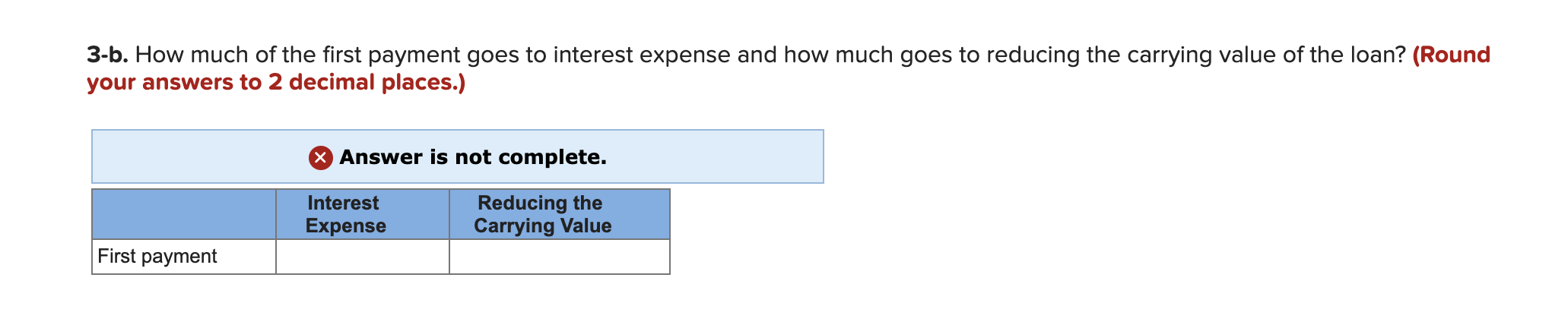

Required information Problem 9-1B Record and analyze installment notes (LO9-2) [The following information applies to the questions displayed below.] On January 1, 2021, Stoops Entertainment purchases a building for $450,000, paying $100,000 down and borrowing the remaining $350,000, signing a 7%, 20-year mortgage. Installment payments of $2,713.55 are due at the end of each month, with the first payment due on January 31, 2021. Problem 9-1B Part 3 3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2 decimal places.) Answer is complete and correct. No Date General Journal Debit Credit January 31, 2021 Interest Expense 2,041.67 Notes Payable 671.88 Cash 2,713.55 3-b. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan? (Round your answers to 2 decimal places.) X Answer is not complete. Reducing the Carrying Value Interest Expense First payment

Required information Problem 9-1B Record and analyze installment notes (LO9-2) [The following information applies to the questions displayed below.] On January 1, 2021, Stoops Entertainment purchases a building for $450,000, paying $100,000 down and borrowing the remaining $350,000, signing a 7%, 20-year mortgage. Installment payments of $2,713.55 are due at the end of each month, with the first payment due on January 31, 2021. Problem 9-1B Part 3 3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2 decimal places.) Answer is complete and correct. No Date General Journal Debit Credit January 31, 2021 Interest Expense 2,041.67 Notes Payable 671.88 Cash 2,713.55 3-b. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan? (Round your answers to 2 decimal places.) X Answer is not complete. Reducing the Carrying Value Interest Expense First payment

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 30E

Related questions

Question

![Required information

Problem 9-1B Record and analyze installment notes (LO9-2)

[The following information applies to the questions displayed below.]

On January 1, 2021, Stoops Entertainment purchases a building for $450,000, paying $100,000 down and borrowing the

remaining $350,000, signing a 7%, 20-year mortgage. Installment payments of $2,713.55 are due at the end of each

month, with the first payment due on January 31, 2021.

Problem 9-1B Part 3

3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, select

"No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2

decimal places.)

Answer is complete and correct.

No

Date

General Journal

Debit

Credit

January 31, 2021 Interest Expense

2,041.67

Notes Payable

671.88

Cash

2,713.55](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F10f2b1d8-bba1-418d-bb78-c7c206932e07%2F54214fd8-2863-4af6-826c-17966210199b%2Fm55lhcp.png&w=3840&q=75)

Transcribed Image Text:Required information

Problem 9-1B Record and analyze installment notes (LO9-2)

[The following information applies to the questions displayed below.]

On January 1, 2021, Stoops Entertainment purchases a building for $450,000, paying $100,000 down and borrowing the

remaining $350,000, signing a 7%, 20-year mortgage. Installment payments of $2,713.55 are due at the end of each

month, with the first payment due on January 31, 2021.

Problem 9-1B Part 3

3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, select

"No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2

decimal places.)

Answer is complete and correct.

No

Date

General Journal

Debit

Credit

January 31, 2021 Interest Expense

2,041.67

Notes Payable

671.88

Cash

2,713.55

Transcribed Image Text:3-b. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan? (Round

your answers to 2 decimal places.)

X Answer is not complete.

Reducing the

Carrying Value

Interest

Expense

First payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,