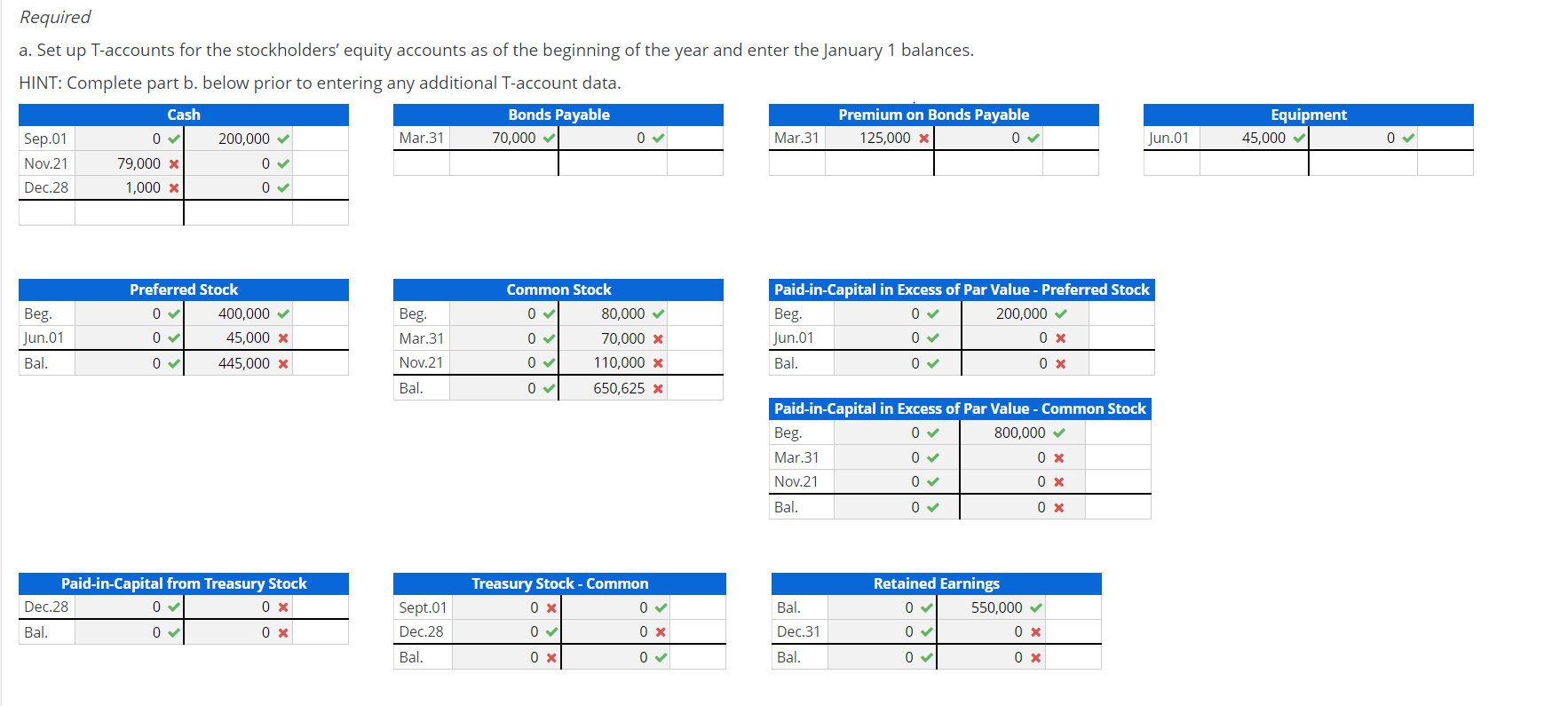

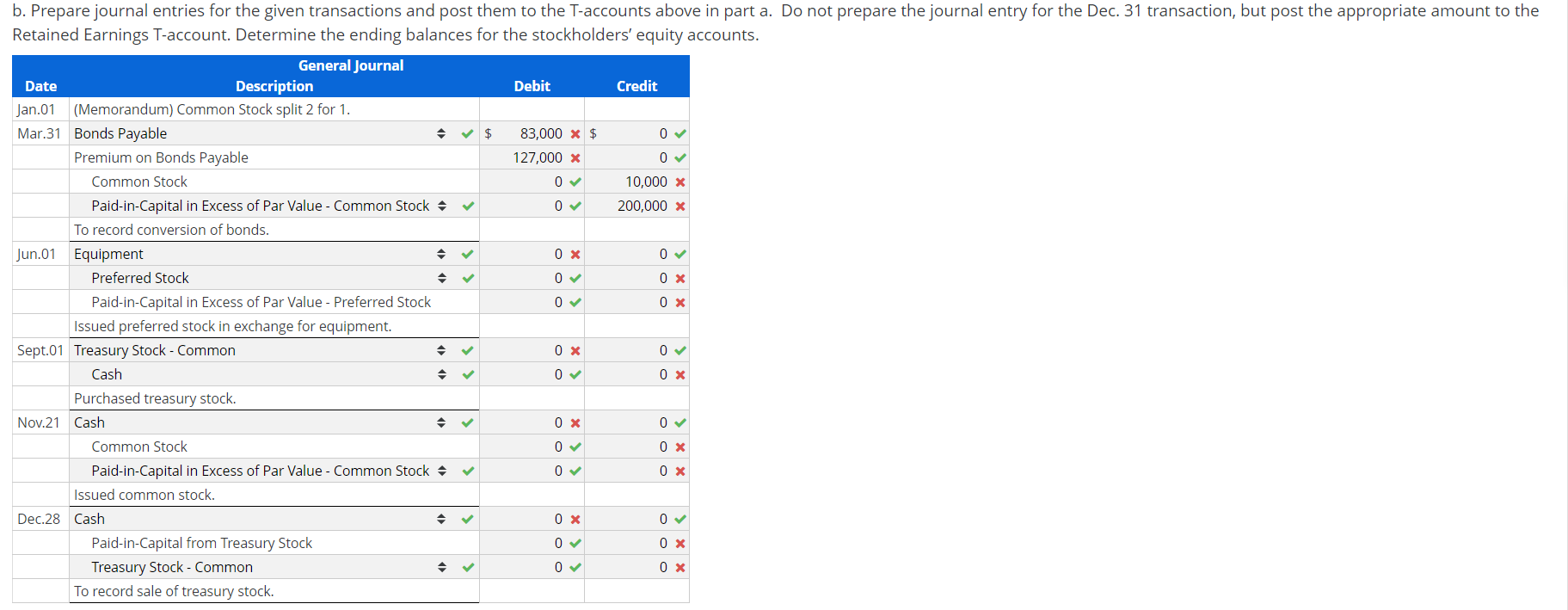

Required a. Set up T-accounts for the stockholders' equity accounts as of the beginning of the year and enter the January 1 balances. HINT: Complete part b. below prior to entering any additional T-account data. Bonds Payable Premium on Bonds Payable Cash Equipment Mar.31 Mar.31 70,000 v 125,000 x Jun.01 45,000 Sep.01 200,000 Nov.21 79,000 x Dec.28 1,000 x Preferred Stock Paid-in-Capital in Excess of Par Value - Preferred Stock Common Stock 400,000 v 80,000 v Beg. Beg. Beg. 200,000 v 45,000 x Jun.01 70,000 x Jun.01 Mar.31 445,000 x Bal. Nov.21 110,000 x Bal. Bal. 650,625 x Paid-in-Capital in Excess of Par Value - Common Stock Beg. 800,000 v Mar.31 Nov.21 Bal. Retained Earnings Paid-in-Capital from Treasury Stock Treasury Stock - Common Dec.28 Bal. Sept.01 550,000 v Bal. Dec.28 Dec.31 ох Bal. Bal. b. Prepare journal entries for the given transactions and post them to the T-accounts above in part a. Retained Earnings T-account. Determine the ending balances for the stockholders' equity accounts. Do not prepare the journal entry for the Dec. 31 transaction, but post the appropriate amount to the General Journal Credit Debit Description Date Jan.01 (Memorandum) Common Stock split 2 for 1. Mar.31 Bonds Payable 83,000 x $ Premium on Bonds Payable Common Stock Paid-in-Capital in Excess of Par Value 127,000 x 10,000 x - Common Stock + 200,000 x To record conversion of bonds. Jun.01 Equipment Preferred Stock Paid-in-Capital in Excess of Par Value - Preferred Stock Issued preferred stock in exchange for equipment. Sept.01 Treasury Stock - Common Cash Purchased treasury stock. Nov.21 Cash Common Stock Paid-in-Capital in Excess of Par Value - Common Stock Issued common stock. + Dec.28 Cash Paid-in-Capital from Treasury Stock Treasury Stock - Common To record sale of treasury stock.

Required a. Set up T-accounts for the stockholders' equity accounts as of the beginning of the year and enter the January 1 balances. HINT: Complete part b. below prior to entering any additional T-account data. Bonds Payable Premium on Bonds Payable Cash Equipment Mar.31 Mar.31 70,000 v 125,000 x Jun.01 45,000 Sep.01 200,000 Nov.21 79,000 x Dec.28 1,000 x Preferred Stock Paid-in-Capital in Excess of Par Value - Preferred Stock Common Stock 400,000 v 80,000 v Beg. Beg. Beg. 200,000 v 45,000 x Jun.01 70,000 x Jun.01 Mar.31 445,000 x Bal. Nov.21 110,000 x Bal. Bal. 650,625 x Paid-in-Capital in Excess of Par Value - Common Stock Beg. 800,000 v Mar.31 Nov.21 Bal. Retained Earnings Paid-in-Capital from Treasury Stock Treasury Stock - Common Dec.28 Bal. Sept.01 550,000 v Bal. Dec.28 Dec.31 ох Bal. Bal. b. Prepare journal entries for the given transactions and post them to the T-accounts above in part a. Retained Earnings T-account. Determine the ending balances for the stockholders' equity accounts. Do not prepare the journal entry for the Dec. 31 transaction, but post the appropriate amount to the General Journal Credit Debit Description Date Jan.01 (Memorandum) Common Stock split 2 for 1. Mar.31 Bonds Payable 83,000 x $ Premium on Bonds Payable Common Stock Paid-in-Capital in Excess of Par Value 127,000 x 10,000 x - Common Stock + 200,000 x To record conversion of bonds. Jun.01 Equipment Preferred Stock Paid-in-Capital in Excess of Par Value - Preferred Stock Issued preferred stock in exchange for equipment. Sept.01 Treasury Stock - Common Cash Purchased treasury stock. Nov.21 Cash Common Stock Paid-in-Capital in Excess of Par Value - Common Stock Issued common stock. + Dec.28 Cash Paid-in-Capital from Treasury Stock Treasury Stock - Common To record sale of treasury stock.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 5RE

Related questions

Question

The stockholders’ equity of Fremantle Corporation at January 1 follows:

| 8 Percent |

|

| authorized; 4,000 shares issued and outstanding | $400,000 |

| Common stock, $2 par value, 10,000 shares | |

| authorized; 40,000 shares issued and outstanding | 80,000 |

| Paid-in capital in excess of par value-Preferred stock | 200,000 |

| Paid-in capital in excess of par value-Common stock | 800,000 |

| 550,000 | |

| Total Stockholders' Equity | $2,030,000 |

The following transactions, among others, occurred during the year:

| Jan. | 1 | Announced a 2-for-1 common stock split, reducing the par value of the common stock to $1 per share. |

| Mar. | 31 | Converted $70,000 face |

| June | 1 | Acquired equipment with a fair market value of $45,000 in exchange for 300 shares of preferred stock. |

| Sept. | 1 | Acquired 10,000 shares of common stock for cash at $20 per share. |

| Nov. | 21 | Issued 5,000 shares of common stock at $22 cash per share. |

| Dec. | 28 | Sold 1,000 treasury shares at $24 per share. |

| 31 | Closed net income of $103,000, to the Retained Earnings account. |

Transcribed Image Text:Required

a. Set up T-accounts for the stockholders' equity accounts as of the beginning of the year and enter the January 1 balances.

HINT: Complete part b. below prior to entering any additional T-account data.

Bonds Payable

Premium on Bonds Payable

Cash

Equipment

Mar.31

Mar.31

70,000 v

125,000 x

Jun.01

45,000

Sep.01

200,000

Nov.21

79,000 x

Dec.28

1,000 x

Preferred Stock

Paid-in-Capital in Excess of Par Value - Preferred Stock

Common Stock

400,000 v

80,000 v

Beg.

Beg.

Beg.

200,000 v

45,000 x

Jun.01

70,000 x

Jun.01

Mar.31

445,000 x

Bal.

Nov.21

110,000 x

Bal.

Bal.

650,625 x

Paid-in-Capital in Excess of Par Value - Common Stock

Beg.

800,000 v

Mar.31

Nov.21

Bal.

Retained Earnings

Paid-in-Capital from Treasury Stock

Treasury Stock - Common

Dec.28

Bal.

Sept.01

550,000 v

Bal.

Dec.28

Dec.31

ох

Bal.

Bal.

Transcribed Image Text:b. Prepare journal entries for the given transactions and post them to the T-accounts above in part a.

Retained Earnings T-account. Determine the ending balances for the stockholders' equity accounts.

Do not prepare the journal entry for the Dec. 31 transaction, but post the appropriate amount to the

General Journal

Credit

Debit

Description

Date

Jan.01 (Memorandum) Common Stock split 2 for 1.

Mar.31 Bonds Payable

83,000 x $

Premium on Bonds Payable

Common Stock

Paid-in-Capital in Excess of Par Value

127,000 x

10,000 x

- Common Stock

+

200,000 x

To record conversion of bonds.

Jun.01 Equipment

Preferred Stock

Paid-in-Capital in Excess of Par Value - Preferred Stock

Issued preferred stock in exchange for equipment.

Sept.01 Treasury Stock

- Common

Cash

Purchased treasury stock.

Nov.21 Cash

Common Stock

Paid-in-Capital in Excess of Par Value - Common Stock

Issued common stock.

+

Dec.28 Cash

Paid-in-Capital from Treasury Stock

Treasury Stock - Common

To record sale of treasury stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning