidated income tax payable of Mr. and Mrs. De Guzman

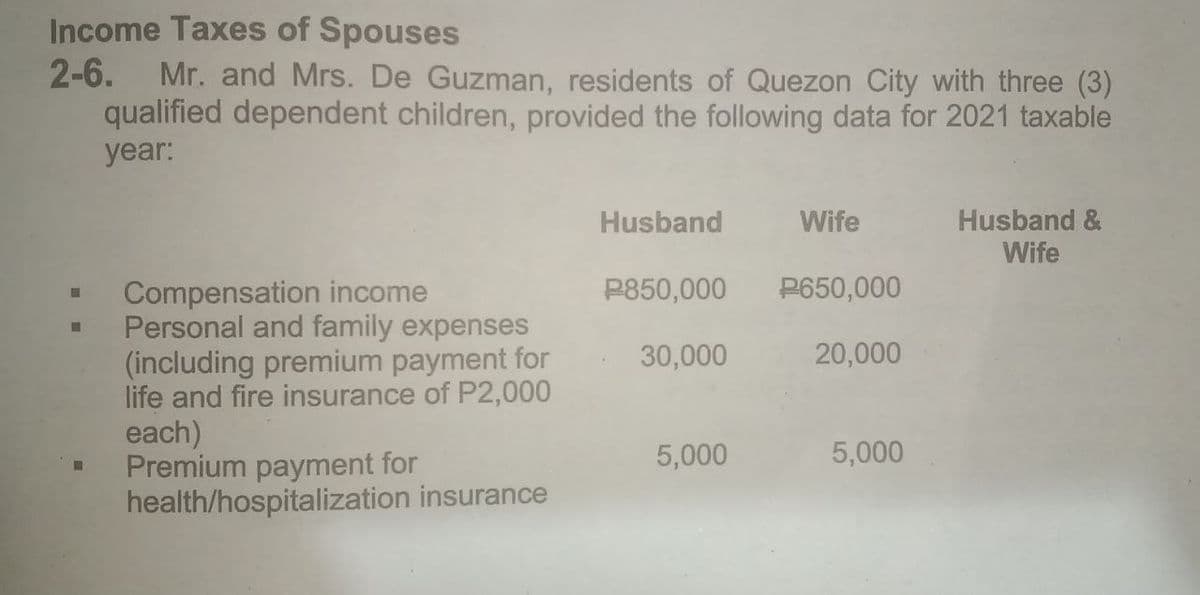

Transcribed Image Text:Income Taxes of Spouses

2-6.

Mr. and Mrs. De Guzman, residents of Quezon City with three (3)

qualified dependent children, provided the following data for 2021 taxable

year:

Husband &

Wife

Husband

Wife

P850,000

P650,000

Compensation income

Personal and family expenses

(including premium payment for

life and fire insurance of P2,000

each)

Premium payment for

health/hospitalization insurance

30,000

20,000

5,000

5,000

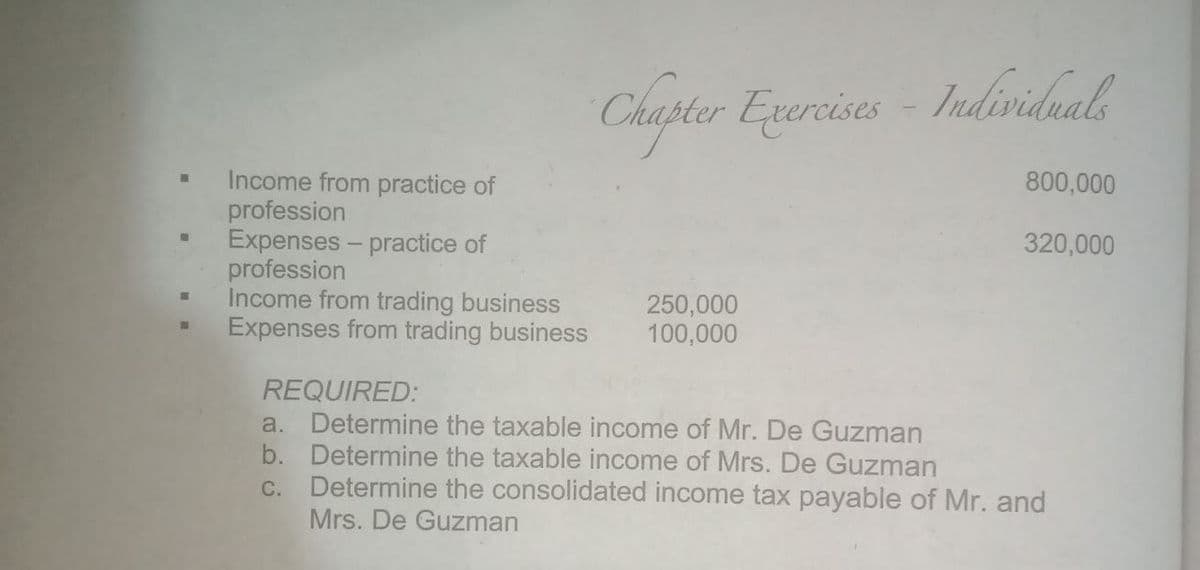

Transcribed Image Text:Chapter Exercises- Iulivilual

Income from practice of

profession

Expenses - practice of

profession

Income from trading business

Expenses from trading business

800,000

320,000

250,000

100,000

REQUIRED:

a. Determine the taxable income of Mr. De Guzman

b. Determine the taxable income of Mrs. De Guzman

Determine the consolidated income tax payable of Mr. and

Mrs. De Guzman

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT