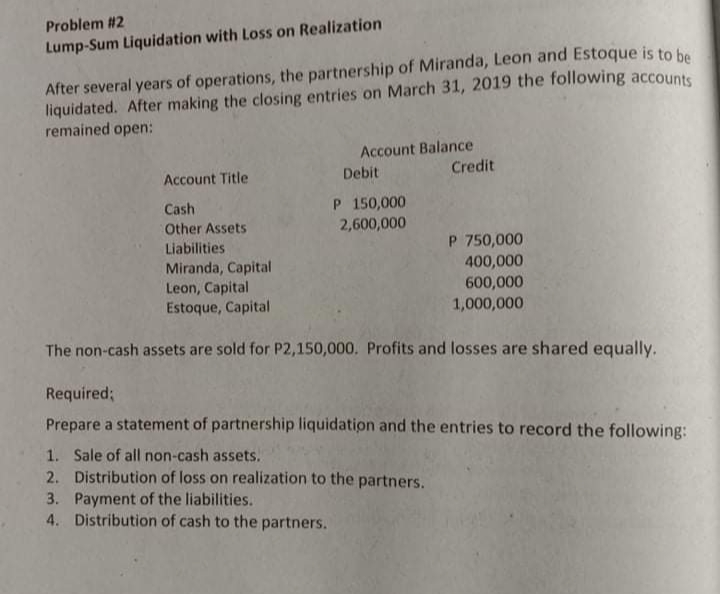

Required; Prepare a statement of partnership liquidation and the entries to record the following: 1. Sale of all non-cash assets. 2. Distribution of loss on realization to the partners. 3. Payment of the liabilities. 4. Distribution of cash to the partners.

Q: Choose the correct.Which of the following statements is true concerning the accounting for a…

A:

Q: Prepare a statement of partnership liquidation and the entries to record the following: 1. Sale of…

A: Partnership Liquidation:-It is the process in which assets get sold out, liabilities get paid off…

Q: 2. The cash settlement of all liabilities is referred to as realization. 1 1. Liquidation is the…

A: In case of interlinked question, as per bartleby guidelines answer first three only 1) When the…

Q: Mr. A who is a managing partner in charge with human resource collected the debt from Mr. C, his…

A: Partnership Deed: There are several types of partnership deeds, each with its own unique set of…

Q: In the absence of Partnership deed, specify the rules relating to the following :(i) Sharing of…

A: Partnership: This is the form of business entity which is formed by an agreement, owned and managed…

Q: In the installment liquidation of a partnership, each installment of cash is distributed: a) As if…

A: Liquidation of Partnership Firm: To dissolve a partnership firm is to stop doing business as that…

Q: Required: 1. Prepare a Statement of Partnership Liquidatfion 2. Prepare thejournal entries…

A: Step 1 Journal is the part of book keeping.

Q: In the liquidation of general partnership, which of the following claims shall be settled first by…

A: Partnership is an association between two or more than two partners. Liquidation of partnership…

Q: IDENTIFICATION: Another term for liquidation by total. A partner whose capital account balance is…

A: The question is related to Partnership Accounting. It deals with the identification.

Q: no need to explain. What is a cash priority program? a. A guideline for the cash distributions made…

A: At the time of liquidation of partnership business, there are some procedural steps that need to be…

Q: If a partnership is liquidated, how is the final allocation of business assets made to the partners?…

A: Partnership: This is the form of business entity that is formed by an agreement, owned and managed…

Q: On Dissolution of a partnership firm, the claims of the partners on their capital will be listed for…

A: Answer

Q: the assets of the partnership shall be applied lastly to

A: Liquidation of partnership firm takes place while turning down the business of the firm which…

Q: Which of the following statements is correct? Options: Each partner has the authority to enter…

A: The partnership is the business form that is owned ad controlled by two or more partners. When the…

Q: Enter problem statement, appropriate input type, and other instructions here. Elyn is the general…

A:

Q: Required: As the accountant for the partnership, compute the amount to be paid to Mrs. Cero under…

A: Partnership is a legal form of business registration favoring both small and medium entities to…

Q: 1. When a property other than Cash is invested in a partnership, at what amount should the noncash…

A: In the light of provisions of Partnership Act, When a property other than Cash is invested in a…

Q: What is a predistribution plan? A list of the procedures to be performed during a liquidation. A…

A: Predistribution Plan is a guide for the cash distributions to partners during a liquidation.

Q: partnership final accounts?

A: Correct Answer :- D Adjustments will have dual effects in the income statement and statement of…

Q: In the liquidation of a partnership it is important to (1) distribute cash to the partners, (2) sell…

A: Liquidation of partnership refers to winding up or ending of operations of a partnership or a…

Q: in a partnership liquidation , the accountant's primary responsibility is to manage the company in a…

A: A liquidation of a partnership is the process of paying off liabilities, selling assets, and…

Q: In a partnership liquidation, the final cash distribution to the partners should be made in…

A: Partnership: It can be defined as an agreement whereby two or more persons agree to conduct a…

Q: After C’s admission, the partners agreed to adjust their capital balances to reflect their’…

A:

Q: Question Bobby Donal and Bill Spader are discussing the liquidation of a partnership. Bobby…

A: Answer: No, Bobby is not Correct.

Q: Enter problem statement, appropriate input type, and other instructions here. Elyn is the general…

A: Partnership is a form of business; where two or more persons join hands to oversee business…

Q: Required: Prepare the final statement of partnership liquidation.

A: In case of liquidation of partnership business , all non cash assets are sold and the proceeds from…

Q: n of a limited liability partnership, a loan payable to a partner by the partnership is: a.…

A: Liquidation of a limited liability partnership means dissolution or discontinuance of partnership…

Q: Required: 1. Prepare the opening journal entries in the books of the partnership. 2. Prepare the…

A: A partnership is an agreement by two or more parties to operate a business and share profit.

Q: In preparing the schedule of safe payments, it is assumed that: a. all partners are solvent b. All…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: When a partner withdraws assets from a partnership that is considered as a permanent withdrawal, it…

A: Partnership is one of the form of business organisation under which two or more than two persons…

Q: In case of admission of a partner, the first adjustment that need to be prepared is?? A. Bank…

A: As per the guidelines, only one question is allowed to be answered. Please upload different…

Q: How are safe capital balances computed when preliminary distributions of cash are to be made in a…

A: Definition: Partnership: This is the form of business entity that is formed by an agreement, owned…

Q: Required Thetotalloss from the liquidation of the partnership Prepare the staternent ofliquidation.…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Just like Accounts Receivable being recorded at gross with the Allowance for Doubtful Accounts in…

A: Solution Concept The books of accounts of partnership such as statement of financial position has…

Q: Is a true or false question: 1) During a partnership liquidation, if a partner has a debit capital…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: In partnership liquidation the first cash distribution should be made for

A: Loan to bank is a Firm's outside liability, therefore, first cash distribution is payment of loan to…

Q: Prepare journal entries to record the transactions incurred in the liquidation of a partnership.

A: In a partnership, two or more parties agree to operate and manage a business and share the profits…

Q: Required: Prepare a statement of partnership liquidation and the entries to record the following: 1.…

A: Statement of liquidation is the statement by the partnership firm at the time of winding up of the…

Q: Answer if TRUE or FALSE. If the statement is FALSE provide at least a brief explanation why it's…

A: Partnership agreement: It is an agreement where business practices for the partners of a company…

Q: The admission of a new partner effected through purchase of interest in the partnership is…

A: The admission of a new partner effected through purchase of interest in the partnership is recorded…

Q: Which of the following is considered a "constructive receipt" of gross income? * a. A partner's…

A: Constructive receipt is an accounting word that refers to the requirement for an individual or…

Q: A partnership liquidation occurs when a. the assets are sold, liabilities paid, and business…

A: The partnership firm can continue to exist after retirement, admission or death of a partner.

Q: If the personal assets of the partners are exposed to the business debts, it is called? O a. Mutual…

A:

Q: For a partnership, which of the following account is not a current asset

A: Current assets are the assets that provide a financial benefit to the company in the future. It…

Q: In partnership liquidation the first cash distribution to the partner should be made in accordance…

A: Partnership is an agreement in which two or more than two persons invest capital, run business and…

Q: oncerning a partnership's Form 1065, llowing statements is not true? - The partnership balance sheet…

A: Answer: All taxable/deductible partnership income and expense items are reported on Form 1065,…

Q: Which two methods are used to add cash to partners in an installment liquidation. A The schedule of…

A: Ans. In the event of liquidation, assets are sold and liability is settled. Partners contribution is…

Q: When a partnership is liquidated, which of the following statements is FALSE? Non-cash assets are…

A: Partnership: It is an agreement between two or more individuals to share profit and losses of the…

Q: n a partnership liquidation, if a partner has a debit capital balance in his or her capital account,…

A: Partnership means where two or more person comes together to do some common business activity and…

Step by step

Solved in 3 steps with 3 images

- STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the partnership of Delco, Smith, and Walker is to be liquidated. After making closing entries on March 31, 20--, the following accounts remain Open. The noncash assets are sold for 165,000. Profits and losses are shared equally. REQUIRED 1. Prepare a statement of partnership liquidation for the period April 115, 20--, showing the following: (a) The sale of noncash assets on April 1 (b) The allocation of any gain or loss to the partners on April 1 (c) The payment of the liabilities on April 12 (d) The distribution of cash to the partners on April 15 2. Journalize these four transactions in a general journal.Problem #2 Lump-Sum Liquidation with Loss on Realization After several years of operations, the partnership of Concepcion, Macabata and Pedroso is to be liquidated. After making closing entries on March 31, 2011 the following accounts remained open: Account Balance Account Title Debit Credit Cash P 150,000 Non-cash Assets 2,600,000 Liabilities P 750,000 Concepcion, Capital 400,000 Macabata, Capital 600,000 Pedroso, Capital 1,000,000 The non-cash assets are sold for P2,150,000. Profits and losses are shared equally. Required: Prepare a statement of partnership liquidation and the entries to record the following: 1. Sale of all non-cash assets. 2. Distribution of loss on realization to the partners. 3. Payment of the liabilities. 4. Distribution of cash to the partners.Problem #1 Lump-Sum liquidation with Gain on Realization After several years of operations, the partnership of Arenas, Dulay and Laurente is to be liquidated. After making the closing entries on June 30, 2011, the following accounts remained open: Account Balance Account Title Debit Credit Cash P 50,000 Non-cash Assets 2,350,000 Liabilities P 400,000 Arenas, Capital 900,000 Dulay, Capital 500,000 Laurente, Capital 600,000 The non-cash assets are sold for P2,650,000. Profits and losses are shared equally. Required: Prepare a statement of partnership liquidation and entries to record the following: 1. Sale of all non-cash assets. 2. Distribution of gain on realization to the partners. 3. Payment of the liabilities. 4. Distribution of cash to the partners.

- F. The partnership of Anthony and Davis had an unprofitable year and agreed to liquidate their business on December 31, 2019. The Statement of Financial Position as of December 31, 2019 is presented below: A S S E T S Cash P 1,000 Accounts Receivable P 80,000 Less Allowance for Bad Debts 20,000 60,000 Merchandise Inventory 50,000 Prepaid Advertising 2,000 Office Equipment P 100,000 Less Accumulated Depreciation 60,000 40.000 TOTAL ASSETS P 153,000 LIABILITIES AND EQUITY Accounts Payable P 20,000 Notes Payable (due October 31, 2020) 86,000 Anthony, Capital 30,000 Davis, Capital 17,000 TOTAL…The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash $ 37,000 Liabilities $ 49,000 Noncash assets 209,000 Drysdale, loan 12,500 Drysdale, capital (50%) 71,500 Koufax, capital (30%) 61,500 Marichal, capital (20%) 51,500 a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be $16,000. Prepare a predistribution schedule to guide the distribution of cash. Further, modify the tags in explanation as well. b. Assume that assets costing $75,000 are sold for $60,500. How is the available cash to be divided?Part C Part C (2021 and 2022) The trial balance of A, B, and D at December 31, 2021 after all adjustments have been made is as follows: Adjusted Balances Account Title Debit Credit Cash 83,000 Other Assets 80,000 Accounts Payable 140,000 A, Capital 7,000 B, Capital 7,000 C, Capital 9,000 163,000 163,000 On January 1, 2022 the partnership is liquidated. Other assets are sold for: $ 144,000 Gains and losses are liquidated in a ratio of: A 3 B 2 D 5 Required 6 Print out the "Part. Liqu." page (see tab below). Complete the schedule. Assume any partner deficiency (debit balance) is repaid with cash by the applicable partner. 7 Prepare the…

- XYZ Partnership begins the liquidation process with the following balance sheet and profit and loss percentages: Cash 280,000 Noncash Assets 300,000 Liabilities 200,000 X Capital (40%) 100,000 Y Capital (30%) 150,000 Z Capital (30%) 130,000 Liquidation expenses are estimated at $50,000. Assume any deficit in a partner’s capital balance will not be repaid. How much is the safe payment that can be made to partner Z (hint: prepare a proposed schedule of liquidation). a. $0 b. $15,000 This is the ans c. $25,000 d. $10,000 i got this e. $5,000Use the following information for the next two questions: Farewell Partnership is undergoing liquidation. Information on Farewell follows: Cash 40,000 Accounts receivable 180,000 Receivable from B 10,000 Inventory 160,000 Equipment 310,000 Total 700,000 Accrued liabilities 250,000 Payable to A 20,000 A, Capital (60%) 240,000 B, Capital (40%) 190,000 Total 700,000 Case #1: Lump-sum liquidation Information on the conversion of non-cash assets is as follows: Only 60% of the accounts receivable was collected; the balance is uncollectible. ₱50,000 was received for the entire inventory. The equipment was sold at its carrying amount. ₱10,000 Liquidation expenses were paid. Requirement: Determine the amounts of cash distributed to the partners in the final settlement of their capital…On January 1, 2018, ACJ Partnership entered into liquidation. The partners' profit and loss ratios and capital balances on this date were as follows: A (25%) P2,500,000 C (35%) P5,400,000 J (40%) P3,700,000 The partnership has liabilities amounting to P4,400,000, including a loan from C in the amount of P600,000. Cash on hand before the start of liquidation is P800,000. Non-cash assets amounting to P7,400,000 were sold at book value and the remainder of non-cash assets were sold at a loss of P4,200,000. How much cash will be distributed to the partners?

- 11 On January 1, 2017, ACJ Partnership entered into liquidation. The partners’ capital balances on this date were as follows: A (25%) P2,500,000 ; C (35%) P5,400,000 ; J (40%) P3,700,000. The partnership has liabilities amounting to P4,400,000, including a loan from C P600,000. Cash on hand before the start of liquidation is P800,000. Noncash assets amounting to P7,400,000 were sold at book value and the rest of the noncash assets were sold at a loss of P4,200,000. 1. How much cash will be distributed to the partners? Group of answer choices 7,400,000 11,800,000 8,000,000 4,400,000 2. After exhausting the noncash assets of the partnership, assuming all partners has personal assets more than their personal liabilities. How much cash must be invested by the partners to satisfy the claims of the outside creditors and to pay the amount due to the partner/s? Group of answer choices 3,800,000 4,360,000 4,480,000 3,680,000Partners Arias, Bobadilla and Briones share profits and losses 50:30:20, respectively. The statement of financial position at April 30, 2019 follows: Cash P 40,000 Accounts Payable P100,000 Other Assets 360,000 Arias, Capital 74,000 Bobadilla, Capital 130,000 Briones, Capital 96,000 Total 400,000 Total P400,000 The assets and liabilities are recorded and presented at their respective fair values. Banzon is to be admitted as a new partner with a 20% capital interest and a 20% share of profits and losses in exchange for a cash contribution. No goodwill or bonus is to be…A. The Abrams, Bartle, and Creighton partnership began the process of liquidation with thefollowing balance sheet: Cash $16,00 Non cash Assets $434,000 Liabilities $150,000 Abrams Capital $80,000 Bartle Capital $90,000 Creighton Capital $130,000 Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000.1. If the non-cash assets were sold for $234,000, what amount of the loss would have been allocated to Bartle?2. If the non-cash assets were sold for $134,000, which partner(s) would have had to contribute assets to the partnership to cover a deficit in his/her capital account?3. After the liquidation expenses of $12,000 were paid and the non-cash assets sold, Creighton had a deficit of $8,000. For what amount were the non-cash assets sold?