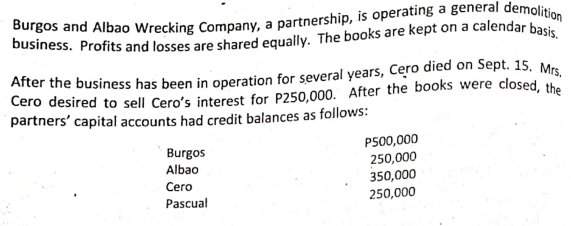

Required: As the accountant for the partnership, compute the amount to be paid to Mrs. Cero under the agreement and prepare the journal entry required to enter the check issued to her in payment of the deceased husband's interest in the partnership. According to the partnership agreement, the difference between the amount paid to Mrs. Cero and the book value of Cero's capital account is allocated to the remaining partners based on their ending capital balances.

Q: Prepare a statement of partnership liquidation and the entries to record the following: 1. Sale of…

A: Partnership Liquidation:-It is the process in which assets get sold out, liabilities get paid off…

Q: Prior to the creation of a partnership, the sole proprietor must first re-evaluate or adjust its…

A: Re-evaluation or Adjustment in Assets or Liability: To determine whether or not there was a net gain…

Q: Which of the following statements about partnerships is true? Group of answer choices a)Partnerships…

A: Partnership is an agreement between two or more persons who invest capitals, run business and then…

Q: Mr. A who is a managing partner in charge with human resource collected the debt from Mr. C, his…

A: Partnership Deed: There are several types of partnership deeds, each with its own unique set of…

Q: In the installment liquidation of a partnership, each installment of cash is distributed: a) As if…

A: Liquidation of Partnership Firm: To dissolve a partnership firm is to stop doing business as that…

Q: a. What is the partnership's and each partner's gain or loss recognized on the formation of the…

A: A partnership is a firm where 2 or more individuals run a firm by being a partner in it. All the…

Q: debit balance on his capital

A: In partnership there are two Types of Method of maintaining capital Account FIXED CAPITAL ACCOUNT…

Q: Closing entries of a partnership include entries to

A: The answer for the multiple choice question and relevant explanation are presented hereunder :…

Q: Two individuals who were previously sole proprietors formed a partnership. Property other than cash…

A: Solution : Two individuals who were previously sole proprietors formed a partnership. Property other…

Q: In

A: Liquidation of partnership means all the assets of partnership are realised and liabilities are paid…

Q: Prepare a Statement of Partnership Liquidation and the entries to record the following: 1. Sale of…

A: Partnership liquidation Statement: It is a statement showing the closure of capital A/Cs of partners…

Q: 1. Which of the following statements concerning partnership is true? a. A partnership is a legal…

A: Hi student Since there are multiple questions, we will answer only first question

Q: If a partnership is liquidated, how is the final allocation of business assets made to the partners?…

A: Partnership: This is the form of business entity that is formed by an agreement, owned and managed…

Q: Enter problem statement, appropriate input type, and other instructions here. Elyn is the general…

A:

Q: 1. When a property other than Cash is invested in a partnership, at what amount should the noncash…

A: In the light of provisions of Partnership Act, When a property other than Cash is invested in a…

Q: Two individuals who were previously sole proprietors formed a partnership. Property other than cash…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Required: 1. Prepare the journal entries for the following: a. To close the books of Amos'…

A: Partnership means a group of persons who come together with a purpose to control and manage the…

Q: Which of the following is NOT considered a legitimate expense of a partnership business? Interest…

A: Partnership is the form of business entity whereby two or more individuals together run a business.…

Q: Which of the following IS an allowable deduction for partnerships? Select one: Superannuation…

A: Allowable deductions are described as those payments or expenses that can be deducted from the…

Q: Enter problem statement, appropriate input type, and other instructions here. Elyn is the general…

A: Partnership is a form of business; where two or more persons join hands to oversee business…

Q: When a partner withdraws assets from a partnership that is considered as a permanent withdrawal, it…

A: Partnership is one of the form of business organisation under which two or more than two persons…

Q: Which one of the following will be recorded in the statement of financial position of the…

A: A statement of financial position is a document that is widely used to examine a company's financial…

Q: In case of admission of a partner, the first adjustment that need to be prepared is?? A. Bank…

A: As per the guidelines, only one question is allowed to be answered. Please upload different…

Q: Which statement is CORRECT? Select one: A. Partners' salary is an allowable expenses B. Tax…

A: Following is correct

Q: Required A. Orange believes the partnership will receive at least $80,000 for the noncash assets.…

A:

Q: Required; Prepare a statement of partnership liquidation and the entries to record the following: 1.…

A: Partnership refers to an agreement between 1 or more people to operate a business together and share…

Q: Refer to Problem 1: If Pete pays P4,200 for 4 of the interest of Tan, and the deficiency in the…

A: Partnership: A form of organization formed by legal agreement between two or more persons for…

Q: Which of the following statements is correct with regard to drawing accounts that may be used by a…

A: A partnership is an association or agreement between two or more than two persons. Partners can also…

Q: K. Kolmer, C. Eidman, and C. Ryno share income on a 5:3:2 basis. They have capital balances of $…

A: The question is based on the concept of Journal Entries. As per the Bartleby guidelines we are…

Q: Under what circumstances can the closing of the income summary account result in a debit to one…

A: Solution: The closing of the income summary account result in a debit to one partners’ capital…

Q: Journalize the entries in the partnership accounts for (a) Barton's investment and (b) Fallows's…

A: The Value to be Considered for the partners bringing different assets will depend on what is agreed…

Q: When two or more sole proprietors form a partnership, the following are correct, except When a…

A: Partnership is one of the agreement or arrangement between two or more than two persons, in which…

Q: What is the proper disposition of a partnership loan that was made from a partner who has a debit…

A: As per the liquidation of a partnership firm, if there is a partner who has the debit capital…

Q: Required: 1. Prepare the journal entry(s) for the admission of Fran to the partnership assuming Fran…

A: 1) Date Particulars Debit Amount Credit Amount 1 Goodwill a/c $400,000 To D's Capital…

Q: If a new partner purchases his interest from an old partner, the only entry on the partnership books…

A: A partnership firm business is a business where two or more people agree to start a business to…

Q: In the liquidation of a partnership, a loan from a partner a. Will be paid off at the same time as…

A: Partnership characteristics includes: Existence of an agreement Existence of business Sharing of…

Q: Answer the following questions regarding a partner's capital account. a. What is a partner's…

A: a. (Note: The missing words in the question above have been answered here) A partner's capital…

Q: Required: Prepare a statement of partnership liquidation and the entries to record the following: 1.…

A: Statement of liquidation is the statement by the partnership firm at the time of winding up of the…

Q: Which of the following is an election or calculation made by the partner rather than the…

A: Partnership is one of the forms of business organizations wherein two or more than two persons work…

Q: The admission of a new partner effected through purchase of interest in the partnership is…

A: The admission of a new partner effected through purchase of interest in the partnership is recorded…

Q: Which of the following is considered a "constructive receipt" of gross income? * a. A partner's…

A: Constructive receipt is an accounting word that refers to the requirement for an individual or…

Q: REQUIRED: For the year ended 31st October 2012, prepare profit and loss appropriation statement for…

A:

Q: YOU ARE REQUIRED TO: 1. Prepare the entries in the General journal to record the events described…

A: Robert and Donald are partners sharing partnership profits and losses in the ratio of 3:2. They…

Q: What is June's capital balance just after the formation? What is the amount of the total current…

A: Partnership is the business which is started by the partners and to start there must be a minimum of…

Q: Capital account

A: Each partner has a claim on partnership assets based on his/her. D. CAPITAL ACCOUNT.

Q: Neil has a partnership basis of $100,000 and receives $40,000 of cash, inventory with a basis to the…

A: Partnership can be defined as the form of business in which two or more people come together to earn…

Q: on the 4. Partnership Activities. (Obj. 2) Indicate how each of the following items is reported…

A: Partnership taxable income is the one which is to be paid by the partners as per the percentage…

Q: oncerning a partnership's Form 1065, llowing statements is not true? - The partnership balance sheet…

A: Answer: All taxable/deductible partnership income and expense items are reported on Form 1065,…

Q: Which of the following statements is correct when a new partner is admitted to an existing…

A: Solution: The correct statement when a new partner is admitted to an existing partnership by…

Required:

As the accountant for the

Step by step

Solved in 2 steps with 2 images

- The capital balances of the partners are presented to you before the retirement of Y: X, P40,000; Y, P35,000; Z, P25,000. P/L ratio, equally. After the retirement of Y, the capital balance of X was P42,000. How much was the cash settlement to Y? A. P31,000 B. P33,000 C. P37,000 D. P39,000Doy, Rey, May, and Fay are partners with capitals of P 22,000, P 20,600, P 27,400, and P 18,000 respectively. Doy has a loan balance of P 4,000. Profits and losses are shared 40%; 30%; 20%; 10% by Doy, Rey, May, and Fay respectively. Assuming assets were sold and liabilities paid and the balance of cash showed P 24,000. Prepare a schedule showing how the P 24,000 will be distributed to the partners.AA and BB are partners engaged in a manufacturing business. Transactions affecting the partners’ capital accounts in 2022 are as follows: AA BB Debit Credit Debit Credit Beg. Balance P250,000 P350,000 April 1 150,000 100,000 June 30 125,000 250,000 September 1 225,000 300,000 October 1 350,000 200,000 The income summary has a debit balance of P225,000. Agreement between AA and BB are as follows: Interest on average capital at 8%. Salaries of P125,000 and P175,000 are given to AA and BB, respectively. Bonus to BB at 25% of net income after deducting interest and salaries but before deducting bonus. Balance is to be divided equally. How much is the net increase (decrease) in BB’s capital account in 2022?

- Partners WAG, MAG, PANG, and GAP, shares profits at the ratio 5:3:1:1. OnJune 30, relevant partners’ accounts follow: Advances Loans Capital Dr. Cr. Cr. WAG 20,000 160,000MAG 40,000 120,000PANG 18,000 60,000GAP 10,000 100,000On this day, cash of P72,000 is declared as available for distribution topartners as profits.How much will partner Gap receive from the 72,000 if he has a hare in it?On November 10, 2020, Maher, Saher, and Taher, partners of Maher, Saher, & Taher LLP, had capital account balances of $40,000, $50,000, and $18,000, respectively, and shared net income and losses in a 4 : 2 : 1 ratio respectively. the Capital per unit of income sharing ratio for Maher would be: a. $40,000. b. $10,000. c. $20,000. d. $25,000.A partner had a debit balance on his current account of $1600 on 1 January 2009. On 31 December 2009 the following amounts were entered in the partner’s current account: interest on capital $500 share of profit $4000 What was the balance on the partner’s current account on 1 January 2010? A credit $1900 B credit $2900 C debit $5100 D debit $6100

- Partners WAG, MAG, PANG, and GAP, shares profits at the ratio 5:3:1:1. OnJune 30, relevant partners’ accounts follow: Advances Loans Capital Dr. Cr. Cr. WAG 20,000 160,000MAG 40,000 120,000PANG 18,000 60,000GAP 10,000 100,000 On this day, cash of P72,000 is declared as available for distribution topartners as profits. How much will partner Gap receive from the 72,000 if he has a hare in it?Partners Biore and Selishana each have P450,000 capital balance and share profits and losses in a 3:2 ratio. Cash equals P150,000, non-cash assets equal P1,500,000 and liabilities equal P750,000. If non-cash assets are sold for P1,000,000, the change in Selishana's capital account will be:The balance sheet for Coney, Honey, and Money partnership shows the following information as of December 31, 2015;Cash P 40,000 Liabilities P 100,000Other assets 560,000 Coney, loan 50,000 Coney, capital 250,000 Honey, capital 140,000 Money, capital 60,000 P 600,000 P 600,000Profit and loss ratio is 3:2:1 for Coney, Honey, and Money, respectively. Other assets were realized as follows:Date Cash Received Book ValueJanuary 2016 P 120,000 P 180,000February 2016 70,000 154,000March 2016 250,000…

- The following debit (credit) balances on the account of SAM Partnership are as follows: Sucrose, Capital (P1,000,000) Albedo, Capital ( 1,200,000) Mona, Capital ( 800,000) Sucrose, Loan 100,000 Albedo, Loan 300,000 Mona, Loan ( 100,000) Sucrose, Albedo and Mona currently allocate their profits and losses based on the ratio of 3:4:3, respectively. With the consent of the remaining partners, Albedo decided to retire from the partnership by selling 75% of his capital to…The capital balances of the partners are presented to you before the retirement of X: X, P50,000; Y, P45,000; Z, P35,000. P/L ratio, equally. After the retirement of X, the capital balance of Z was P34,000. How much is the total capital after the retirement of X? A. P48,000 B. P80,000 C. P78,000 D. P52,000 The capital balances of the partners are presented to you before the retirement of Z: X, P60,000; Y, P55,000; Z, P45,000. P/L ratio, equally. After the retirement of Z, the capital balance of X was P57,500. How much is the capital of Y after the retirement of Z? A. P55,000 B. P57,500 C. P52,500 D. P115,00057 On December 31, 20x20, the Statement of Financial Position of ABC Partnership with profit or loss ratio of 6:1:3 of partners A, B and C respectively, revealed the following data: Cash P1,000,000 Other liabilities P2,000,000 Receivable from A 500,000 Payable to B 1,000,000 Other noncash assets 2,000,000 Payable to C 100,000 A, Capital 700,000 B, Capital (650,000) C, Capital 350,000 On January 1, 20x21, the partners decided to liquidate the partnership. All partners are legally declared to be personally insolvent. The other noncash assets are sold for P1,500,000. Liquidation expenses amounting to P100,000 were incurred. How much cash was received by C at the end of partnership liquidation?