Required information [The following information applies to the questions displayed below.] On January 2, Summers Company received a machine that the company had ordered with an invoice price of $85,000. Freight costs of $1,000 were paid by the vendor per the sales agreement. The company exchanged the following on January 2 to acquire the machine: a. Issued 2,000 shares of Summers Company common stock, par value $1 (market value, $3.50 per share). b. Signed a note payable for $60,000 with an 11.5 percent interest rate (principal plus interest are due April 1 of the current year). c. The balance of the invoice price was on account with the vendor, to be paid in cash by January 12. On January 3, Summers Company paid $2,400 cash for installation costs to prepare the machine for use. On January 12, Summers Company paid the balance due on its accounts payable to the vendor. Required: 2. Record the purchase on January 2, the installation costs on January 3, and the subsequent payment on January 12. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Required information [The following information applies to the questions displayed below.] On January 2, Summers Company received a machine that the company had ordered with an invoice price of $85,000. Freight costs of $1,000 were paid by the vendor per the sales agreement. The company exchanged the following on January 2 to acquire the machine: a. Issued 2,000 shares of Summers Company common stock, par value $1 (market value, $3.50 per share). b. Signed a note payable for $60,000 with an 11.5 percent interest rate (principal plus interest are due April 1 of the current year). c. The balance of the invoice price was on account with the vendor, to be paid in cash by January 12. On January 3, Summers Company paid $2,400 cash for installation costs to prepare the machine for use. On January 12, Summers Company paid the balance due on its accounts payable to the vendor. Required: 2. Record the purchase on January 2, the installation costs on January 3, and the subsequent payment on January 12. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 6PA: PA6. 8.4 Prepare a trial balance using the journal entries in PA5.

Related questions

Question

DO NOT ANSWER IMAGE FORMET

![Required information

[The following information applies to the questions displayed below.]

On January 2, Summers Company received a machine that the company had ordered with an invoice price of $85,000.

Freight costs of $1,000 were paid by the vendor per the sales agreement. The company exchanged the following on

January 2 to acquire the machine:

a. Issued 2,000 shares of Summers Company common stock, par value $1 (market value, $3.50 per share).

b. Signed a note payable for $60,000 with an 11.5 percent interest rate (principal plus interest are due April 1 of the current

year).

c. The balance of the invoice price was on account with the vendor, to be paid in cash by January 12.

On January 3, Summers Company paid $2,400 cash for installation costs to prepare the machine for use.

On January 12, Summers Company paid the balance due on its accounts payable to the vendor

Required:

2. Record the purchase on January 2, the installation costs on January 3, and the subsequent payment on January 12.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fd0b9094c-857f-4394-9647-e46fdce81da0%2Ff11ccc30-449d-48be-a1f9-df3b564c5e9f%2Fmn9b23_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

On January 2, Summers Company received a machine that the company had ordered with an invoice price of $85,000.

Freight costs of $1,000 were paid by the vendor per the sales agreement. The company exchanged the following on

January 2 to acquire the machine:

a. Issued 2,000 shares of Summers Company common stock, par value $1 (market value, $3.50 per share).

b. Signed a note payable for $60,000 with an 11.5 percent interest rate (principal plus interest are due April 1 of the current

year).

c. The balance of the invoice price was on account with the vendor, to be paid in cash by January 12.

On January 3, Summers Company paid $2,400 cash for installation costs to prepare the machine for use.

On January 12, Summers Company paid the balance due on its accounts payable to the vendor

Required:

2. Record the purchase on January 2, the installation costs on January 3, and the subsequent payment on January 12.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

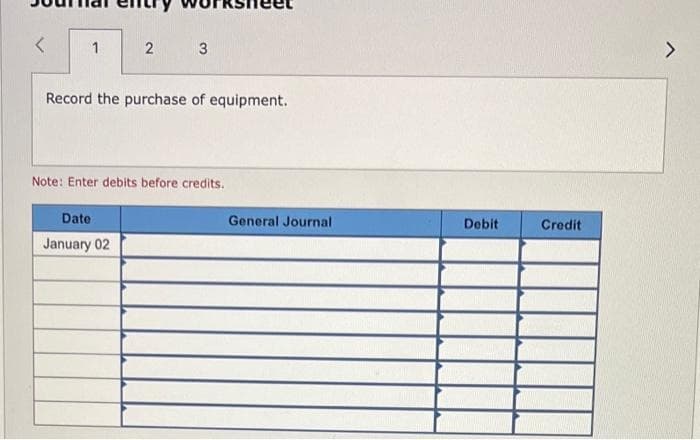

Transcribed Image Text:1

2 3

Record the purchase of equipment.

Note: Enter debits before credits.

Date

January 02

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,