Required: i) Prepare the Cash Budget by month for the first quarter of 2016. Identify and comment on those areas of the cash budget that you wish to draw to the attention of management and recommend action to be taken.

Required: i) Prepare the Cash Budget by month for the first quarter of 2016. Identify and comment on those areas of the cash budget that you wish to draw to the attention of management and recommend action to be taken.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 34E: A companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and...

Related questions

Question

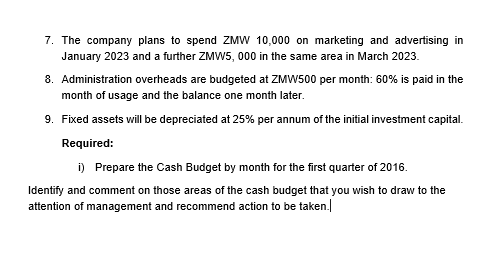

Transcribed Image Text:7. The company plans to spend ZMW 10,000 on marketing and advertising in

January 2023 and a further ZMW5, 000 in the same area in March 2023.

8. Administration overheads are budgeted at ZMW500 per month: 60% is paid in the

month of usage and the balance one month later.

9. Fixed assets will be depreciated at 25% per annum of the initial investment capital.

Required:

i) Prepare the Cash Budget by month for the first quarter of 2016.

Identify and comment on those areas of the cash budget that you wish to draw to the

attention of management and recommend action to be taken.

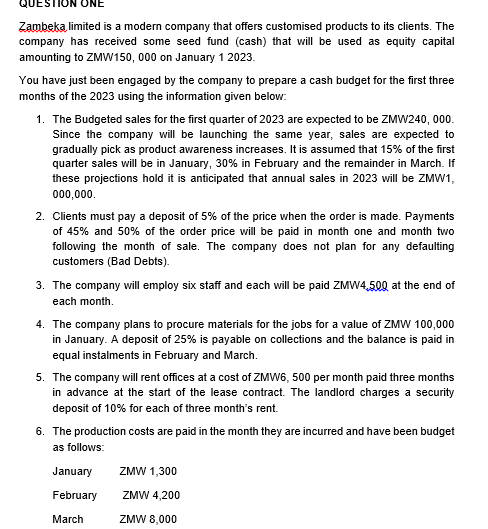

Transcribed Image Text:QUESTION ONE

Zambeka limited is a modern company that offers customised products to its clients. The

company has received some seed fund (cash) that will be used as equity capital

amounting to ZMW150, 000 on January 1 2023.

You have just been engaged by the company to prepare a cash budget for the first three

months of the 2023 using the information given below:

1. The Budgeted sales for the first quarter of 2023 are expected to be ZMW240,000.

Since the company will be launching the same year, sales are expected to

gradually pick as product awareness increases. It is assumed that 15% of the first

quarter sales will be in January, 30% in February and the remainder in March. If

these projections hold it is anticipated that annual sales in 2023 will be ZMW1,

000,000.

2. Clients must pay a deposit of 5% of the price when the order is made. Payments

of 45% and 50% of the der price

month one an month two

be paid

following the month of sale. The company does not plan for any defaulting

customers (Bad Debts).

3. The company will employ six staff and each will be paid ZMW4,500 at the end of

each month.

4. The company plans to procure materials for the jobs for a value of ZMW 100,000

in January. A deposit of 25% is payable on collections and the balance is paid in

equal instalments in February and March.

5. The company will rent offices at a cost of ZMW6, 500 per month paid three months

in advance at the start of the lease contract. The landlord charges a security

deposit of 10% for each of three month's rent.

6. The production costs are paid in the month they are incurred and have been budget

as follows:

January

February

March

ZMW 1,300

ZMW 4,200

ZMW 8,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College