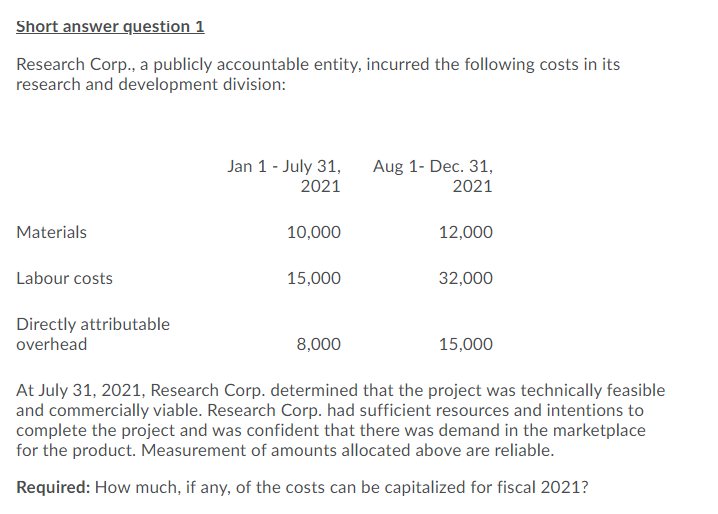

Required: How much, if any, of the costs can be capitalized for fiscal 2021?

Q: If your corporation's current assets are $350 and your current liabilities are $250, what is the net…

A: Net working capital is the value of current assets of the company minus the current liabilities of…

Q: Required: Record the amortization expense for 2019.

A: Amortization of the intangible assets : Intangible assets to need to depreciate like tangible…

Q: What amount should be recognized as pretax revaluation surplus on January 1, 2019?

A:

Q: depletion expense should be recognized for 2021? 550,000

A:

Q: Apollo Corp. has the following investment which were throughout 2021-2022: Fair Value Cost 12/31/21…

A: Unrealized gain An unrealized gain is a rise in the value of an asset that has yet to be sold for…

Q: Compute the annual depreciation to be charged, beginning with 2019. Annual depreciation…

A: Depreciation is recorded on the cost of fixed assets to record a reduction in value. It can be…

Q: During 2020, ABC Company constructed various assets. The weighted average expenditures for…

A: This question deals with the IAS 23 'Borrowing cost". As per IAS, interest expense incurred on…

Q: The fair value of the plan assets at December 31, 2020 is

A:

Q: How about these other questions? 4.Using the same information above, how much is the balance of the…

A: Construction work in progress means the cost related to the work in progress of each incomplete work…

Q: On December 31, 2020, ABC Company had the following balances in its memorandum records related to…

A: Interest costs = Benefit Obligation, December 31, 2020, x discount rate = P12,000,000 x 12% =…

Q: In 2020, Sandstorm Corporation incurs $25,000 in research and experimental expenses. Benefits from…

A: 174 - Research and experimental expenditures (a)Treatment as expenses A taxpayer may treat…

Q: 2019 2020 Plan asset (fair value), Dec 31 2,796,000 3,396,000 Defined benefit obligation, Jan 1…

A: Journal entry is the process of recording business transactions for the first time in the accounting…

Q: On January 1, 2021 COMET Company provided the following data in connection with the defined benefit…

A: Interest costs = Projected benefit obligation x Discount rate = ₱7,600,000 x 10% = ₱760,000 Expected…

Q: are incurred by the company on an annual basis. What should be the carrying value of the investment…

A: After initial recognition, investment property is accounted for in accordance with the cost model -…

Q: Calculate the depreciation expense by straight-line for 2020. (.

A: Straight-line Depreciation: Under the straight-line method of depreciation, the same amount of…

Q: The cost of materials purchases for 2021?

A: We have to do the reverse calculation in the cost sheet to find the cost of materials purchases for…

Q: An entity provided the following items related to its defined benefit plan for 2019: January 1…

A: Interest rate = Interest income / Fair value of plan assets at beginning = 160000/1600000 = 10%

Q: Given the following items and amounts, compute the actual return on plan assets: fair value of plan…

A: Actual return on plan assets = Fair value of plan assets at the end + Benefit paid - Contribution…

Q: The actual return on plan assets __is equal to interest expenses accrued each year on the…

A: Plan assets refer to long term assets held for the benefit of employees. It includes long term…

Q: How much is the total carrying amount of the property as of June 30, 2021? Show the solutions…

A: Depreciation Cost The purpose of using the depreciation method to know the actual cost of the assets…

Q: Kingbird Corporation has the following information available concerning its postretirement benefit…

A: Many forms of costs that an employer provides to its retirees are known as postretirement costs.…

Q: On January 1, 2020, FB Company had the following data in connection with its defined benefit plan:…

A: Interest = Beginning Defined benefit obligation x Discount rate = P7,500,000 x 10% = P750,000

Q: 3. Information on an entity's plan assets is shown below: Fair value of plan assets, Jan. 1 Return…

A: The fair value of plan assets at the year-end is calculated as follows:

Q: How much is the total assets for 2021?

A: Total Assets = Net Book value of Non current assets or Plant and equipments + Total current assets

Q: For the next 3 questions.. What amount should be reported as pretax revaluation surplus on…

A: solution : What amount should be reported as pretax revaluation surplus on December 31, 2019?…

Q: What is the loss on repayment of the grant on January 1, 2022? What is the depreciation of the…

A: The solutions are as per your requirement which relate to the situation number 2 Depreciation is a…

Q: Alta Company is constructing a production complex that qualifies for interest capitalization. The…

A: Borrowing costs relating to the acquisition, construction, and production of a qualifying asset…

Q: How much should PINK report as current assets on December 31, 2021?

A: Current assets are those assets which are already in cash or can be converted into cash into short…

Q: The memorandum records ofGalindezTrading at January 1, 2021 show the following data: Define…

A: Plan Asset at December 31, 2021 = Beginning Fair value of plan assets + Actual return on plan assets…

Q: ta Company is constructing a production complex that qualifies for interest capitalization. The…

A: The computation of the amount of interest cost capitalized of 2019 and 2020 is shown below:-…

Q: How much is the employee benefit expense taken to profit or loss during 2021?

A: Employee benefit expenses will include : 1. Current service cost 2. Past service cost 3. Net…

Q: 1. What amount should be recognized as investment income for 2021 as a result of the investment? a.…

A: Investment refers to those mechanism which is used by the company for the purpose of generating…

Q: An entity provided the following items related to its defined benefit plan for 2019: January 1…

A: According to the accounting standard benefit expenses include the following Current service Cost…

Q: An entity's defined benefit plan has the following information: 12/31/19 12/31/20 Fair value of plan…

A: Amount that the entity would recognize in other comprehensive income for the year 2020 = Present…

Q: What amount of interest is capitalized for 2023? 2,940,000 4,200,000 1,260,000 1,200,000

A: Answer: The interest to be capitalized is the part of interest to be increased in total value of…

Q: On December 31, 2020, ABC Company had the following balances in its memorandum records related to…

A: Interest costs = Benefit Obligation, December 31, 2020, x discount rate = P12,000,000 x 12% =…

Q: On December 31, 2020, GHI Company had the following balances in its memorandum records related to…

A: Interest costs = Benefit Obligation, December 31, 2020, x discount rate = P12,000,000 x 12% =…

Q: Operating Expense

A: Operating expense = Direct costs + General and administrative expenses

Q: Calculate the depreciation expense by sum-of-the-years'-digits for 2021.

A: Depreciation: Depreciation refers to the reduction in the monetary value of a fixed asset due to its…

Q: uppose that, in 2019, Indiana incurred additional costs of $66 million and estimated an additional…

A: Answer 1: Information Provided: Contract price = $160 million 2018 costs = 36 million Estimates…

Q: our answer must indicate the overall and individual effect of changes in relevant item

A: Step 1 Working capital is the difference between a company’s current assets, such as cash, accounts…

Q: What amount will be charged to profit or loss for the year ended 30th September 2021 in respect of…

A: Research and development costs are those costs which has been incurred by the company in order to…

Q: Hawkins Corporation has the following balances at December 31, 2020. Projected benefit obligation…

A:

Q: In relation to the asset ceiling, the amount that the entity would recognize in other comprehensive…

A: As per IAS 19, The net defined benefit from the asset is to be recognized at the lower of - 1)…

Q: Information about the defined benefit plan of the company is shown belowFair value on plan asset,…

A: Contributions to defined benefit plans are often tax-deductible for employers. Improved employee…

Q: what is the carrying value of the property at December 31, 2020?

A: In fair value method of investment property, the investment property would be valued at its fair…

Q: Alta Company is constructing a production complex that qualifies for interest capitalization. The…

A:

Q: Information on an entity's defined benefit plan are shown below Return on plan asset 240,000 Fair…

A: Given The fair value of plan asset 01 Jan 2020 20,00,000

Q: What is the total contributed capital as of December 31, 2020?

A: Contributed capital is total amount received by company from investors for acquiring their rights in…

Q: Required: Complete the following schedules to calculate the following for 2020: ) Actual interest…

A: Interest Capitalization: Capitalized interest is the borrowing cost for acquiring the long-term…

Step by step

Solved in 3 steps

- Question 3What is the proper solution for this problem? B. On August 1, 2021, the board of directors of LL Co. voted to approve the disposal of one of its B division.The sale is expected to occur in June of next year. The B division's revenue and expenses for the period from January 1 to July 31 amounted to P14,000,000 and P10,000,000, respectively. For the period from August 1 to December 31, B Division's revenue amounted to P5,000,000 while expenses totaled P4,500,000. The carrying amount of B Division's net assets on December 31, 2021 was P21,000,000 and the fair value less cost of disposal was P25,000,000. The sale contract requires the company to pay termination cost of affected employees in the amount of P1,200,000 to be paid on September 30, 2022. The income tax rate is 30%. Required:25 – 27. Determine the income (loss) net of tax from discontinued operation.Answer for Question A, B and C. Services Ltd incurred research and development costs of $10 million on a project to develop product A in 2018. The research phase can be clearly distinguished from the development phase of the project. Total costs in the research phase are $6 million, and in the development phase total costs are $4 million. All of the IAS 38 criteria have been met for recognition of the development costs as an asset. Product A was brought to market in Year 2019 and is expected to be marketable for five years. Total sales of Product A are estimated at more than $100 million. Required: A) Explain the research and development expenditure related regulations of IAS and US GAAP. B) Determine the impact research and development costs have on Services Ltd in 2018 and 2019 income under (1) IFRS and (2) U.S. GAAP. C) Summarize the difference in income, total assets, and total shareholders’ equity related to Product A over its five-year life under the two different sets…22.Sponge Co. incurred research and development costs in 2021 as follows: Equipment acquired for use in various research and development projects 975,000 Depreciation on the above equipment 135,000 Materials used 200,000 Compensation costs of personnel 500,000 Outside consulting fees 150,000 Indirect costs appropriately allocated 250,000The total research and development costs charge in Sponge's 2021 statement of profit or loss should be: 850,000 1,085,000 1,235,000 1,825,000

- Q1. Anna Essentials has determined that the Capping Division is a cash generating unit. The entity calculated that the value in use of the division to be P2.750,000. The entity has also determined that the Fair Value Less cost to dispose of the Plant is P1.625,000. The carrying amount of the assets are as follows: Plant - P2.000,000; Machineries - P1,000,000: Inventories - P1.500,000; Goodwill - P500,000. How much is the carrying amount of Machineries after the impairment? Q2. Anna Essentials has determined that the Capping Division is a cash generating unit. The entity calculated that the value in use of the division to be P2,750,000. The entity has also determined that the Fair Value Less cost to dispose of the Plant is P1,625,000. The carrying amount of the assets are as follows: Plant – P2,000,000; Machineries – P1,000,000; Inventories – P1,500,000; Goodwill – P500,000. How much is the carrying amount of Inventories after the impairment? Q3. On January 1, 2019, Army Company…35.During 2021, King Co. incurred the following costs: Testing in search for process alternatives 720,000 Costs of testing prototype and design modifications 500,000 Modification of the formulation of a process 1,220,000 Research and development services performed by Queen Corp. for King 650,000 In King's 2021 statement of profit or loss, research and development expense should be 1,220,000 1,870,000 2,590,000 3,090,00041. On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a commercial building for P9,000,000. ABC determined that the performance obligation is satisfied over time. Information relating to the contract is as follows: 2022 2023 Percentage of completion 25% 75% Estimated costs at completion P6,750,000 P7,200,000 How much is the gross profit to be recognized in 2023?

- E 12-9 Research and Development Cost In 2019, Lalli Corporation incurred R&D costs as follow: Materials used from inventory 100,000 Personnel in R&D lab 100,000 Allocation of the cost of utilities and maintenance costs of the R&D facility 50,000 These costs relate to a product that will be marked in 2020. The company estimates tht these costs will be recouped by December 31, 2020. Required: 1. What is the amount of R&D cost expensed in 2019? 2. Would your answer change if the materials were purchased and not used or if the utilities and maintence costs were related to the corporate offices?17. The entity incurred the following in exploring a natural resources on January 1,2021Acquisition cost of the land P10,000,000Development cost 5,000,000Exploration cost 6,000,000Purchase of equipment 3,000,000The entity expects to mine a total of 5,000,000 tons of natural gas, it is also estimated that 1,000,000 of natural gas will be extracted every year. The useful life of the equipment is 6 years, the equipment is used over a several project not just in that specific natural resources. On 2021 the entity extracted 1,500,000 tons of natural gas. How much is the depletion for the year 2021?Q3) (Classification Issues—intangibles) Presented below and on the next page is a list of that could be included in the intangible assets section of the statement of financial position. Investment in a subsidiary company. Timberland, Cost of engineering activity required 10 advance the design of product to the manufacturing stage. Cost of searching for applications of new research findings. Costs incurred in the formation of a corporation. Training costs incurred in start-up of new operation. Purchase cost of a franchise. Goodwill generated internally Cost of testing in search for product alternatives. Goodwill acquired in the purchase of a business. Cost of developing a patent (before achieving economic viability). Cost of purchasing a patent from an inventor. Legal costs incurred in securing a patent. Unrecovered costs of a successful legal suit to protect the patent, Cost of conceptual formulation of possible product alternatives. Cost of purchasing a copyright. Development costs…

- 42. ABC, Inc. works on a P5,250,000 contract in 2022 to construct an office building. During 2022, ABC, Inc. uses the cost to cost method. At December 31, 2022, the balances in certain accounts were: Construction in progress – P1,890,000; accounts receivable – P180,000; and billings on construction in process – P900,000; contract retention – P90,000; mobilization fee – P70,000. At December 31,2022, the estimated costs to completion are P2,352,000. How much is the realized gross profit in 2022?______21. The acquisition costs of property, plant, and equipment should include all normal, reasonable and necessary costs to get the asset in place and ready for use. ____ 22. An estimate of the amount which an asset can be sold at the end of its useful life is called residual value. ____ 23. Federal unemployment taxes are paid by the employer and the employee. ____ 24. When minor errors occur in the estimates used in the determination of depreciation, the amounts recorded for depreciation expense in the past should be corrected. ____ 25. Residual value is not relevant when calculating the annual depreciation expense using the double declining-balance method (do not consider the calculation for the final year). True and False questions56 On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a commercial building for P9,000,000. ABC determined that the performance obligation is satisfied over time. Information relating to the contract is as follows: 2022 2023 Percentage of completion 25% 75% Estimated costs at completion P6,750,000 P7,200,000 How much is the contract costs charged to profit or loss in 2022? On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a commercial building for P9,000,000. ABC determined that the performance obligation is satisfied over time. Information relating to the contract is as follows: 2022 2023 Percentage of completion 25% 75% Estimated costs at completion P6,750,000 P7,200,000 How much is the contract costs charged to profit or loss in 2022?