Required information [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit $ 22,300 37,500 Cash Accounts Receivable Allowance for Uncollectible $ 3,500 Accounts Inventory Land 32,000 64,600 Accounts Payable Notes Payable (9%, due in 3 years) 31,400 32,000 58,000 31,500 $156,400 $156,400 Common Stock Retained Earnings Totals The $32,000 beginning balance of inventory consists of 320 units, each costing $100. During January 2021, Big Blast Fireworks had the following inventory transactions: 3 Purchase 1,100 units for $117, 700 on account ($107 each). 8 Purchase 1,200 units for $134, 400 on account ($112 each). January January January 12 Purchase 1,300 units for $152,100 on account ($117 each). January 15 Return 110 of the units purchased on January 12 because of defects. January 19 Sell 3,700 units on account for $555,000. The cost of the units sold is determined using a FIFO perpetual inventory system. January 22 Receive $533,000 from customers on accounts receivable. January 24 Pay $363,000 to inventory suppliers on accounts payable. January 27 Write off accounts receivable as uncollectible, $2,700. January 31 Pay cash for salaries during January, $116,000. The following information is available on January 31, 2021. a. At the end of January, the company estimates that the remaining units of inventory are expected to sell in February for only $100 each. b. The company estimates future uncollectible accounts. The company determines $4,200 of accounts receivable on January 31 are past due, and 40% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) c. Accrued interest expense on notes payable for January. Interest is expected to be paid each December 31. d. Accrued income taxes at the end of January are $12,500.

Required information [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit $ 22,300 37,500 Cash Accounts Receivable Allowance for Uncollectible $ 3,500 Accounts Inventory Land 32,000 64,600 Accounts Payable Notes Payable (9%, due in 3 years) 31,400 32,000 58,000 31,500 $156,400 $156,400 Common Stock Retained Earnings Totals The $32,000 beginning balance of inventory consists of 320 units, each costing $100. During January 2021, Big Blast Fireworks had the following inventory transactions: 3 Purchase 1,100 units for $117, 700 on account ($107 each). 8 Purchase 1,200 units for $134, 400 on account ($112 each). January January January 12 Purchase 1,300 units for $152,100 on account ($117 each). January 15 Return 110 of the units purchased on January 12 because of defects. January 19 Sell 3,700 units on account for $555,000. The cost of the units sold is determined using a FIFO perpetual inventory system. January 22 Receive $533,000 from customers on accounts receivable. January 24 Pay $363,000 to inventory suppliers on accounts payable. January 27 Write off accounts receivable as uncollectible, $2,700. January 31 Pay cash for salaries during January, $116,000. The following information is available on January 31, 2021. a. At the end of January, the company estimates that the remaining units of inventory are expected to sell in February for only $100 each. b. The company estimates future uncollectible accounts. The company determines $4,200 of accounts receivable on January 31 are past due, and 40% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) c. Accrued interest expense on notes payable for January. Interest is expected to be paid each December 31. d. Accrued income taxes at the end of January are $12,500.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12E: Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120...

Related questions

Question

Please help:

![Required information

[The following information applies to the questions displayed below.]

On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances:

Debit

$ 22,300

37,500

Accounts

Credit

Cash

Accounts Receivable

Allowance for Uncollectible

$ 3,500

Accounts

32,000

64,600

Inventory

Land

Accounts Payable

Notes Payable (9%, due in 3

31,400

32,000

years)

Common Stock

Retained Earnings

58,000

31,500

Totals

$156,400 $156,400

The $32,000 beginning balance of inventory consists of 320 units, each costing $100. During January 2021,

Big Blast Fireworks had the following inventory transactions:

3 Purchase 1,100 units for $117,700 on account ($107 each).

8 Purchase 1,200 units for $134,400 on account ($112 each).

January

January

January 12 Purchase 1,300 units for $152,100 on account ($117 each).

January 15 Return 110 of the units purchased on January 12 because of defects.

January 19 Sell 3,700 units on account for $555,000. The cost of the units

sold is determined using a FIF0 perpetual inventory system.

January 22 Receive $533,000 from customers on accounts receivable.

January 24 Pay $363,000 to inventory suppliers on accounts payable.

January 27 Write off accounts receivable as uncollectible, $2,700.

January 31 Pay cash for salaries during January, $116,000.

The following information is available on January 31, 2021.

a. At the end of January, the company estimates that the remaining units of inventory are expected to sell in

February for only $100 each.

b. The company estimates future uncollectible accounts. The company determines $4,200 of accounts

receivable on January 31 are past due, and 40% of these accounts are estimated to be uncollectible. The

remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to

be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.)

c. Accrued interest expense on notes payable for January. Interest is expected to be paid each December

31.

d. Accrued income taxes at the end of January are $12,500.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fc098fe48-a884-469f-b06b-e645dd891d79%2Ff91f5661-5722-4efc-af0d-ddba1d642863%2Fx2w4zo_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances:

Debit

$ 22,300

37,500

Accounts

Credit

Cash

Accounts Receivable

Allowance for Uncollectible

$ 3,500

Accounts

32,000

64,600

Inventory

Land

Accounts Payable

Notes Payable (9%, due in 3

31,400

32,000

years)

Common Stock

Retained Earnings

58,000

31,500

Totals

$156,400 $156,400

The $32,000 beginning balance of inventory consists of 320 units, each costing $100. During January 2021,

Big Blast Fireworks had the following inventory transactions:

3 Purchase 1,100 units for $117,700 on account ($107 each).

8 Purchase 1,200 units for $134,400 on account ($112 each).

January

January

January 12 Purchase 1,300 units for $152,100 on account ($117 each).

January 15 Return 110 of the units purchased on January 12 because of defects.

January 19 Sell 3,700 units on account for $555,000. The cost of the units

sold is determined using a FIF0 perpetual inventory system.

January 22 Receive $533,000 from customers on accounts receivable.

January 24 Pay $363,000 to inventory suppliers on accounts payable.

January 27 Write off accounts receivable as uncollectible, $2,700.

January 31 Pay cash for salaries during January, $116,000.

The following information is available on January 31, 2021.

a. At the end of January, the company estimates that the remaining units of inventory are expected to sell in

February for only $100 each.

b. The company estimates future uncollectible accounts. The company determines $4,200 of accounts

receivable on January 31 are past due, and 40% of these accounts are estimated to be uncollectible. The

remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to

be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.)

c. Accrued interest expense on notes payable for January. Interest is expected to be paid each December

31.

d. Accrued income taxes at the end of January are $12,500.

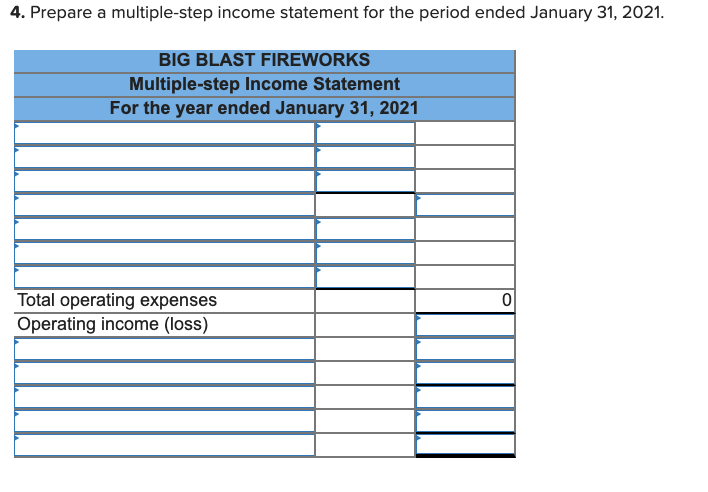

Transcribed Image Text:4. Prepare a multiple-step income statement for the period ended January 31, 2021.

BIG BLAST FIREWORKS

Multiple-step Income Statement

For the year ended January 31, 2021

Total operating expenses

Operating income (loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning