Required: Journalise the adjustments (First voucher number = No. 101). Note - The subsidiary journals have been closed off, so all additional transactions are recorded in the general journal. No journal narrations or folio numbers are required. You are not required to journalise the closing transfers. END OF PAPER

Required: Journalise the adjustments (First voucher number = No. 101). Note - The subsidiary journals have been closed off, so all additional transactions are recorded in the general journal. No journal narrations or folio numbers are required. You are not required to journalise the closing transfers. END OF PAPER

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.23E: Adjustment for depreciation The estimated amount of depredation on equipment for the current year is...

Related questions

Question

100%

Transcribed Image Text:4G

12:07 PM A

Required

Calculate the depreciation and accumulated depreciation for 2019 and 2020.

Rou

how all vour workin

Take-Home Te...

earest Ra

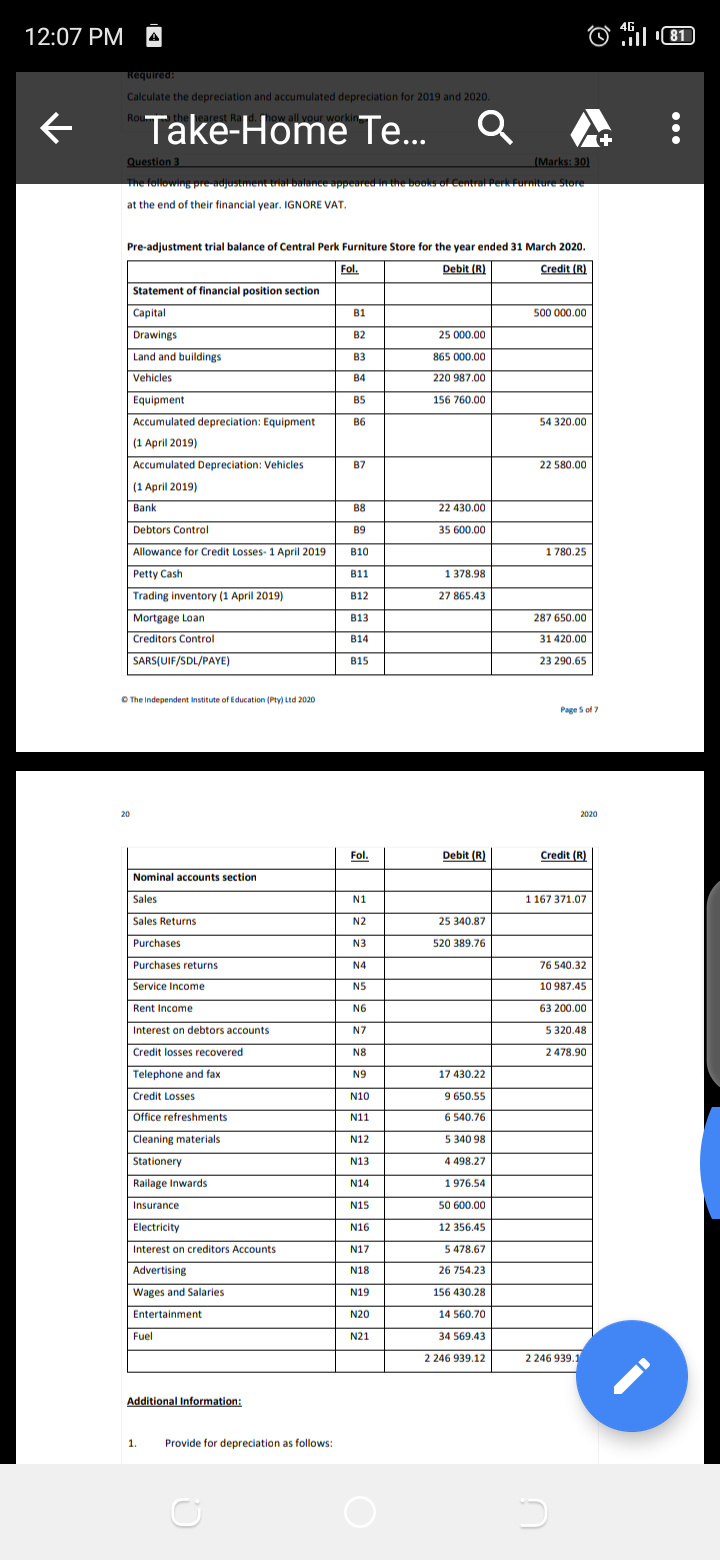

Question 3

(Marks: 30)

The following pre adjustment trial balance appeared in the beeks of Central Perk Furniture Store

at the end of their financial year. IGNORE VAT.

Pre-adjustment trial balance of Central Perk Furniture Store for the year ended 31 March 2020.

Fol.

Debit (R)

Credit (R)

Statement of financial position section

Capital

B1

500 000.00

Drawings

B2

25 000.00

Land and buildings

B3

865 000.00

Vehicles

B4

220 987.00

Equipment

B5

156 760.00

Accumulated depreciation: Equipment

B6

54 320.00

(1 April 2019)

Accumulated Depreciation: Vehicles

B7

22 580.00

(1 April 2019)

Bank

B8

22 430.00

Debtors Control

B9

35 600.00

Allowance for Credit Losses- 1April 2019

B10

1 780.25

Petty Cash

B11

1 378.98

Trading inventory (1 April 2019)

B12

27 865.43

Mortgage Loan

B13

287 650.00

Creditors Control

B14

31 420.00

SARS(UIF/SDL/PAYE)

B15

23 290.65

O The Independent Institute of Education (Pty) Ltd 2020

Page S of 7

20

2020

Fol.

Debit (R)

Credit (R

Nominal accounts section

Sales

N1

1167 371.07

Sales Returns

Purchases

N2

25 340.87

N3

520 389.76

Purchases returns

N4

76 540.32

Service Income

N5

10 987.45

Rent Income

63 200.00

N6

Interest on debtors accounts

N7

5 320.48

Credit losses recovered

N8

2 478.90

Telephone and fax

Credit Losses

N9

17 430.22

N10

9 650.55

Office refreshments

N11

6 540.76

Cleaning materials

Stationery

N12

5 340 98

N13

4 498.27

Railage Inwards

N14

1 976.54

Insurance

N15

50 600.00

Electricity

12 356.45

N16

Interest on creditors Accounts

N17

5 478.67

Advertising

N18

26 754.23

Wages and Salaries

N19

156 430.28

Entertainment

N20

14 560.70

Fuel

N21

34 569.43

2 246 939.12

2 246 939.:

Additional Information:

1.

Provide for depreciation as follows:

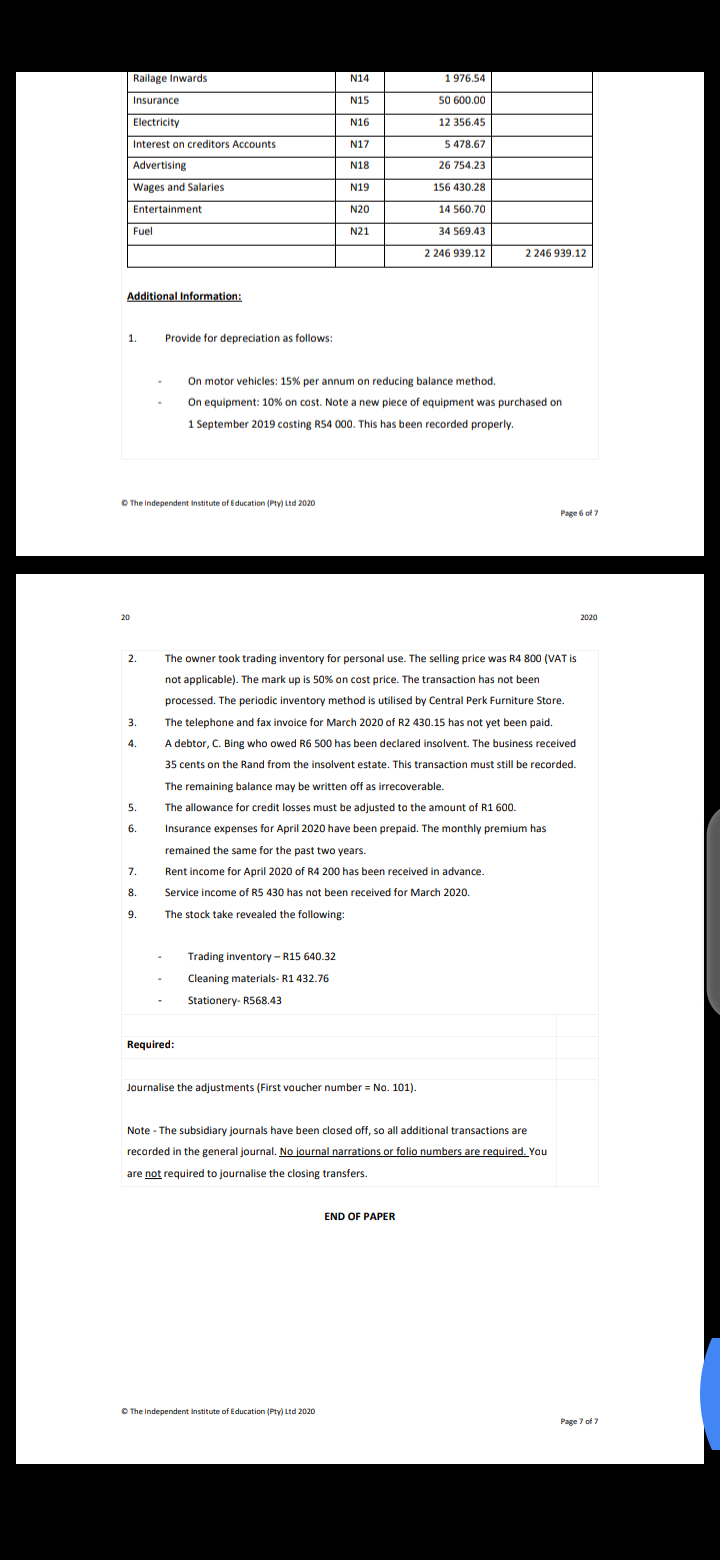

Transcribed Image Text:Railage Inwards

Insurance

Electricity

N14

1976.54

N15

50 600.00

N16

12 356.45

Interest on creditors Accounts

N17

5 478.67

Advertising

Wages and Salaries

N18

26 754.23

N19

156 430.28

Entertainment

N20

14 560.70

Fuel

N21

34 569.43

2 246 939.12

2 246 939.12

Additional Information:

1.

Provide for depreciation as follows:

On motor vehicles: 15% per annum on reducing balance method.

On equipment: 10% on cost. Note a new piece of equipment was purchased on

1 September 2019 costing R54 000. This has been recorded properly.

O The Independent Institute of iducation (Pty) Ltd 2020

Page 6 of 7

20

2020

2.

The owner took trading inventory for personal use. The selling price was R4 800 (VAT is

not applicable). The mark up is 50% on cost price. The transaction has not been

processed. The periodic inventory method is utilised by Central Perk Furniture Stare.

3.

The telephone and fax invoice for March 2020 of R2 430.15 has not yet been paid.

4.

A debtor, C. Bing who owed R6 500 has been declared insalvent. The business received

35 cents on the Rand from the insolvent estate. This transaction must still be recorded.

The remaining balance may be written off as irrecoverable.

5.

The allowance for credit losses must be adjusted to the amount of R1 600.

6.

Insurance expenses for April 2020 have been prepaid. The monthly premium has

remained the same for the past two years.

7.

Rent income for April 2020 of R4 200 has been received in advance.

8.

Service income of R5 430 has not been received for March 2020.

9.

The stock take revealed the following:

Trading inventory – R15 640.32

Cleaning materials- R1 432.76

Stationery- R568.43

Required:

Journalise the adjustments (First voucher number = No. 101).

Note - The subsidiary journals have been closed off, so all additional transactions are

recorded in the general journal. No journal narrations or folio numbers are required. You

are not required to jaurnalise the closing transfers.

END OF PAPER

O The Independent Institute of Education (Pty) Ltd 2020

Page 7 of 7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning