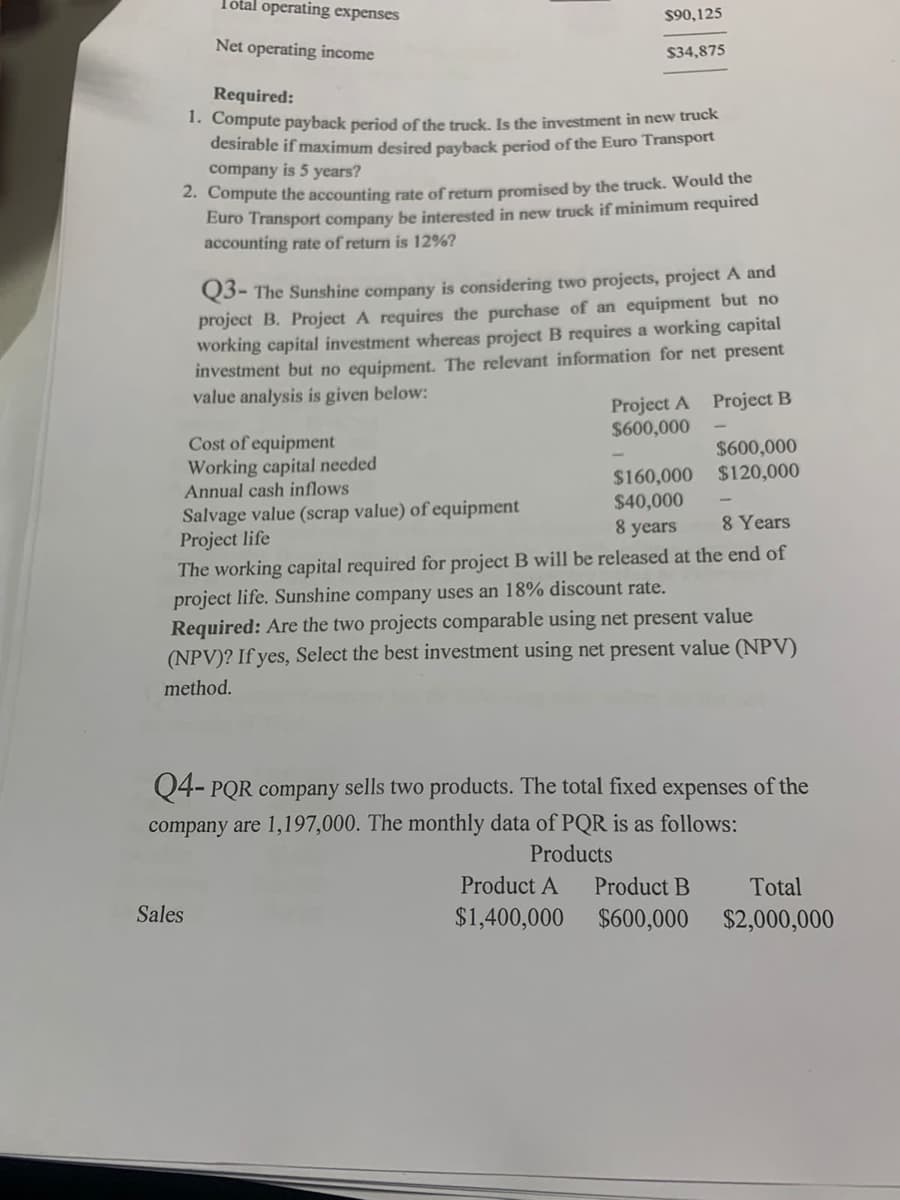

Net operating income $34,875 Required: 1. Compute payback period of the truck. Is the investment in new truck desirable if maximum desired payback period of the Euro Transport company is 5 years? 2. Compute the accounting rate of return promised by the truck. Would the Euro Transport company be interested in new truck if minimum required accounting rate of return is 12%? Q3- The Sunshine company is considering two projects, project A and project B. Project A requires the purchase of an equipment but no working capital investment whereas project B requires a working capital investment but no equipment. The relevant information for net present value analysis is given below: Project A $600,000 Project B Cost of equipment Working capital needed Annual cash inflows $600,000 $160,000 $120,000 $40,000 8 years Salvage value (scrap value) of equipment Project life The working capital required for project B will be released at the end of project life. Sunshine company uses an 18% discount rate. Required: Are the two projects comparable using net present value (NPV)? If yes, Select the best investment using net present value (NPV) 8 Years method. Q4- PQR company sells two products. The total fixed expenses of the company are 1,197,000. The monthly data of PQR is as follows: Products Product A Product B Total $1,400,000 $600,000 $2,000,000 Sales

Net operating income $34,875 Required: 1. Compute payback period of the truck. Is the investment in new truck desirable if maximum desired payback period of the Euro Transport company is 5 years? 2. Compute the accounting rate of return promised by the truck. Would the Euro Transport company be interested in new truck if minimum required accounting rate of return is 12%? Q3- The Sunshine company is considering two projects, project A and project B. Project A requires the purchase of an equipment but no working capital investment whereas project B requires a working capital investment but no equipment. The relevant information for net present value analysis is given below: Project A $600,000 Project B Cost of equipment Working capital needed Annual cash inflows $600,000 $160,000 $120,000 $40,000 8 years Salvage value (scrap value) of equipment Project life The working capital required for project B will be released at the end of project life. Sunshine company uses an 18% discount rate. Required: Are the two projects comparable using net present value (NPV)? If yes, Select the best investment using net present value (NPV) 8 Years method. Q4- PQR company sells two products. The total fixed expenses of the company are 1,197,000. The monthly data of PQR is as follows: Products Product A Product B Total $1,400,000 $600,000 $2,000,000 Sales

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 16P: REPLACEMENT CHAIN The Lesseig Company has an opportunity to invest in one of two mutually exclusive...

Related questions

Question

Q3

Transcribed Image Text:Total operating expenses

$90,125

Net operating income

$34,875

Required:

1. Compute payback period off the truck. Is the investment in new truck

desirable if maximum desired payback period of the Euro Transport

company is 5 years?

2. Compute the accounting rate of return promised by the truck. Would the

Euro Transport company be interested in new truck if minimum required

accounting rate of return is 12%?

Q3- The Sunshine company is considering two projects, project A and

project B. Project A requires the purchase of an equipment but no

working capital investment whereas project B requires a working capital

investment but no equipment. The relevant information for net present

value analysis is given below:

Project A Project B

$600,000

Cost of equipment

Working capital needed

Annual cash inflows

$600,000

$160,000 $120,000

$40,000

Salvage value (scrap value) of equipment

Project life

The working capital required for project B will be released at the end of

project life. Sunshine company uses an 18% discount rate.

Required: Are the two projects comparable using net present value

(NPV)? If yes, Select the best investment using net present value (NPV)

8 years

8 Years

method.

Q4- PQR company sells two products. The total fixed expenses of the

company are 1,197,000. The monthly data of PQR is as follows:

Products

Product A

Product B

Total

$1,400,000 $600,000 $2,000,000

Sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College