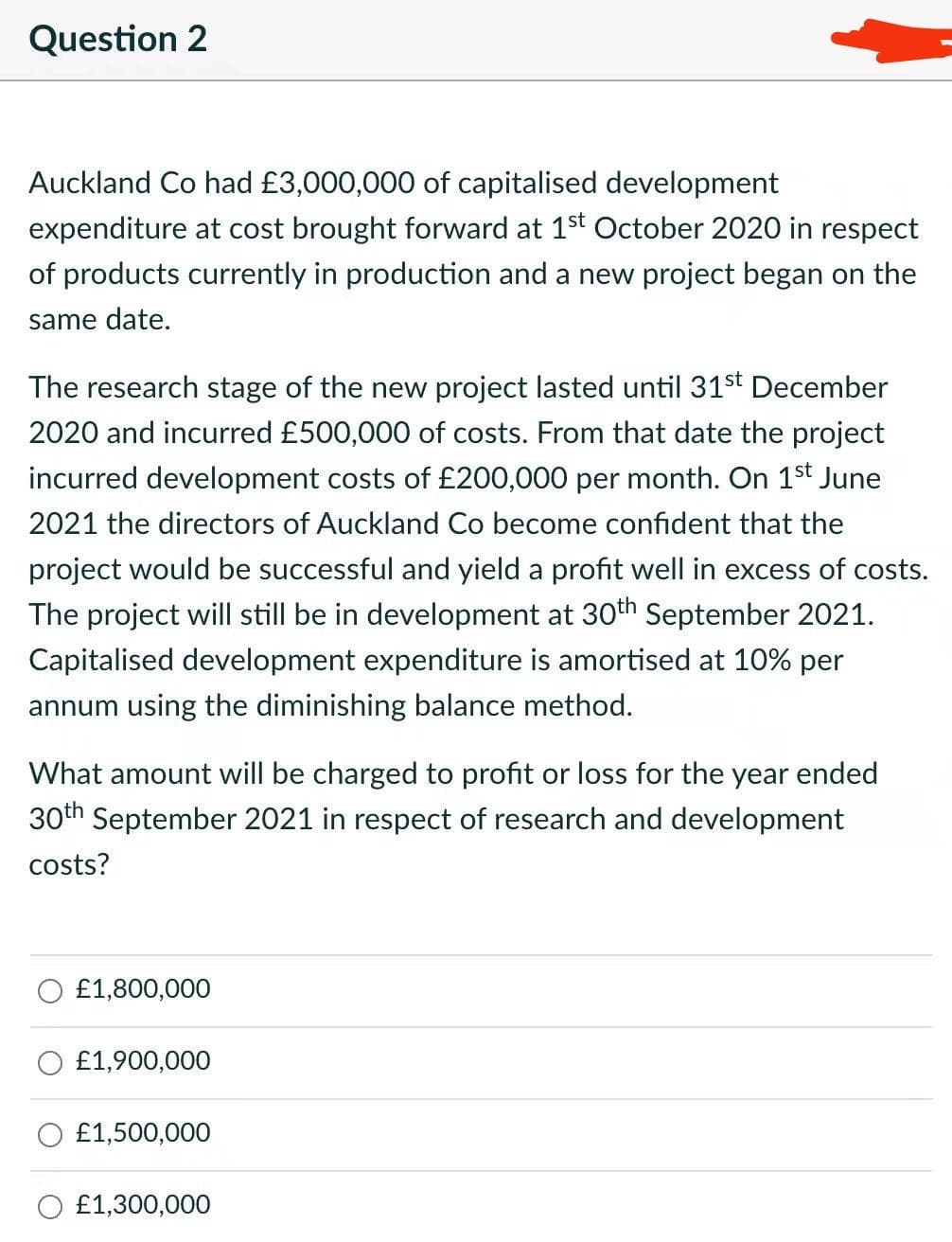

What amount will be charged to profit or loss for the year ended 30th September 2021 in respect of research and development costs?

Q: Enter the amount (if any) of each year's carryover utilized in 2020. Amount of Carryover Year…

A: (a) The table below shows the each year carryover utilized:

Q: a) Using the above data, compute the gross profit to be recognised for each of the three years,…

A:

Q: What amount should be recognized as pretax revaluation surplus on January 1, 2019?

A:

Q: 1. What amount of depreciation should be reported in the historical cost income statement for 2021?…

A: 1. Depreciation Expense based on Historical Cost = P5,000,000/5years = P1,000,000 2.…

Q: depletion expense should be recognized for 2021? 550,000

A:

Q: 3. On January 1, 2020, Sheridan incurred organization costs of $265,000. What amount of organization…

A: Answer 3) Organization costs include: Legal fees Accounting services Consulting fees Filing fees

Q: Entity A carries out research and development on 1 July 2019 called Plan X. In the year ended 30…

A:

Q: Apollo Corp. has the following investment which were throughout 2021-2022: Fair Value Cost 12/31/21…

A: Unrealized gain An unrealized gain is a rise in the value of an asset that has yet to be sold for…

Q: Compute the annual depreciation to be charged, beginning with 2019. Annual depreciation…

A: Depreciation is recorded on the cost of fixed assets to record a reduction in value. It can be…

Q: What amount of gross profit on sale should be recognized for the year ended December 31, 2020? a…

A: Gross profit represents the profit that remains after production costs have been subtracted from…

Q: What is the loss on repossession for the year ended December 31, 2022?

A: Loss on repossession is the loss on the sale of goods that are taken back because of non-payment of…

Q: What portion of the total contract price would be recognized as revenue in 2020? In 2021? Revenue…

A: Using percentage of completion method, the revenue is recognized on the basis of percentage of work…

Q: 2020 2021 Costs incurred during the year Estimated costs to complete, as of December 31 Billings…

A: Gross profit is that the profit a corporation makes once deducting the prices related to creating…

Q: Calculate the depreciation expense by double-declining balance for 2021.

A:

Q: a. Prepare journal entry to record the revaluation on January 1, 2020. b. Prepare journal entry to…

A: Calculation for revaluation amount of assets Asset Cost as on 1 Jan 17 (A) Revalued % of Assets…

Q: What is the impairment loss for 2021 and 2022? What is the depreciation for 2023?

A: Impairment loss is a situation when carrying value of the asset is more than the fair value of the…

Q: Calculate the amount of revenue to be recognized in 2020 and 2021. Calculate the construction costs…

A: Step 1 Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for…

Q: The depreciation charges for the year to 31 March 2021 are to be apportioned as follows: Cost of…

A: Allocation of Expenses = Expense can be allocated according the decided according the different…

Q: Delco Berhad operates a defined benefit plan. At the end of the year, the company has the following…

A: On 31 December 2018, Celco Berhad will report a net liability in the statement of financial…

Q: How much is the total carrying amount of the property as of June 30, 2021? Show the solutions…

A: Depreciation Cost The purpose of using the depreciation method to know the actual cost of the assets…

Q: How much should be the carrying amount of the wasting assets at December 31 of next year?

A: Depletion refers to the allocation or expense of extracting natural resources from the surface of…

Q: corrected profit for the following year

A: Corrected profit for the year = Reported net income - Overstatement in ending inventory

Q: Based on the information shown below, calculate for the year ended December 31, 2021, (a) the total…

A: The question is based on the concept of Business Accounting.

Q: Required a. Calculate the revised carrying amount of the assets for this CGU for the year ending 31…

A: Whenever the impairment case arises, the impairment is first allocated to goodwill and then other…

Q: For the next 3 questions.. What amount should be reported as pretax revaluation surplus on…

A: solution : What amount should be reported as pretax revaluation surplus on December 31, 2019?…

Q: Which of the following is a true statement concerning research and development (R&D) costs? All R&D…

A: The research and development expenses are the expenses that are incurred for the research and…

Q: 3. Suppose the estimated costs to complete at the end of 2019 are $80 million instead of $60…

A: Calculate the percentage of completion as of 2019: Percentage of completion = Actual costs to date /…

Q: Price Company from time to time embarks on a research program when a special project seems to offer…

A: Note: Since we are entitled to answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit…

Q: Price Company from time to time embarks on a research program when a special project seems to offer…

A: The question is based on the concetp of Accounting Theory.

Q: eauty Company a „ 2021, the entity -

A: Introduction Non-Current Asset held for sale: If the majority of the carrying value of a…

Q: what si the amount of revenue from long-term contract for the year ended December 31,2022? what is…

A: Revenue recognition: Revenue recognition is the principle that provides specific conditions under…

Q: Price Company from time to time embarks on a research program when a special project seems to offer…

A: Solution:- The following account should be charged for the $325,000, and it should be shown in the…

Q: What is the revenue earned from award credits for 2022? *see attached a. P 0 b. P 28,000 c. P…

A: Given, Total Sales for 3 years = P 2,800,000 Actual Warranty Expenditure = P 136,000 Total expected…

Q: a) Using percentage-of-completion method, prepare schedules to compute the profit and loss to be…

A: The amount earned from the business operation is known as operating income, but when the expenses to…

Q: Required a) Calculate the borrowing costs that can be capitalized for the piece of machinery. b)…

A: Step 1 As per the Provisions of US GAAP, Borrowing cost is the” interest and other cost “ which is…

Q: On January 1, 2022, Charis Company adopted a plan anuary 1, 2026 at an estimated cost of P20,000,000…

A: In this question, we have to find out the annual deposit to the fund.

Q: Cerise Ltd (Cerise) has a year end of 30 April 2021. The company began developing a project on 1 May…

A: IAS 38 states that an intangible asset is to be recognized if the following criteria or conditions…

Q: What is the excess of construction in progress over progress billings on December 31, 2020 under…

A: The cost-to-cost method compares the total expected costs of a project to the costs incurred to…

Q: During 2019, Gulf Co. started a construction project with a total contract price of $3,500,000.…

A: Expected Revenue from Construction Contract 3,500,000 Less: Actual Cost Incurred…

Q: 15. The gain on sale of equipment is 16. The interest income to be recognized in 2021 is

A: Answer carrying amount of equipment = P800,000 Sale Value of equipment = P1,200,000 Calculation of…

Q: Prepare the statement of profit or loss of Amazing Enterprise for the year ended 30 April 2021.

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: accepted a long-term construction project for an initial contract price of P2,000,000 to be…

A: % of completion = Costs during the year / (Costs during the year + Remaining estimated costs to…

Q: calculate pension expense b) calculate net defined obligation liability/asset surplus or deficit.

A: The employee benefit expenses will be computed as per IAS 19. ie all the cost associated with…

Q: Determine the WACC, and determine whether the company generated value or not, and what the amount…

A: The weighted Average cost of capital is calculated by multiplying the cost of the source of finance…

Q: GinebraCorporation recognizes construction revenue and cost using the percentage of completion…

A: The percentage of completion technique seems to be a revenue recognition accounting technique that…

Q: How much are the depreciation expenses for the year 2019

A: The depreciation expense is calculated on right to use of assets. The Right to use of assets…

Q: What is the amount of R&D costs expense in 2020

A: Intangible asset are the non-current asset which can’t be seen and touched. It does not have any…

Q: Compute the capital allowance, balancing charges and balancing allowance (if any) for each asset for…

A: Computation of balance of Lorry for each the relevant years of assessment up to the year of…

Q: How should NSB, Inc. report significant research and development costs incurred? A. Expense all…

A: Solution;- Introduction:- Research and development costs are the costs incurred in a planned search…

Step by step

Solved in 2 steps

- Assoria Plc has $20 million of capitalised development expenditure at cost brought forward at 1 October 2022 in respect of products currently in production. A new project began on 1 October 2022. The research stage of the new project lasted until 31 December 2022 and incurred $1.4 million of costs. From that date the project incurred development costs of $800,000 per month. On 1 April 2023 the directors of Assoria Co became confident that the project would be successful and yield a profit well in excess of costs. The project was still in development at 30 September 2023. Capitalised development expenditure is amortised at 20% per annum using the straight-line method. What amount will be charged to profit or loss for the year ended 30 September 2023 in respect of research and development costs?A company completed development of a product on 31 December 20X0. The development cost was £100 million. Sales commenced on 1 January 20X1, and expected future profits at that date were £60 million (excluding development expenditure). You should assume the life of the product is 5 years with sales and profits spread equally over that period. What is the value of capitalised development expenditure (after amortisation) in the statement of financial position at 31 December 20X1? A. 48 million B. 60 million C. 100 million D. 80 millionDempsey Ltd’s year end is 30 September 2023. Dempsey Ltd commenced the development stage of a project to produce a new pharmaceutical drug on 1 January 2023. Expenditure of $40,000 per month was incurred until the project was completed on 30 June 2023 when the drug went into immediate production. The directors became confident of the project’s success on 1 March 2023. The drug is expected to generate benefits for 5 years. What is the carrying amount of any intangible asset recognised in respect of the project at 30 September 2023 and what is the total amount Dempsey Ltd will charge to profit or loss for the year ended 30 September 2023?

- (ii) Tonson Plc had acquired a machine on 1 January 2020 at a cost of £100,000 with an estimated useful economic life of ten years. The fair value of the machine is £52,000 and the selling costs are £4,000. The expected future cash flows are £10,000 per annum for the next five years. The current cost of capital is 10%. An annuity factor for this rate over this period is 3.791.Required:Prepare extracts from the financial statement for the year-ended 31 December 2020. Show all your workings.Hatch PLC had $20 million of capitalised development expenditure at cost brought forward at 1 October 20X7 in respect of products currently in production and a new project began on the same date. The research stage of the new project lasted until 31 December 20X7 and incurred $1.4 million of costs. From that date the project incurred development costs of $800,000 per month. On 1 April 20X8 the directors became confident that the project would be successful and yield a profit well in excess of costs. The project was still in development at 30 September 20X8. Capitalised development expenditure is amortised at 20% per annum using the straight line method. What amount will be charged to profit or loss for the year ended 30 September 20X8 in respect of research and development costs? Select one alternative $6,880,000 $8,280,000 $3,800,000 $7,800,000A company had $20 million of capitalised development expenditure at cost brought forward at 1 October 20X7 in respect of products currently in production and a new project began on the same date. The research stage of the new project lasted until 31 December 20X7 and incurred $1.4 million of costs. From that date the project incurred development costs of $800,000 per month. On 1 April 20X8 the directors became confident that the project would be successful and yield a profit well in excess of costs. The project was still in development at 30 September 20X8. Capitalised development expenditure is amortised at 20% per annum using the straight line method. What amount will be charged to profit or loss for the year ended 30 September 20X8 in respect of research and development costs?

- One of your company's clients has proposed a contract offering an estimated $150,000 in net profits for the next six years; however, your company would be required to invest $585,000 today to acquire the needed resources for the project. Determine whether the project should be accepted if the cost of capital is a. 10% b. 13% c. 16%3. Baboki Ltd are planning to invest in a new project which will cost an initial P375 000 and they expect the following cash.Year Net Cash Profits (P)1 25 0002 55 0003 70 0004 80 0005 40 0006 30 000The investment will be depreciated to a scrap value of P175, 000 over the period of the project. Required: Calculate the Accounting Rate of Return (Return on Capital Employed) of the project.Question: Sufain Limited planning to invest in a project with an initial investment of Rs. 2,000,000. Following is the sales forecast for 5 years of useful life. Cost of Capital 8%. Year Cash Flows (Rs.) 1 600,000 2 750,000 3 960,000 4 1,200,000 5 1,350,000 Required: Net present value (NPV)

- Apply WACC in NPV. Brawn Blenders has the following incremental cash flow for its new project: Category T0 T1 T2 T3 Investment −$4,886,000 Net working capital change −$359,000 $359,000 Operating cash flow $1,731,000 $1,731,000 $1,731,000 Salvage $439,000 Should Brawn accept or reject this project at an adjusted WACC of 9.71%, 11.71%, or 13.71%? Should Brawn accept or reject this project at an adjusted WACC of 9.71%? (Select the best response.) A. The project should be accepted because the NPV is positive. The benefits exceed the costs in today's dollars. B. The project should be rejected because the NPV is negative. The costs exceed the benefits in today's dollars.1. Sun City Ltd commences construction of a multi purpose water park on 1 July 2022 for Pretoria Ltd. Sun City Ltd signs a fixed-price contract for total revenues of $50 million. The project is expected to be completed by the end of 2025 and Pretoria Ltd controls the asset throughout the period of construction. The expected cost as at the commencement of construction is $38 million. The estimated costs of a construction project might change throughout the project – in this example, they do change. The following data relates to the project (the financial years end on 30 June): Particulars 2023($m) 2024 ($m) 2025($m) Costs for the year 10 18 12 Costs incurred to date 10 28 40 Estimated costs to complete 28 12 - Progress billings during the year 12 20 18 Cash collected during the year 11 19 20 Prepare the journal entries for the 2023 financial year, assuming that the measure of progress on the contract cannot be reliably…36 Determine the capitalized cost of a research laboratory which requires P5,000,000 for original construction; P100,000 at the end of every year for the first 5 years and then P147,980 each year thereafter for operating expenses, and P500,000 every 6 years for replacement of equipment with interest at 12% per annum? A. 6,441,350 B. 6,067,015 C. 6,632,445 D. 6,573,650 E. None of the above