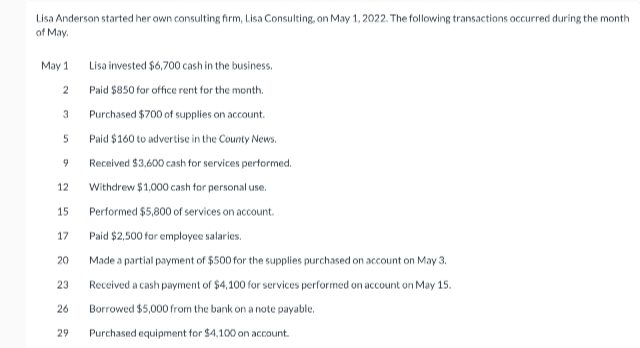

Lisa Anderson started her own consulting firm, Lisa Consulting, on May 1, 2022. The following transactions occurred during the month of May. May 1 2 3 5 9 12 15 Lisa invested $6,700 cash in the business. Paid $850 for office rent for the month. Purchased $700 of supplies on account. Paid $160 to advertise in the County News. Received $3,600 cash for services performed. Withdrew $1,000 cash for personal use. Performed $5,800 of services on account.

Q: A Corp. leased equipment to a lessee on January 1, 2021. The lease is for an eight-year period…

A: A Corp. leased equipment to a lessee on January 1, 2021. The lease is for an eight-year period…

Q: Cash flows from operating activities with the indirect method include: A. changes in accounts…

A: Introduction:- A cash flow statement denotes total amount cash is inflows and cash outflows your…

Q: Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net…

A: The ratio analysis represents an essential aspect in the study of the company's financial…

Q: Recommend THREE (3) audit procedures which can be performed to prevent external auditor's reliance…

A: The external auditor shall determine whether work of the internal audit function can be used for the…

Q: Neptune purchased a new storage facility on April 1, 2021. The new building cost $80,000. A new…

A: Depreciation is an amount charged on the fixed assets by which the asset value decreases over its…

Q: as per information viii - the depreciation for Vehicles 25% "reducing balance", not on cost. 2) vi.…

A: It has been mentioned in the question that the depreciation on the vehicle is 25% but the same is…

Q: a. If the tender offer is planned at a premium of 40 percent over market price, what will be the…

A: Shares are units of equity ownership in a corporation. Generally there are two types of Shares 1.…

Q: Problem 1 - Inventory Methods Magic Jelly Beans Company Operating information Sales…

A: Under FIFO method the units came first in store will be sold first. Under LIFO method the units…

Q: The following items are related to Berjaya Bhd's financial statements for the year ended 30 June…

A: Change in accounting estimates or an error states the results from new information or new…

Q: Question 5 To determine the scope of a bookkeeping clean-up engagement, you are reviewing the Client…

A: Recording in equity account opening balance in the Quick book are done in the following…

Q: Hair-raising Hats has three lines of hats: baseball, winter, and fashion. On May 18, 2020,…

A: Sales for the period: $780,000 Beginning Inventory at cost: $97,000 Beginning Inventory at retail:…

Q: Required a. The ledger is already set up for you based on the chart of accounts. b. Journalize (all…

A: The journal entry means to post the transaction of the month in the books of the company. Journal is…

Q: Complete the 2021 Statement of Cash flows Indirect and Direct methods Operating Sources/Uses:

A: *Decrease in current assets is added while increase in current assets is deducted. *Increase in…

Q: Before Khalish completes the audit, critically analyse Bright Bhd.'s financial statements from…

A: An auditor when performs the audit on the financial statements of the company have to give or in…

Q: The general management of the client have a history of corporate tax avoidance and violating listing…

A: In case of fraud there are two type that include the miss appropriation of assets and fraud…

Q: What is the amount of shortage due from the sales manager? What is the amount of undeposited…

A: A petty cash fund is a fund used for receipts and payments of some of the daily cash transactions of…

Q: Inventory records for Dunbar Incorporated revealed the following: Date Transaction Number of Units…

A: Introduction: In accounting, the Weighted Average Cost (WAC) method estimates the amount that goes…

Q: Select the necessary words from the list of possibilities to complete the following statements.…

A: Net income :— It is revenue minus expenses. Subsidiary ledger :— It is the list of accounts of…

Q: Riley Company promises to pay Janet Anderson or her estate $150,000 per year for the next 10 years,…

A: Ans. The amount promised by the company is $150000 * 10 i.e.$1500000. This amount will be the full…

Q: During its hrst year of manufacturing costs: Direct materials, $5 per unit, Direct labor, $3 per…

A: Answer : Income under absorption Costing = Income under variable costing + Fixed overhead cost in…

Q: The following data are taken from the financial statements of Sheffield Company. Accounts receivable…

A: As per the given information: 20222021Accounts receivable (net), end of year$555,000$470,000Net…

Q: The following information relates to Stimulus Traders: Balance at 31 December 2012 Trading…

A: Opening Inventory: 15000 Purchases: 90000 Purchases Returns: 5500 Drawings: 2500 Closing Inventory:…

Q: Required: 1. Assuming that the vehicle transfer was downstream, calculate Plock's consolidated net…

A: When a company purchases the majority of shares of another company then it is known as an…

Q: The Unadjusted Trial Balance columns of a work sheet total $84,000. The Adjustmer columns contain…

A: Amount of unadjusted trial balance columns: $84,000 Office supplies used: $1,200 Expiration of…

Q: His total home office expenses are: His net business income based on notes 4 to 6 above is : 7. Paul…

A: 6. Total office expenses = 25% of personal residence Total cost associated with Paul's home is as…

Q: 11 C. Denim cloth Direct labor i. ii. performance evaluation and decision making: RM 15.00 per pair…

A: Break even is the point where the company or entity is neither in profits nor in losses. It is the…

Q: Assume the St. Cloud plant uses a single plantwide overhead rate to assign all overhead (plantwide…

A: a1 Budgeted Plant-wide overhead 250000 Add: Budgeted department overhead 437000…

Q: What is meant by owners’ equity?

A: Owner's Equity is the amount contributed to the business by the owners with no obligation of…

Q: Prepare an Income Statement for the year ended 31 March 2020 and a Statement of Financial Position…

A: Income statement :— Income statement Is the part of the Financial Statement of the Company. Income…

Q: Lansing Company's current-year income statement and selected balance sheet data at December 31 of…

A: Cash flow from operating activities is a part of cash flow statement that states the net cash flow…

Q: b. Changes in measurement methods implied changes in accounting estimates. Choose TWO (2) of the…

A: In the Business, it is not possible to accurately calculate the Financial Figures of Assets and…

Q: Lansing Company's current-year income statement and selected balance sheet data at December 31 of…

A: The cash flow statement is one of the financial statement of the business. Under indirect method,…

Q: Prepare journal Entries: Oscar is a self-employed electrician. He purchases a piece of equipment for…

A: Introduction: A journal entry contains information about a single business transaction, such as the…

Q: I are shown below. What amount will be posted to Wilson Peters, Capital in th rocess of closing the…

A: Introduction:- Income statement shows company's income and expenses over a period of time.…

Q: Prepare Liquidators Final statement of Account.

A: When a Company is get liquidated, A liquidator has been appointed. All the Assets are realized and…

Q: Brave Company maintains a branch in Davao City and makes inventory shipment to its branch at 20%…

A: The Allowance for overvaluation of branch inventory account, also called Unrealized profit in branch…

Q: Fresh-start accounting must be adopted by certain debtors emerging from chapter 11 bankruptcy. When…

A: Fresh start accounting is a method of accounting used by organizations that have just emerged from…

Q: You borrow money on a self-liquidating installment loan (equal payments at the end of each year,…

A: The formula to calculate installment is Loan = annual installment×1-1+i-ni Total interest payment…

Q: is generally prepared as the first step in preparing the operating budgets O a. A sales budget O b.…

A: Lets understand the basics. Management prepares various budgets in order to estimate future profit…

Q: Prepare the journal entry to record the purchase of the machines, indicating the initial cost of…

A: Journal entries are passed following the golden rules of accounting. Debit all assets and expenses…

Q: Enter the following December 31 normal balances in the first row of T-accounts below: K. Korver,…

A: Lets understand the basics. There are various steps involved in preparing financial statement which…

Q: (iii) Pau Bhd, a public company, purchases a 60% interest of another company, Pol Sdn Bhd, on 1…

A:

Q: The beginning inventory and the purchases and sales of inventory for March for the Carolina Company…

A: The inventory can be valued using various methods as FIFO, LIFO and weighted average method. Using…

Q: Prepaid rent should be ________ and rent expense should be ________ for rent incurred during the…

A: Prepaid rent is rent paid in advance. As rent is an expense prepaid rent is a type of prepaid…

Q: Required information [The following information applies to the questions displayed below.] Lansing…

A: Introduction: The direct method is one of two accounting treatments that are used to create a cash…

Q: On the first day of the fiscal year, a company issues a $3,400,000, 9%, 5-year bond that pays…

A: Solution; Face value of bond = $3,400,000 Issue price of bond = $3,682,766 Premium on issue of bond…

Q: C10.58 Solid State sells electronic products. The controller is responsible for preparing the master…

A: Introduction Accounts Receivables: Accounts Receivable (AR) is the term used to describe the money…

Q: On December 31, 2010, EEEE Company was indebted to AFE Company on a P2,000,000, 10% note. Only…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: Why is it necessary for accountants to assume that business entity will remain a going concern?

A: Introduction: The concept of a going concern is crucial to accounting. It presupposes that a…

Q: Recording transactions in the expanded accounting equation (15 min) ASSETS E1-4A. Record the…

A: The journal is the first step of accounting process and it is based on the accounting equation. The…

Prepare an income statement for the month of May

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?In July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow. a. Schwartz deposited 25,000 in a bank account in the name of the business. b. Bought office equipment on account from QuipCo, 9,670. c. Schwartz invested his personal law library, which cost 2,800. d. Paid the office rent for the month, 1,700, Ck. No. 2000. e. Bought office supplies for cash, 418, Ck. No. 2001. f. Bought insurance for two years, 944, Ck. No. 2002. g. Sold legal services for cash, 8,518. h. Paid the salary of the part-time receptionist, 1,820, Ck. No. 2003. i. Received and paid the telephone bill, 388, Ck. No. 2004. j. Received and paid the bill for utilities, 368, Ck. No. 2005. k. Sold legal services for cash, 9,260. l. Paid on account to QuipCo, 2,670, Ck. No. 2006. m. Schwartz withdrew cash for personal use, 2,500, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2018. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement, 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Recorded services provided on account for the period May 115, 9,180. 16. Paid part-time receptionist for two weeks salary including the amount owed on April 30, 750. 17. Recorded cash from cash clients for fees earned during the period May 1-16, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Recorded services provided on account for the period May 16-20,4,820. 25. Recorded cash from cash clients for fees earned for the period May 17- 23, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Recorded cash from cash clients for fees earned for the period May 26-31, 3,300. 31. Recorded services provided on account for the remainder of May, 2,650. 31. Paid dividends, 10,500. Instructions 1. The cl1art of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2018, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2018, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two-column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). (A) Insurance expired during May is 275. (B) Supplies on hand on May 31 are 715. (C) Depreciation of office equipment for May is 330. (D) Accrued receptionist salary on May 31 is 325. (E) Rent expired during May is 1,600. (F) Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a retained earnings statement, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of d1e journal. (Income Summary is account #34 in d1e chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.B. Kelso established Computer Wizards during November of this year. The accountant prepared the following chart of accounts: The following transactions occurred during the month: a. Kelso deposited 45,000 in a bank account in the name of the business. b. Paid the rent for the current month, 1,800, Ck. No. 2001. c. Bought office desks and filing cabinets for cash, 790, Ck. No. 2002. d. Bought a computer and printer from Cyber Center for use in the business, 2,700, paying 1,700 in cash and placing the balance on account, Ck. No. 2003. e. Bought a neon sign on account from Signage Co., 1,350. f. Kelso invested her personal computer software with a fair market value of 600 in the business. g. Received a bill from Country News for newspaper advertising, 365. h. Sold services for cash, 1,245. i. Received and paid the electric bill, 345, Ck. No. 2004. j. Paid on account to Country News, a creditor, 285, Ck. No. 2005. k. Sold services for cash, 1,450. l. Paid wages to an employee, 925, Ck. No. 2006. m. Received and paid the bill for the city business license, 75, Ck. No. 2007. n. Kelso withdrew cash for personal use, 850, Ck. No. 2008. o. Kelso withdrew cash for personal use, 850, Ck. No. 2008. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance, with a three-line heading, dated November 30, 20--.

- Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.During December of this year, G. Elden established Ginnys Gym. The following asset, liability, and owners equity accounts are included in the chart of accounts: During December, the following transactions occurred: a. Elden deposited 35,000 in a bank account in the name of the business. b. Bought exercise equipment for cash, 8,150, Ck. No. 1001. c. Bought advertising on account from Hazel Company, 105. d. Bought a display rack on account from Cyber Core, 790. e. Bought office equipment on account from Office Aids, 185. f. Elden invested her exercise equipment with a fair market value of 1,200 in the business. g. Made a payment to Cyber Core, 200, Ck. No. 1002. h. Sold services for the month of December for cash, 800. Required 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental accounting equation, as well as the plus and minus signs and Debit and Credit. 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction. 4. Foot and balance the accounts.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.