Required: Based on the information contained in the extracts of Bowdry Ltd's latest financial statements, answer the questions below. (a) Give the formulas for calculating the following two working capital ratios: (1) inventory days. (i) receivables collection period. (b) Calculate the inventory days and receivables collection period for Bowdry Ltd for 2021 and 2020 and show your workings. (Assume all sales and purchases are made on credit. All calculations should be to whole days.) (c) (i) In the accounting period above, the payables payment ratio has gone up from 39 in 2020 to 41 days in 2021. Calculate the working capital Cucle for Rowdn I td for 2021 ond 2020

Required: Based on the information contained in the extracts of Bowdry Ltd's latest financial statements, answer the questions below. (a) Give the formulas for calculating the following two working capital ratios: (1) inventory days. (i) receivables collection period. (b) Calculate the inventory days and receivables collection period for Bowdry Ltd for 2021 and 2020 and show your workings. (Assume all sales and purchases are made on credit. All calculations should be to whole days.) (c) (i) In the accounting period above, the payables payment ratio has gone up from 39 in 2020 to 41 days in 2021. Calculate the working capital Cucle for Rowdn I td for 2021 ond 2020

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 6P

Related questions

Question

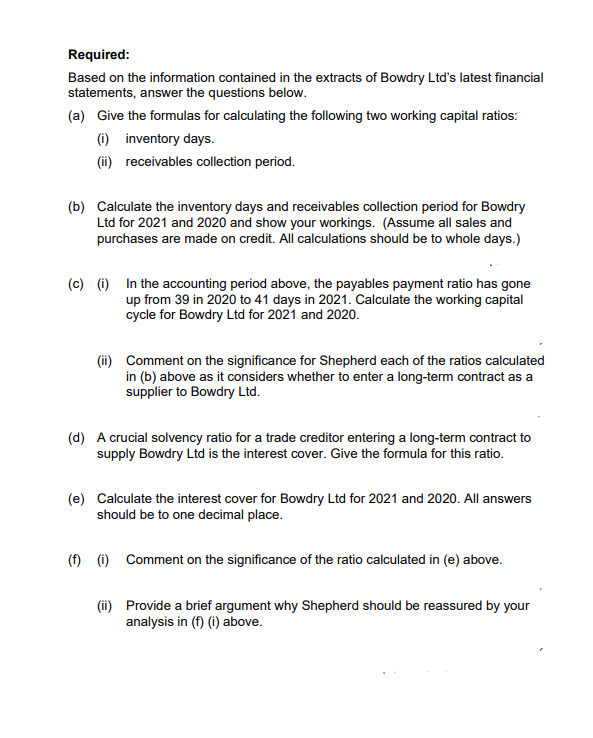

Transcribed Image Text:Required:

Based on the information contained in the extracts of Bowdry Ltd's latest financial

statements, answer the questions below.

(a) Give the formulas for calculating the following two working capital ratios:

(i) inventory days.

(ii) receivables collection period.

(b) Calculate the inventory days and receivables collection period for Bowdry

Ltd for 2021 and 2020 and show your workings. (Assume all sales and

purchases are made on credit. All calculations should be to whole days.)

(c) (i) In the accounting period above, the payables payment ratio has gone

up from 39 in 2020 to 41 days in 2021. Calculate the working capital

cycle for Bowdry Ltd for 2021 and 2020.

(ii) Comment on the significance for Shepherd each of the ratios calculated

in (b) above as it considers whether to enter a long-term contract as a

supplier to Bowdry Ltd.

(d) A crucial solvency ratio for a trade creditor entering a long-term contract to

supply Bowdry Ltd is the interest cover. Give the formula for this ratio.

(e) Calculate the interest cover for Bowdry Ltd for 2021 and 2020. All answers

should be to one decimal place.

(f) (1) Comment on the significance of the ratio calculated in (e) above.

(i) Provide a brief argument why Shepherd should be reassured by your

analysis in (f) (i) above.

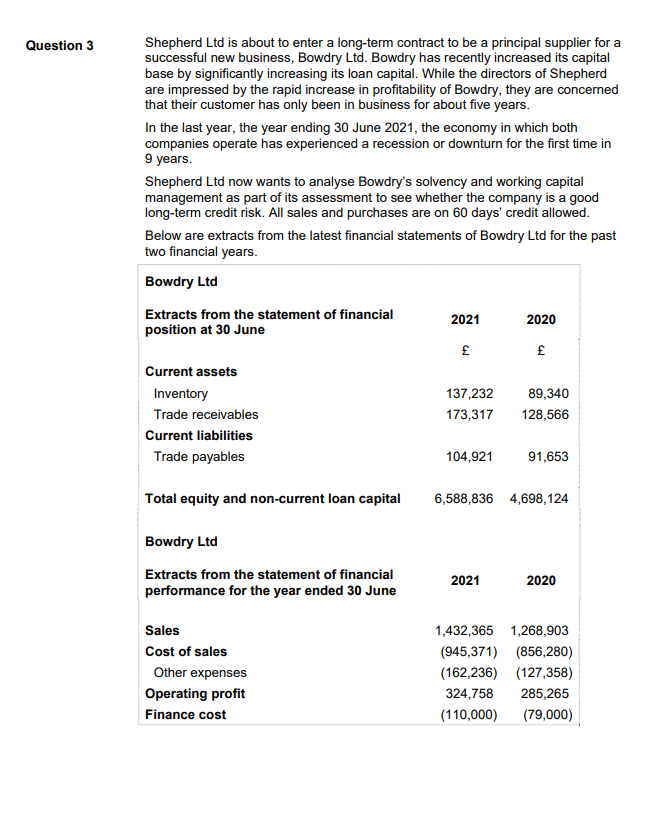

Transcribed Image Text:Shepherd Ltd is about to enter a long-term contract to be a principal supplier for a

successful new business, Bowdry Ltd. Bowdry has recently increased its capital

base by significantly increasing its loan capital. While the directors of Shepherd

are impressed by the rapid increase in profitability of Bowdry, they are concerned

that their customer has only been in business for about five years.

In the last year, the year ending 30 June 2021, the economy in which both

companies operate has experienced a recession or downturn for the first time in

9 years.

Question 3

Shepherd Ltd now wants to analyse Bowdry's solvency and working capital

management as part of its assessment to see whether the company is a good

long-term credit risk. All sales and purchases are on 60 days' credit allowed.

Below are extracts from the latest financial statements of Bowdry Ltd for the past

two financial years.

Bowdry Ltd

Extracts from the statement of financial

2021

2020

position at 30 June

£

£

Current assets

Inventory

137,232

89,340

Trade receivables

173,317

128,566

Current liabilities

Trade payables

104,921

91,653

Total equity and non-current loan capital

6,588,836 4,698,124

Bowdry Ltd

Extracts from the statement of financial

2021

2020

performance for the year ended 30 June

Sales

1,432,365 1,268,903

Cost of sales

(945,371) (856,280)

Other expenses

(162,236) (127,358)

Operating profit

324,758

285,265

Finance cost

(110,000)

(79,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT