Required:- (i) Sales day book and explain why some entries are not recorded (ii) Respective ledger account entries

Required:- (i) Sales day book and explain why some entries are not recorded (ii) Respective ledger account entries

Chapter10: Financial Statements And Reports

Section: Chapter Questions

Problem 3.3C

Related questions

Question

Transcribed Image Text:TAKE AWAY CAX

New tab

X G Personal Clour X

om/u/0/c/NDcwOTU3MTc5OTMx/a/NTM1NDk2MTY4ODQx/details

credited to drawings. (10 Marks)

1st March, 2020

4th March, 2020

5th March, 2020

10th March, 2020

12th March, 2020

30th March, 2020

My Drive - Go X

Open with Google Docs

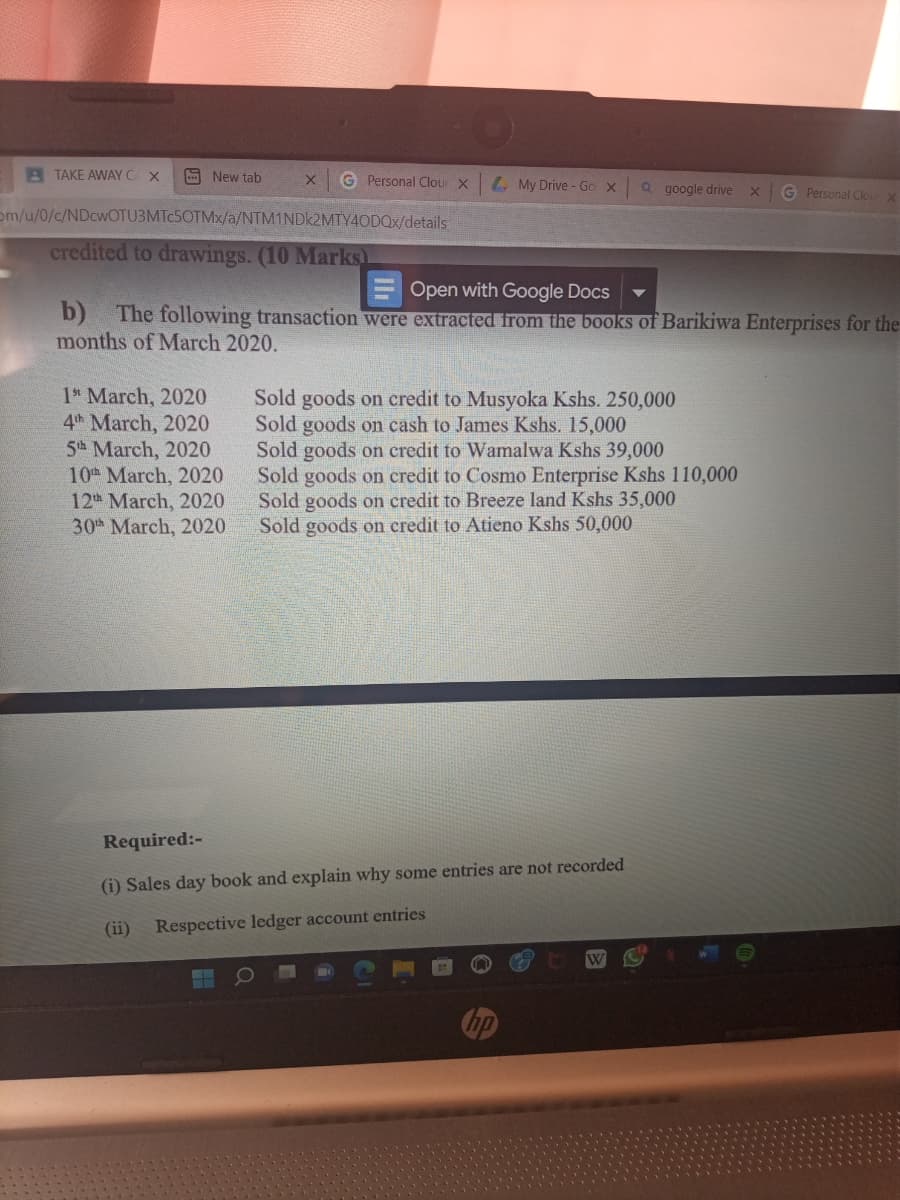

b) The following transaction were extracted from the books of Barikiwa Enterprises for the

months of March 2020.

Q google drive X G Personal Clou

Sold goods on credit to Musyoka Kshs. 250,000

Sold goods on cash to James Kshs. 15,000

Sold goods on credit to Wamalwa Kshs 39,000

Sold goods on credit to Cosmo Enterprise Kshs 110,000

Sold goods on credit to Breeze land Kshs 35,000

Sold goods on credit to Atieno Kshs 50,000

Required:-

(i) Sales day book and explain why some entries are not recorded

(ii)

Respective ledger account entries

W

Transcribed Image Text:WAY C X

New tab

X G Personal Clour X

NOTU3MTc5OTMx/a/NTM1NDk2MTY4ODQx/details

MANAGEMENT

My Drive - Go X

QUESTION ONE

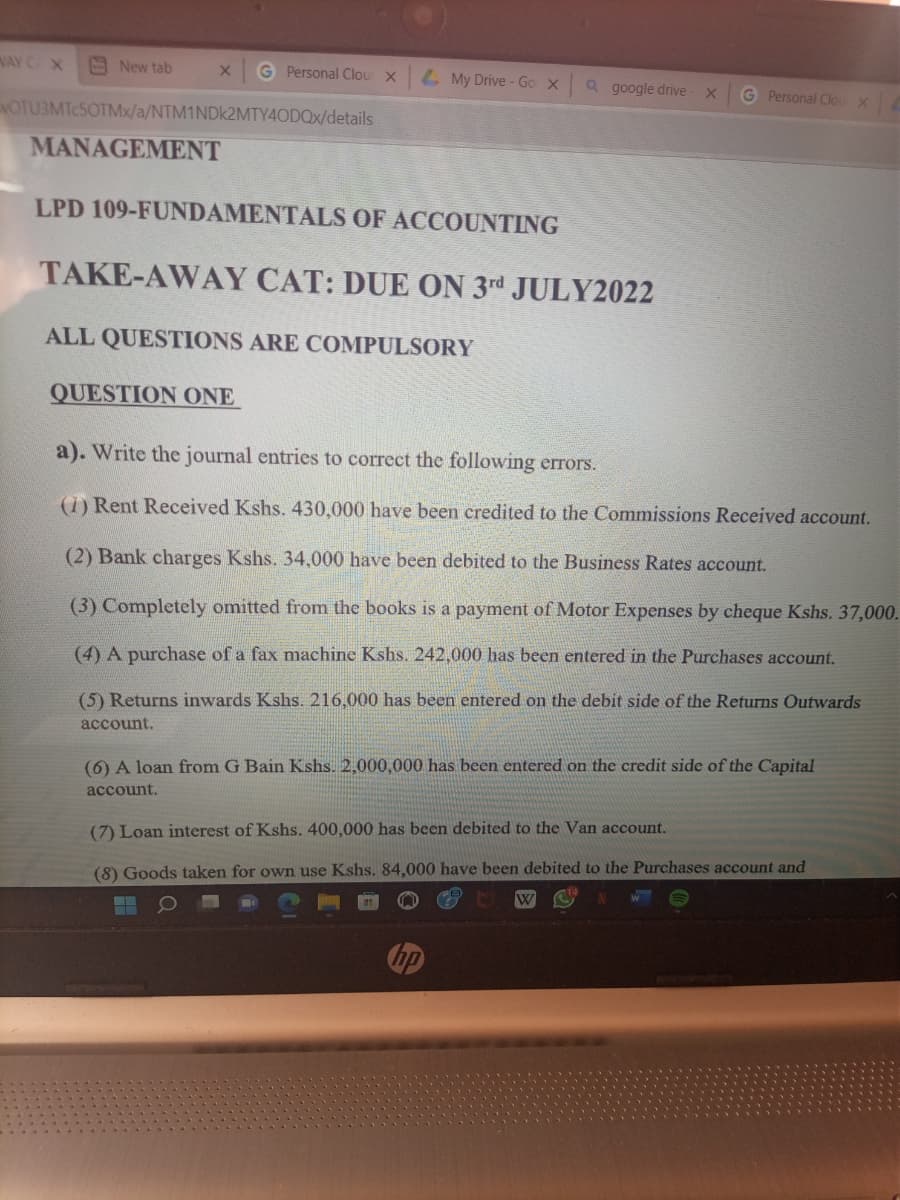

LPD 109-FUNDAMENTALS OF ACCOUNTING

TAKE-AWAY CAT: DUE ON 3rd JULY2022

ALL QUESTIONS ARE COMPULSORY

Q google drive x

G Personal Clou X

a). Write the journal entries to correct the following errors.

(1) Rent Received Kshs. 430,000 have been credited to the Commissions Received account.

(2) Bank charges Kshs. 34,000 have been debited to the Business Rates account.

(3) Completely omitted from the books is a payment of Motor Expenses by cheque Kshs. 37,000.

(4) A purchase of a fax machine Kshs. 242,000 has been entered in the Purchases account.

(5) Returns inwards Kshs. 216,000 has been entered on the debit side of the Returns Outwards

account.

(6) A loan from G Bain Kshs. 2,000,000 has been entered on the credit side of the Capital

account.

W

(7) Loan interest of Kshs. 400,000 has been debited to the Van account.

(8) Goods taken for own use Kshs. 84,000 have been debited to the Purchases account and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you