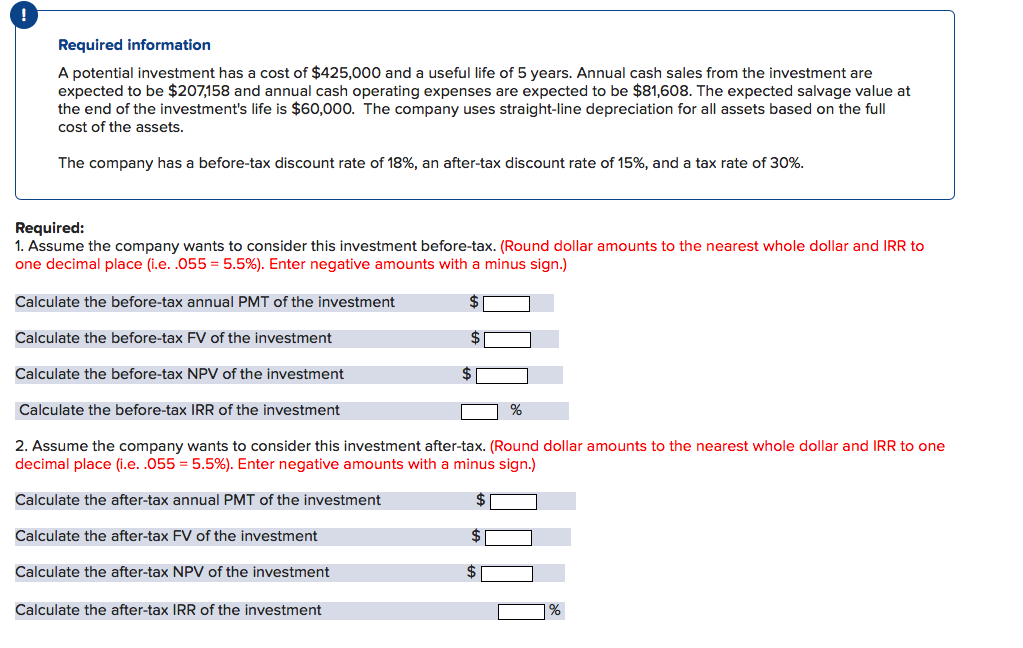

Required information A potential investment has a cost of $425,000 and a useful life of 5 years. Annual cash sales from the investment are expected to be $207,158 and annual cash operating expenses are expected to be $81,608. The expected salvage value at the end of the investment's life is $60,000. The company uses straight-line depreciation for all assets based on the full cost of the assets. The company has a before-tax discount rate of 18%, an after-tax discount rate of 15%, and a tax rate of 30%. ired:

Required information A potential investment has a cost of $425,000 and a useful life of 5 years. Annual cash sales from the investment are expected to be $207,158 and annual cash operating expenses are expected to be $81,608. The expected salvage value at the end of the investment's life is $60,000. The company uses straight-line depreciation for all assets based on the full cost of the assets. The company has a before-tax discount rate of 18%, an after-tax discount rate of 15%, and a tax rate of 30%. ired:

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PA: Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value...

Related questions

Question

N4.

Account

Transcribed Image Text:!

Required information

A potential investment has a cost of $425,000 and a useful life of 5 years. Annual cash sales from the investment are

expected to be $207,158 and annual cash operating expenses are expected to be $81,608. The expected salvage value at

the end of the investment's life is $60,000. The company uses straight-line depreciation for all assets based on the full

cost of the assets.

The company has a before-tax discount rate of 18%, an after-tax discount rate of 15%, and a tax rate of 30%.

Required:

1. Assume the company wants to consider this investment before-tax. (Round dollar amounts to the nearest whole dollar and IRR to

one decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.)

Calculate the before-tax annual PMT of the investment

Calculate the before-tax FV of the investment

Calculate the before-tax NPV of the investment

Calculate the after-tax NPV of the investment

$

Calculate the before-tax IRR of the investment

2. Assume the company wants to consider this investment after-tax. (Round dollar amounts to the nearest whole dollar and IRR to one

decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.)

Calculate the after-tax annual PMT of the investment

Calculate the after-tax FV of the investment

Calculate the after-tax IRR of the investment

%

%

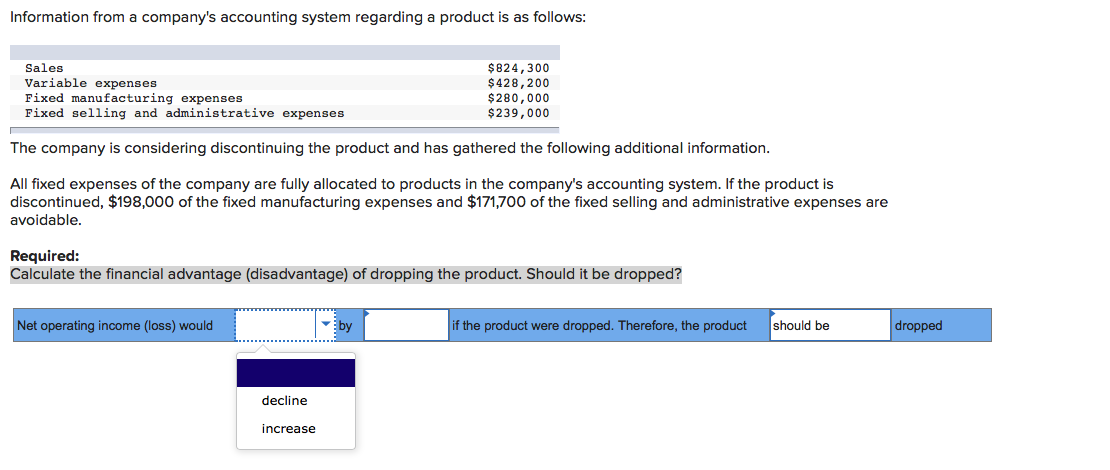

Transcribed Image Text:Information from a company's accounting system regarding a product is as follows:

Sales

Variable expenses.

Fixed manufacturing expenses.

Fixed selling and administrative expenses

The company is considering discontinuing the product and has gathered the following additional information.

All fixed expenses of the company are fully allocated to products in the company's accounting system. If the product is

discontinued, $198,000 of the fixed manufacturing expenses and $171,700 of the fixed selling and administrative expenses are

avoidable.

Required:

Calculate the financial advantage (disadvantage) of dropping the product. Should it be dropped?

Net operating income (loss) would

decline

$824,300

$428,200

$280,000

$239,000

increase

by

if the product were dropped. Therefore, the product

should be

dropped

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 8 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,