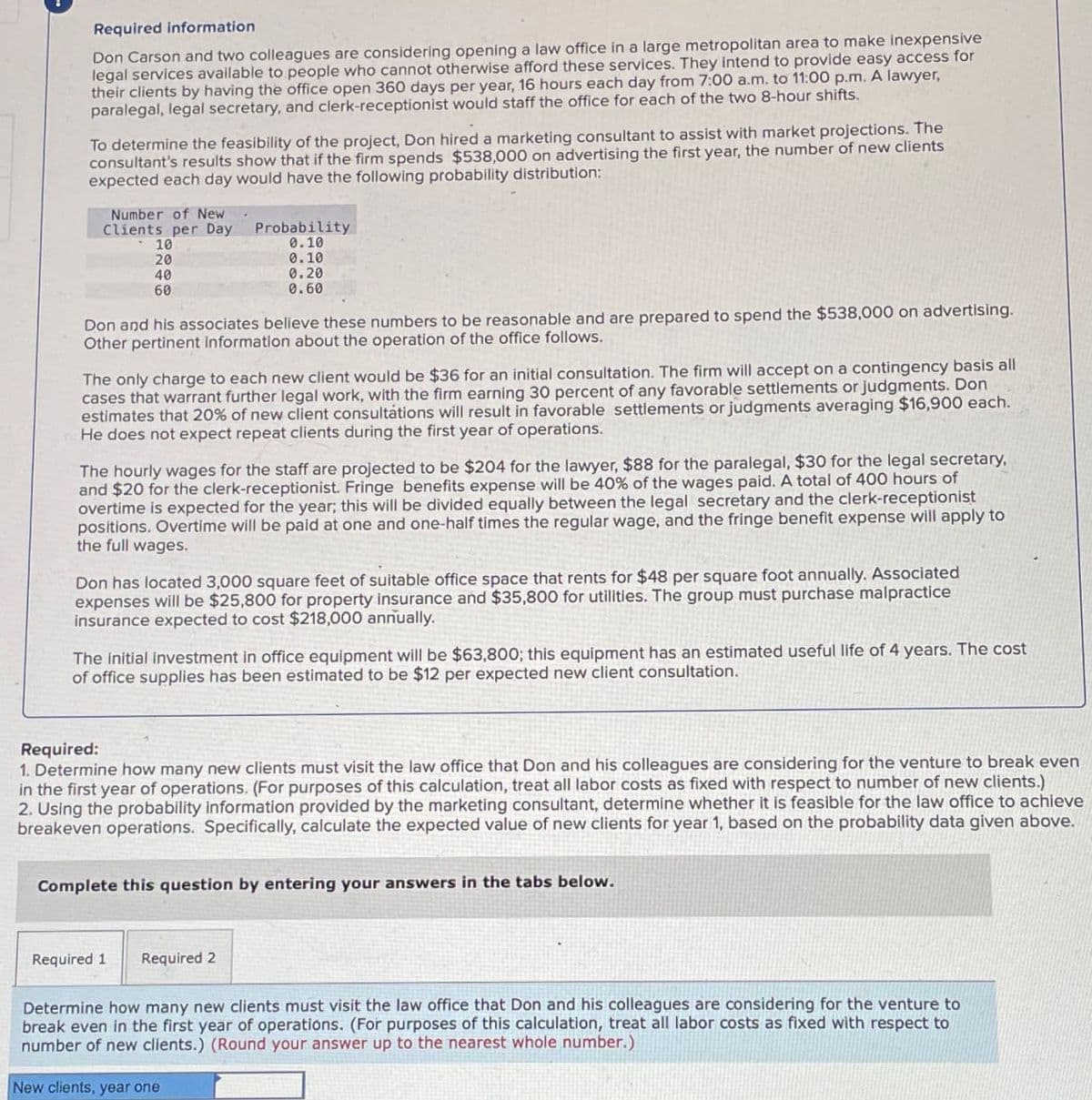

Required information Don Carson and two colleagues are considering opening a law office in a large metropolitan area to make inexpensive legal services available to people who cannot otherwise afford these services. They intend to provide easy access for their clients by having the office open 360 days per year, 16 hours each day from 7:00 a.m. to 11:00 p.m. A lawyer, paralegal, legal secretary, and clerk-receptionist would staff the office for each of the two 8-hour shifts. To determine the feasibility of the project, Don hired a marketing consultant to assist with market projections. The consultant's results show that if the firm spends $538,000 on advertising the first year, the number of new clients expected each day would have the following probability distribution: Number of New Clients per Day 10 20 40 60 Probability 0.10 0.10 0.20 0.60 Don and his associates believe these numbers to be reasonable and are prepared to spend the $538,000 on advertising. Other pertinent information about the operation of the office follows. The only charge to each new client would be $36 for an initial consultation. The firm will accept on a contingency basis all cases that warrant further legal work, with the firm earning 30 percent of any favorable settlements or judgments. Don estimates that 20% of new client consultations will result in favorable settlements or judgments averaging $16,900 each. He does not expect repeat clients during the first year of operations. The hourly wages for the staff are projected to be $204 for the lawyer, $88 for the paralegal, $30 for the legal secretary, and $20 for the clerk-receptionist. Fringe benefits expense will be 40% of the wages paid. A total of 400 hours of overtime is expected for the year; this will be divided equally between the legal secretary and the clerk-receptionist positions. Overtime will be paid at one and one-half times the regular wage, and the fringe benefit expense will apply to the full wages. Don has located 3,000 square feet of suitable office space that rents for $48 per square foot annually. Associated expenses will be $25,800 for property insurance and $35,800 for utilities. The group must purchase malpractice insurance expected to cost $218,000 annually. The initial investment in office equipment will be $63,800; this equipment has an estimated useful life of 4 years. The cost of office supplies has been estimated to be $12 per expected new client consultation. Required: 1. Determine how many new clients must visit the law office that Don and his colleagues are considering for the venture to break even in the first year of operations. (For purposes of this calculation, treat all labor costs as fixed with respect to number of new clients.) 2. Using the probability information provided by the marketing consultant, determine whether it is feasible for the law office to achieve breakeven operations. Specifically, calculate the expected value of new clients for year 1, based on the probability data given above. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine how many new clients must visit the law office that Don and his colleagues are considering for the venture to break even in the first year of operations. (For purposes of this calculation, treat all labor costs as fixed with respect to number of new clients.) (Round your answer up to the nearest whole number.) New clients, year one

Required information Don Carson and two colleagues are considering opening a law office in a large metropolitan area to make inexpensive legal services available to people who cannot otherwise afford these services. They intend to provide easy access for their clients by having the office open 360 days per year, 16 hours each day from 7:00 a.m. to 11:00 p.m. A lawyer, paralegal, legal secretary, and clerk-receptionist would staff the office for each of the two 8-hour shifts. To determine the feasibility of the project, Don hired a marketing consultant to assist with market projections. The consultant's results show that if the firm spends $538,000 on advertising the first year, the number of new clients expected each day would have the following probability distribution: Number of New Clients per Day 10 20 40 60 Probability 0.10 0.10 0.20 0.60 Don and his associates believe these numbers to be reasonable and are prepared to spend the $538,000 on advertising. Other pertinent information about the operation of the office follows. The only charge to each new client would be $36 for an initial consultation. The firm will accept on a contingency basis all cases that warrant further legal work, with the firm earning 30 percent of any favorable settlements or judgments. Don estimates that 20% of new client consultations will result in favorable settlements or judgments averaging $16,900 each. He does not expect repeat clients during the first year of operations. The hourly wages for the staff are projected to be $204 for the lawyer, $88 for the paralegal, $30 for the legal secretary, and $20 for the clerk-receptionist. Fringe benefits expense will be 40% of the wages paid. A total of 400 hours of overtime is expected for the year; this will be divided equally between the legal secretary and the clerk-receptionist positions. Overtime will be paid at one and one-half times the regular wage, and the fringe benefit expense will apply to the full wages. Don has located 3,000 square feet of suitable office space that rents for $48 per square foot annually. Associated expenses will be $25,800 for property insurance and $35,800 for utilities. The group must purchase malpractice insurance expected to cost $218,000 annually. The initial investment in office equipment will be $63,800; this equipment has an estimated useful life of 4 years. The cost of office supplies has been estimated to be $12 per expected new client consultation. Required: 1. Determine how many new clients must visit the law office that Don and his colleagues are considering for the venture to break even in the first year of operations. (For purposes of this calculation, treat all labor costs as fixed with respect to number of new clients.) 2. Using the probability information provided by the marketing consultant, determine whether it is feasible for the law office to achieve breakeven operations. Specifically, calculate the expected value of new clients for year 1, based on the probability data given above. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine how many new clients must visit the law office that Don and his colleagues are considering for the venture to break even in the first year of operations. (For purposes of this calculation, treat all labor costs as fixed with respect to number of new clients.) (Round your answer up to the nearest whole number.) New clients, year one

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 31P

Related questions

Question

None

Transcribed Image Text:Required information

Don Carson and two colleagues are considering opening a law office in a large metropolitan area to make inexpensive

legal services available to people who cannot otherwise afford these services. They intend to provide easy access for

their clients by having the office open 360 days per year, 16 hours each day from 7:00 a.m. to 11:00 p.m. A lawyer,

paralegal, legal secretary, and clerk-receptionist would staff the office for each of the two 8-hour shifts.

To determine the feasibility of the project, Don hired a marketing consultant to assist with market projections. The

consultant's results show that if the firm spends $538,000 on advertising the first year, the number of new clients

expected each day would have the following probability distribution:

Number of New

Clients per Day

10

20

40

60

Probability

0.10

0.10

0.20

0.60

Don and his associates believe these numbers to be reasonable and are prepared to spend the $538,000 on advertising.

Other pertinent information about the operation of the office follows.

The only charge to each new client would be $36 for an initial consultation. The firm will accept on a contingency basis all

cases that warrant further legal work, with the firm earning 30 percent of any favorable settlements or judgments. Don

estimates that 20% of new client consultations will result in favorable settlements or judgments averaging $16,900 each.

He does not expect repeat clients during the first year of operations.

The hourly wages for the staff are projected to be $204 for the lawyer, $88 for the paralegal, $30 for the legal secretary,

and $20 for the clerk-receptionist. Fringe benefits expense will be 40% of the wages paid. A total of 400 hours of

overtime is expected for the year; this will be divided equally between the legal secretary and the clerk-receptionist

positions. Overtime will be paid at one and one-half times the regular wage, and the fringe benefit expense will apply to

the full wages.

Don has located 3,000 square feet of suitable office space that rents for $48 per square foot annually. Associated

expenses will be $25,800 for property insurance and $35,800 for utilities. The group must purchase malpractice

insurance expected to cost $218,000 annually.

The initial investment in office equipment will be $63,800; this equipment has an estimated useful life of 4 years. The cost

of office supplies has been estimated to be $12 per expected new client consultation.

Required:

1. Determine how many new clients must visit the law office that Don and his colleagues are considering for the venture to break even

in the first year of operations. (For purposes of this calculation, treat all labor costs as fixed with respect to number of new clients.)

2. Using the probability information provided by the marketing consultant, determine whether it is feasible for the law office to achieve

breakeven operations. Specifically, calculate the expected value of new clients for year 1, based on the probability data given above.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Determine how many new clients must visit the law office that Don and his colleagues are considering for the venture to

break even in the first year of operations. (For purposes of this calculation, treat all labor costs as fixed with respect to

number of new clients.) (Round your answer up to the nearest whole number.)

New clients, year one

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning