Required information [The following information applies to the questions displayed below.] Sye Chase started and operated a small family architectural firm in Year 1. The firm was affected by two events: (1) Chase provided $19,800 of services on account, and (2) he purchased $6,200 of supplies on account. There were $950 of supplies on hand as of December 31, Year 1. Required a. b. & e. Record the two transactions in the accounts. Record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. Post the entries in the T-accounts and prepare a post-closing trial balance. (Select "a1, a2, or b" for the transactions in the order they take place. Select "cl" for closing entries. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Required information [The following information applies to the questions displayed below.] Sye Chase started and operated a small family architectural firm in Year 1. The firm was affected by two events: (1) Chase provided $19,800 of services on account, and (2) he purchased $6,200 of supplies on account. There were $950 of supplies on hand as of December 31, Year 1. Required a. b. & e. Record the two transactions in the accounts. Record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. Post the entries in the T-accounts and prepare a post-closing trial balance. (Select "a1, a2, or b" for the transactions in the order they take place. Select "cl" for closing entries. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 15EA: Journalize for Harper and Co. each of the following transactions or state no entry required and...

Related questions

Question

Please answer full question.

![Help

Save & Exit

Check m

Required information

[The following information applies to the questions displayed below.]

Sye Chase started and operated a small family architectural firm in Year 1. The firm was affected by two events: (1) Chase

provided $19,800 of services on account, and (2) he purchased $6,200 of supplies on account. There were $950 of

supplies on hand as of December 31, Year 1.

Required

a. b. & e. Record the two transactions in the accounts. Record the required year-end adjusting entry to reflect the use of supplies and

the required closing entries. Post the entries in the T-accounts and prepare a post-closing trial balance. (Select "a1, a2, or b" for the

transactions in the order they take place. Select "cl" for closing entries. If no entry is required for a transaction/event, select "No

journal entry required" in the first account field.)

Suppllie

Accounts Receivable](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fb75e2346-ebf2-4e14-802c-14c74b6109ef%2Fc05e96b6-6a47-40a1-8a5d-c696ca213d9f%2Flp5nlg9_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Help

Save & Exit

Check m

Required information

[The following information applies to the questions displayed below.]

Sye Chase started and operated a small family architectural firm in Year 1. The firm was affected by two events: (1) Chase

provided $19,800 of services on account, and (2) he purchased $6,200 of supplies on account. There were $950 of

supplies on hand as of December 31, Year 1.

Required

a. b. & e. Record the two transactions in the accounts. Record the required year-end adjusting entry to reflect the use of supplies and

the required closing entries. Post the entries in the T-accounts and prepare a post-closing trial balance. (Select "a1, a2, or b" for the

transactions in the order they take place. Select "cl" for closing entries. If no entry is required for a transaction/event, select "No

journal entry required" in the first account field.)

Suppllie

Accounts Receivable

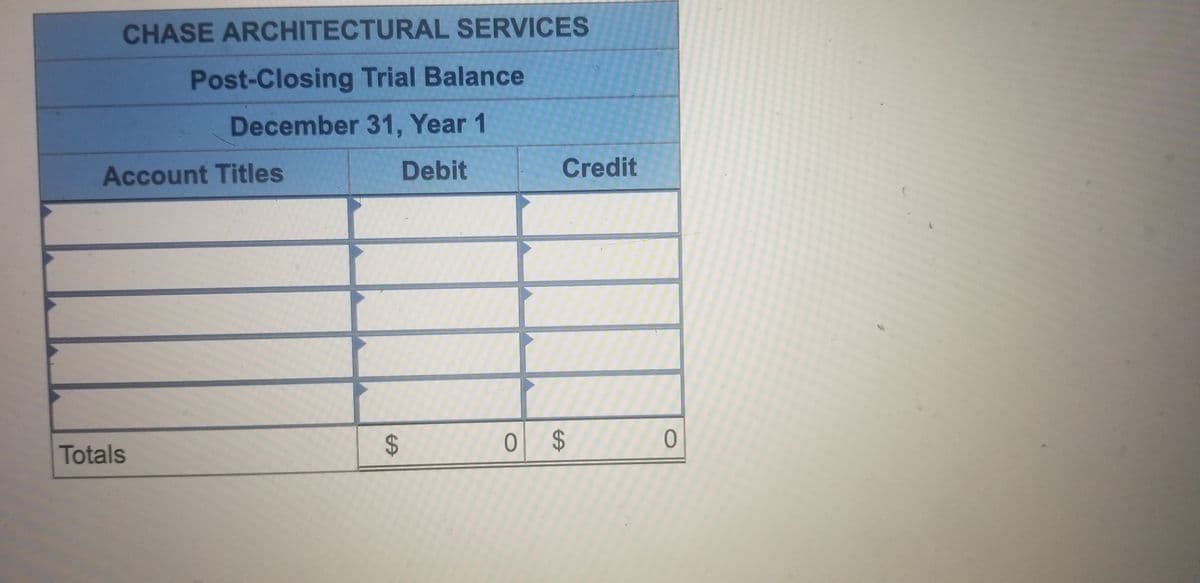

Transcribed Image Text:CHASE ARCHITECTURAL SERVICES

Post-Closing Trial Balance

December 31, Year 1

Account Titles

Debit

Credit

Totals

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage