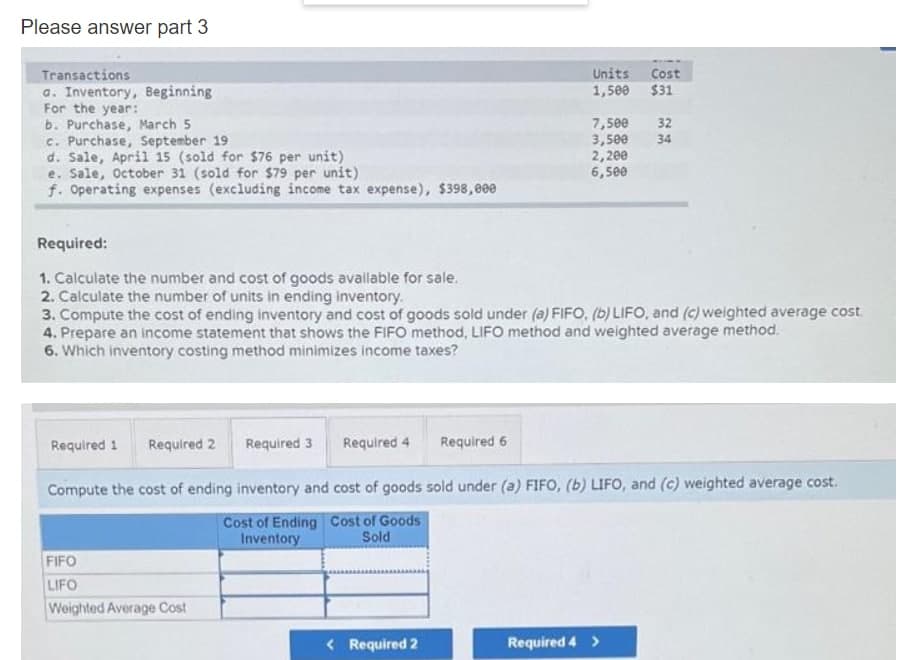

Please answer part 3 Units 1,500 $31 Transactions a. Inventory, Beginning For the year: b. Purchase, March 5 c. Purchase, September 19 d. Sale, April 15 (sold for $76 per unit) e. Sale, October 31 (sold for $79 per unit) f. Operating expenses (excluding income tax expense), $398,000 Cost 7,500 3,500 2,200 6,500 32 34 Required: 1. Calculate the number and cost of goods avallable for sale. 2. Calculate the number of units in ending inventory. 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost 4. Prepare an income statement that shows the FIFO method, LIFO method and weighted average method. 6. Which inventory costing method minimizes income taxes? Required 1 Required 2 Required 3 Required 4 Required 6 Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost. Cost of Ending Cost of Goods Inventory Sold FIFO LIFO Weighted Average Cost < Required 2 Required 4 >

Please answer part 3 Units 1,500 $31 Transactions a. Inventory, Beginning For the year: b. Purchase, March 5 c. Purchase, September 19 d. Sale, April 15 (sold for $76 per unit) e. Sale, October 31 (sold for $79 per unit) f. Operating expenses (excluding income tax expense), $398,000 Cost 7,500 3,500 2,200 6,500 32 34 Required: 1. Calculate the number and cost of goods avallable for sale. 2. Calculate the number of units in ending inventory. 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost 4. Prepare an income statement that shows the FIFO method, LIFO method and weighted average method. 6. Which inventory costing method minimizes income taxes? Required 1 Required 2 Required 3 Required 4 Required 6 Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost. Cost of Ending Cost of Goods Inventory Sold FIFO LIFO Weighted Average Cost < Required 2 Required 4 >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 4RE: Refer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020....

Related questions

Question

Transcribed Image Text:Please answer part 3

Units

1,500

Transactions

a. Inventory, Beginning

For the year:

b. Purchase, March 5

c. Purchase, September 19

d. Sale, April 15 (sold for $76 per unit)

e. Sale, October 31 (sold for $79 per unit)

f. Operating expenses (excluding income tax expense), $398,000

Cost

$31

7,500

3,500

2,200

6,500

32

34

Required:

1. Calculate the number and cost of goods avallable for sale.

2. Calculate the number of units in ending inventory.

3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost

4. Prepare an income statement that shows the FiFO method, LIFO method and weighted average method.

6. Which inventory costing method minimizes income taxes?

Required 1

Required 2

Required 3

Required 4

Required 6

Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost.

Cost of Ending Cost of Goods

Inventory

Sold

FIFO

LIFO

Weighted Average Cost

< Required 2

Required 4 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning