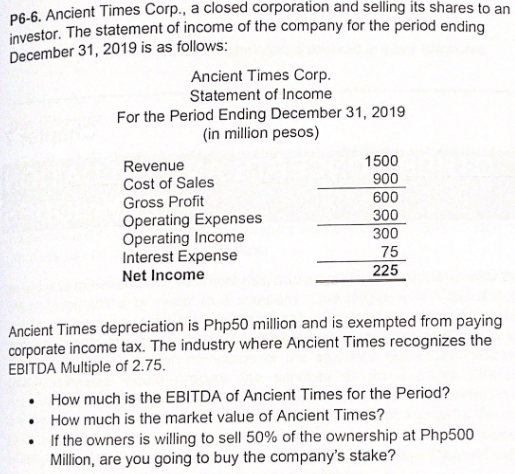

P6-6. Ancient Times Corp., a closed corporation and selling its shares to ar investor. The statement of income of the company for the period ending December 31, 2019 is as follows: Ancient Times Corp. Statement of Income For the Period Ending December 31, 2019 (in million pesos) 1500 Revenue Cost of Sales Gross Profit Operating Expenses Operating Income Interest Expense Net Income 900 600 300 300 75 225 Ancient Times depreciation is Php50 million and is exempted from paying corporate income tax. The industry where Ancient Times recognizes the EBITDA Multiple of 2.75. • How much is the EBITDA of Ancient Times for the Period? • How much is the market value of Ancient Times? • If the owners is willing to sell 50% of the ownership at Php500 Million, are you going to buy the company's stake?

P6-6. Ancient Times Corp., a closed corporation and selling its shares to ar investor. The statement of income of the company for the period ending December 31, 2019 is as follows: Ancient Times Corp. Statement of Income For the Period Ending December 31, 2019 (in million pesos) 1500 Revenue Cost of Sales Gross Profit Operating Expenses Operating Income Interest Expense Net Income 900 600 300 300 75 225 Ancient Times depreciation is Php50 million and is exempted from paying corporate income tax. The industry where Ancient Times recognizes the EBITDA Multiple of 2.75. • How much is the EBITDA of Ancient Times for the Period? • How much is the market value of Ancient Times? • If the owners is willing to sell 50% of the ownership at Php500 Million, are you going to buy the company's stake?

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 40P

Related questions

Question

Transcribed Image Text:P6-6. Ancient Times Corp., a closed corporation and selling its shares to an

investor. The statement of income of the company for the period ending

December 31, 2019 is as follows:

Ancient Times Corp.

Statement of Income

For the Period Ending December 31, 2019

(in million pesos)

1500

900

Revenue

Cost of Sales

Gross Profit

Operating Expenses

Operating Income

Interest Expense

Net Income

600

300

300

75

225

Ancient Times depreciation is Php50 million and is exempted from paying

corporate income tax. The industry where Ancient Times recognizes the

EBITDA Multiple of 2.75.

• How much is the EBITDA of Ancient Times for the Period?

• How much is the market value of Ancient Times?

If the owners is willing to sell 50% of the ownership at Php500

Million, are you going to buy the company's stake?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning