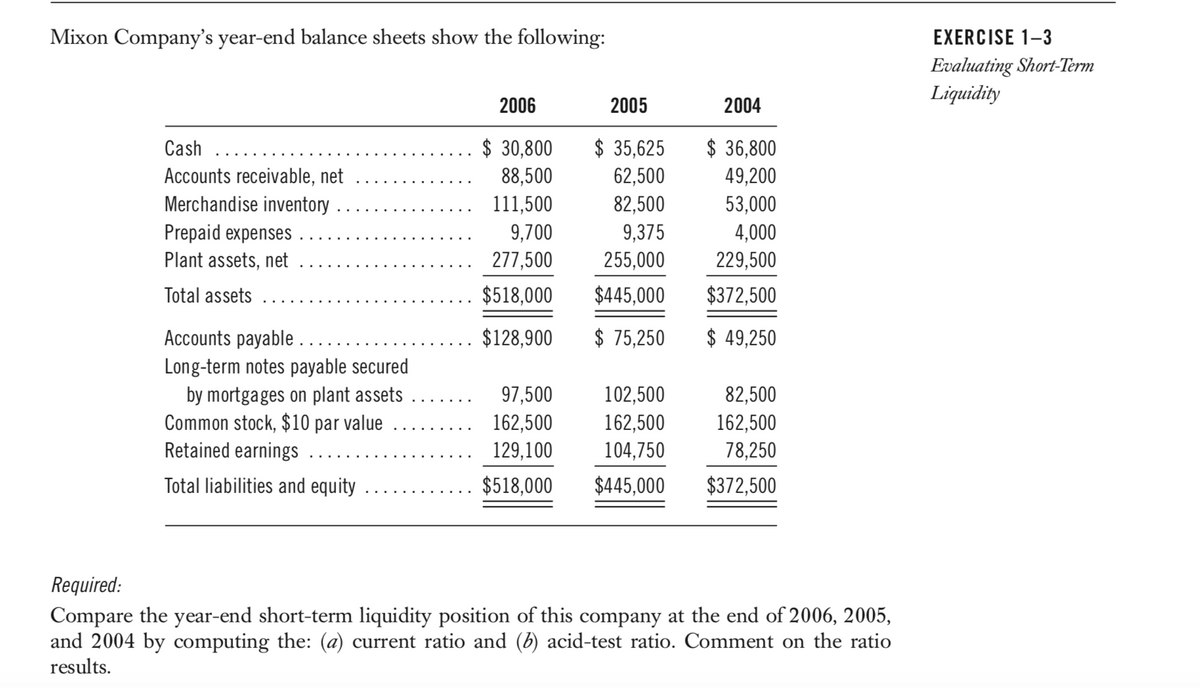

Required: Compare the year-end short-term liquidity position of this company at the end of 2006, 2005, and 2004 by computing the: (a) current ratio and (b) acid-test ratio. Comment on the ratio results.

Required: Compare the year-end short-term liquidity position of this company at the end of 2006, 2005, and 2004 by computing the: (a) current ratio and (b) acid-test ratio. Comment on the ratio results.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 49E

Related questions

Question

Refer to Mixon Company’s balance sheets in Exercise 1–3. Express the balance sheets in common-size percents. Round to the nearest one-tenth of a percent.

Transcribed Image Text:Mixon Company's year-end balance sheets show the following:

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Accounts payable ..

Long-term notes payable secured

by mortgages on plant assets

Common stock, $10 par value

Retained earnings

Total liabilities and equity

2006

$ 30,800

88,500

111,500

9,700

277,500

$518,000

$128,900

97,500

162,500

129,100

$518,000

2005

2004

$ 35,625

$36,800

62,500

49,200

82,500

53,000

9,375

4,000

255,000

229,500

$445,000

$372,500

$ 75,250 $ 49,250

102,500

82,500

162,500

162,500

104,750

78,250

$445,000 $372,500

Required:

Compare the year-end short-term liquidity position of this company at the end of 2006, 2005,

and 2004 by computing the: (a) current ratio and (b) acid-test ratio. Comment on the ratio

results.

EXERCISE 1-3

Evaluating Short-Term

Liquidity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning