Required: Complete the following schedules to calculate the following for 2020: ) Actual interest in) Capitalization rate iii) Avoidable interest iv) Capitalized interest v) Interest expensed vi) Capitalized cost of the building

Required: Complete the following schedules to calculate the following for 2020: ) Actual interest in) Capitalization rate iii) Avoidable interest iv) Capitalized interest v) Interest expensed vi) Capitalized cost of the building

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

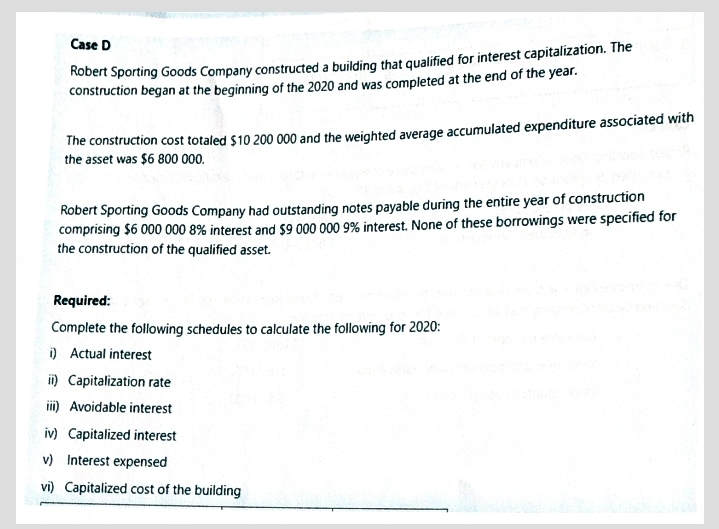

Transcribed Image Text:Case D

Robert Sporting Goods Company constructed a building that qualified for interest capitalization. The

construction began at the beginning of the 2020 and was completed at the end of the year.

The construction cost totaled $10 200 000 and the weighted average accumulated expenditure associated with

the asset was $6 800 000.

Robert Sporting Goods Company had outstanding notes payable during the entire year of construction

comprising $6 000 000 8% interest and $9 000 000 9% interest. None of these borrowings were specified for

the construction of the qualified asset.

Required:

Complete the following schedules to calculate the following for 2020:

i) Actual interest

i) Capitalization rate

iii) Avoidable interest

iv) Capitalized interest

v) Interest expensed

vi) Capitalized cost of the building

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning