Required: 1. Prepare a Statement of Partnership Liquidatfion 2. Prepare thejournal entries torecordthe liquidation of the partnership

Required: 1. Prepare a Statement of Partnership Liquidatfion 2. Prepare thejournal entries torecordthe liquidation of the partnership

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 42P

Related questions

Question

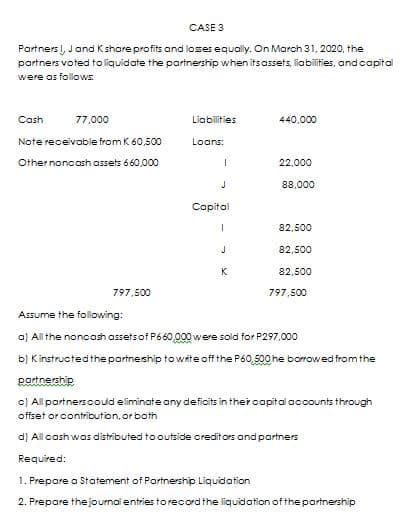

Transcribed Image Text:CASE 3

Partners), Jand K share profits and loses equally. On March 31, 2020, the

partners voted toliquidate the partnership when itsassets, liabilities, andcapital

were as follows:

Cash

77.000

Liabilities

440,000

Note receivable from K 60,500

Loans:

Other noncash assets 660,000

22,000

88,000

Capital

82,500

82,500

K

82,500

797,500

797,500

Assume the following:

a) All the noncash assetsof P660,000 were sold for P297,000

b) Kinstructedthe partneship to wite off the P60,500 he borrowed from the

Rartnership

c) All partnerscoud eliminate any deficits in ther capital accounts through

offset or contribution, or both

d) All cash was distributed to outside creditors and partners

Required:

1. Prepare a Statement of Partnership Liquidation

2. Prepare thejournal entries torecordthe liquidation of the partnership

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College