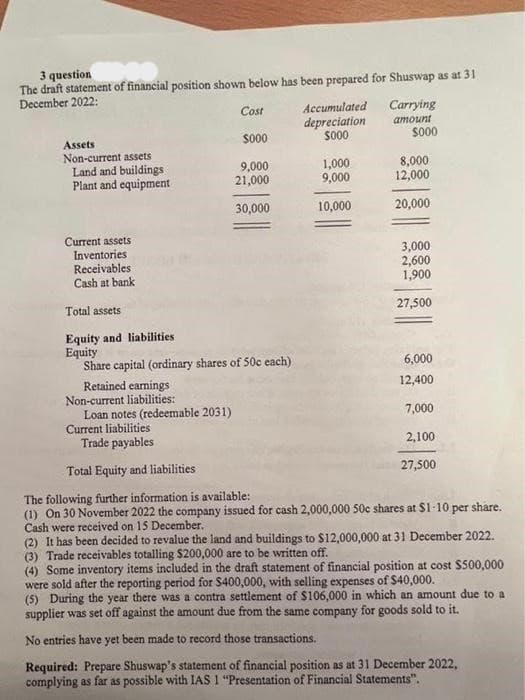

Required: Prepare Shuswap's statement of financial position as at 31 December 2022, complying as far as possible with IAS 1 "Presentation of Financial Statements".

Q: fixed costs

A: The break-even point in business, specifically cost accounting means the point at which total…

Q: income tax payable for 2034 assuming the use of SCIT

A: FIRB: which simply means fiscal incentives, Review Board. Jackie company is a company that comes…

Q: Swifty Limited reported the following for 2023: sales revenue, $920,000; cost of sales, $742,000;…

A: Answer:- Statement of stockholder's equity meaning:- An accounting document that is included in a…

Q: LO.1, 8 Compute the taxable income for 2020 for Emily on the basis of the following information. Her…

A: The processes used to produce tax assets and liabilities in an individual's or a business's…

Q: Pharoah, Inc. began work on a $6,909,000 contract in 2025 to construct an office building. During…

A: Under percentage of completion method, revenue is recognised over the terms of the contract on the…

Q: Question: In calculating depreciation, the number of years of useful life of the asset is: 1. an…

A: Depreciation Expense - Depreciation is calculated on the fixed assets of the company. It is charged…

Q: Teeswater Corp. shows the following information on its 2020 statement of comprehensive income: sales…

A: Operating Cash Flow :— It is the cash generated from operation of business. Earning Before…

Q: Following are the current asset and current liability sections of the balance sheets for Freedom…

A: Current ratio identifies the ability of the company to use its liquidity to pay off its short term…

Q: Prepare Bridgeport's journal entries to record (a) the sale on July 10, 2020, and (b) $78,200 of…

A: In the normal course of business, customers can return the goods sold, if the goods are not as per…

Q: Suppose 1 year T Bills currently yield 7.00% and the future inflation rate is expected to be…

A: INTRODUCTION: The rate at which prices for goods and services grow is known as inflation.…

Q: Complete the cash flow statement using the indirect method on the template provided.

A: `Solution Calculated the Cash flow statement of ICY Company under the Indirect Method…

Q: Song earns $118,000 taxable income as an interior designer and is taxed at an average rate of 20…

A: Working : Calculation of Income tax if Song only earns $88,500 : Income Tax = $88,500 x 25% Income…

Q: Serena is a 48-year-old single taxpayer. She operates a small business on the side as a sole…

A: Health insurance refers to insurance whose motive is to cover the medical expenses arising from the…

Q: b. Compute the AGI on their joint return if AGI before an IRA deduction is $204,100.

A: INTRODUCTION: The adjusted gross income (AGI), which differs from your gross income because it takes…

Q: Key comparative figures for Apple, Google, and Samsung follow. Samsung In millions Total liabilities…

A: Debt Ratio. Formula Debt Ratio = Total Liabilities ÷ Total Assets x 100

Q: what is the annual income?

A: In any investment decision, person have to consider the total cost and total income which is going…

Q: Monitoring internal control systems is the primary responsibility of the: A) Internal Auditors B)…

A: Internal controls are those controls and measures which are implemented for the purpose of effective…

Q: For the following treasury bill bought in 2007, find (a) the price of the T-bill, and (b) the actual…

A: Treasury Bills: Treasury bills are the borrowing instrument of the money market used by the…

Q: Malibu Inc. reported the following (in millions) on its year-end balance sheet: Total liabilities…

A: Non-owner finance is money provided to a firm in exchange for anything like a guaranteed payback,…

Q: Consolidated financial statements are required by GAAP in certain circumstances. This information…

A: Consolidated financial statements are statements prepared by parent company . Parent company is a…

Q: On what should the governmental fund financial statements report? Multiple Choice Cost of…

A: The governmental funds balance sheet states the first assets of the government, resources it…

Q: The Stationery Company purchased merchandise on account from a supplier for $14,500, terms 2/10,…

A: Merchandise refers to the stock which is purchased for the purpose of re-sell only. Sometimes…

Q: What is an “indemnification asset”? How do we account for it? Please use your own words and do…

A: An "indemnification asset" is an asset that is established to cover a potential future loss or…

Q: Arizona Desert Homes (ADH) constructed a new subdivision during 2023 and 2024 under contract with…

A: In the books of Arizona Desert Homes (ADH) Journal entry in 2024 to record revenue Date Account…

Q: The following amounts were reported by the two companies: Raiden Inc. Nash Company Net Income Total…

A: Working : Formula for Net profit margin (%) = (Net Income / Total revenue) x 100

Q: Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8…

A: Depreciation methods The accounting techniques applied to compute the reduction value of assets are…

Q: Prepare an Income Statement Budget and a Cash budget for February 2023.

A: Budget is an estimation which helps an organization in planning its production and revenue.

Q: Payroll. Lorna Chavez is a line manager of Sunday Machine Works and is receiving a monthly salary of…

A: Taxable Income The Philippines levies taxable income on its nationals living abroad. No matter if…

Q: Lightfoot Inc., a software development firm, has stock outstanding as follows: 20,000 shares of…

A: DIVIDEND DISTRIBUTION A dividend is a distribution of profits by a corporation to its…

Q: You sold short 200 shares of META at $130 per share. You put up additional $13,000 to meet the 50%…

A: Each share issued by a corporation that is publicly traded has a fixed price. The cost of a share of…

Q: linear cost function

A: A linear cost function is actually a mathematical method used to figure out the total costs of a…

Q: Determine the amount of the child tax credit in each of the following cases: a. A single parent with…

A: All of the 2021 additions have been eliminated, and the regulations are now back to what they were…

Q: AZCO purchased an item for $695 less 30% and 20%, and marked it up 125% of cost. During a special…

A: Profit Markup: Profit markup is the percentage that a company decides to set the selling price of…

Q: On Dec. 20, X-Mart returned $100 of defective merchandise to its supplier. Demonstrate the required…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources),…

A: The service department costs are allocated to operating departments using various methods as direct,…

Q: Hawthorn Industries is calculating its Cost of Goods Manufactured at year-end. The company's…

A: Cost of goods manufactured - Cost of Goods Manufactured is the total cost incurred for manufactured…

Q: Eclipse Berhad Eclipse Berhad Income Statement as of 31 December 2022 Sales revenue Purchases…

A: Net after-tax earnings less any possible preferred dividends are the earnings that are available to…

Q: Dine-Corp International publishes ratings and reviews of the world's finest restaurants. Following…

A: 1. Balance per company records at end of the month $72,644.12 Less: Bank service…

Q: Refer to the information in Exercise 1-3 about Mixon Company. The company's income state ments for…

A: Ratio analysis allows the business organization to compare one firm to another within the same…

Q: Rock Bridge Corporation bought the entire Solar Energy Corporation for $1,200,000 Cash. The fair…

A: Consolidation As per the consolidation rule when parents gets full/partial control over the…

Q: Round up to two decimal places b. If an item was $3,000 in 2010, how much was it worth in 2015? I…

A: Consumer Price Index can be used for two period to know the real value of an item in the past in…

Q: The FASB requires that not-for-profits show the relationship of functional expenses to natural…

A: Not for profit entities represent the entities which does not operate its business operation with a…

Q: what do students learn in accoutning and how is it beneficial in the future.

A: Accounting is the process of recording and analyzing financial transactions. It is a crucial…

Q: Firm E must choose between two alternative transactions. Transaction 1 requires a $9,150 cash outlay…

A: After tax cost refers to the amount that will be deductable from revenue after appliying tax rate to…

Q: EXERCISE 1-6 use the two attachments provided to Compare the long-term risk and capital structure…

A: Formula : Total Debt Ratio = Total Debt/Total Assets 2006 2007 2008 Accounts…

Q: Required information [The following information applies to the questions displayed below.] Camille…

A: Taxable income refers to the income on which tax is to be paid by an individual or corporation to…

Q: Information for 2023 follows for Sheffield Corp.: Retained earnings, January 1, 2023 Sales revenue…

A: Multiple-step income statement: It is a type of income statement in which all income and expenses…

Q: The information necessary for preparing the December 31, 2024, year-end adjusting entries for Vito's…

A: An adjusting entry is a change you make to your books to better match your revenue and spending…

Q: The cost of goods sold computations for Sheridan Company and Windsor Company are shown below.…

A: Inventory turnover ratio also commonly referred to as stock turnover ratio indicates the extent to…

Q: [The following information applies to the questions displayed below.] In the current year, Randa…

A: Income statement is prepared by the business organizations so as to know how much amount of gross…

dont give answer in image format

Step by step

Solved in 2 steps

- Comparative Analysis: Under Armour, Inc., versus Columbia Sportswear Refer to the 10-K reports of Under Armour, Inc., and Columbia Sportswear that are available for download from the companion website at CengageBrain.com. Required: Are debt and equity likely to be available as inflows of cash in the near future?Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Investments in Equity Securities Noonan Corporation prepares quarterly financial statements and invests its excess funds in marketable securities. At the end of 2018, Noonans portfolio of investments consisted of the following equity securities: Dunne the first half of 2019, Noonan engaged in the following investment transactions: Required: 1. Record Noonans investment transactions for January 6 through June 30, 2019. 2. Show the items of income or loss from investment transactions that Noonan reports for each of the first and second quarters of 2019. 3. Show how the preceding items are reported on the first and second quarter 2019 ending balance sheets, assuming that management expects to dispose of the Keene and Sachs securities within the next year.

- 3. Following information is available in respect of A LtdParticulars As on 31.3.2019(Rupees. In Lacs)As on 31.3.2020(Rupees. In Lacs)Investment in FinancialAssets- 100Equity Share Capital 150 160Long term Loans taken 100 200Dividend paid - 26Dividend received - 10Interest received - 15a. Prepare the cash flow from financing activities from the above information and givereasons for each element whether these elements belongs to financing activities or not. b. Calculate the relationship between the debt and equity for the year 2019 and 2020, andcomment3. Following information is available in respect of A LtdParticulars As on 31.3.2019(Rupees. In Lacs)As on 31.3.2020(Rupees. In Lacs)Investment in Financial Assets - 100Equity Share Capital 150 160Long term Loans taken 100 200Dividend paid - 26Dividend received - 10Interest received - 15a. Prepare the cash flow from financing activities from the above information and give reasons for each element whether these elements belongs to financing activities or notReference is made to the 2022 Balance Sheet of Tram-Ropes limited.Tram-Ropes Limited Balance Sheet 2022Cash 1,000,000.00 Accounts Payable 8,000,000.00Acc. Receivable 12,000,000.00 Notes Payable 8,500,000.00Marketable securities 3,000,000.00 Long-term Debt 20,000,000.00Inventories 7,500,000.00 Common stock 7,500,000.00Fixed Assets 26,500,000.00 Preferred Stock 6,000,000.00Total Assets 50,000,000.00 Total Liabilities and Equity 50,000,000.00Additional Information:i. The Long-Term debt consists of 8% annual coupon bonds, with15 years to maturity and are currently selling for 95% ofpar.ii. The company’s common shares which have a book value of $20per share are currently selling at $25 per share.PREPARED BY THE CI, MGMT2023 4iii. Preferred shares have a book value of $100 per share. Theseshares are currently selling at $120 per share and paysdividends of 6% per annum on book value.iv. The dividend growth rate is expected to be 3%, and dividendfor 2023 is projected to be $5.00 per…

- Reference is made to the 2022 Balance Sheet of Tram-Ropes limited. Tram-Ropes Limited Balance Sheet 2022 Cash 1,000,000.00 Accounts Payable 8,000,000.00 Acc. Receivable 12,000,000.00 Notes Payable 8,500,000.00 Marketable securities 3,000,000.00 Long-term Debt 20,000,000.00 Inventories 7,500,000.00 Common stock 7,500,000.00 Fixed Assets 26,500,000.00 Preferred Stock 6,000,000.00 Total Assets 50,000,000.00 Total Liabilities and Equity 50,000,000.00 Additional Information: The Long-Term debt consists of 8% annual coupon bonds, with 15 years to maturity and are currently selling for 95% of par. The company’s common shares which have a book value of $20 per share are currently selling at $25 per share. Preferred shares have a book value of $100 per share. These shares are currently selling at $120 per share and pays…Reference is made to the 2022 Balance Sheet of Tram-Ropes limited. Tram-Ropes Limited Balance Sheet 2022 Cash 1,000,000.00 Accounts Payable 8,000,000.00 Acc. Receivable 12,000,000.00 Notes Payable 8,500,000.00 Marketable securities 3,000,000.00 Long-term Debt 20,000,000.00 Inventories 7,500,000.00 Common stock 7,500,000.00 Fixed Assets 26,500,000.00 Preferred Stock 6,000,000.00 Total Assets 50,000,000.00 Total Liabilities and Equity 50,000,000.00 Additional Information: The Long-Term debt consists of 8% annual coupon bonds, with 15 years to maturity and are currently selling for 95% of par. The company’s common shares which have a book value of $20 per share are currently selling at $25 per share. Preferred shares have a book value of $100 per share. These shares are currently selling at $120 per share and pays…27. Presented below are data taken from the records of Shamrock Company. December 31,2020 December 31,2019 Cash $14,900 $8,100 Current assets other than cash 85,500 59,800 Long-term investments 10,000 52,700 Plant assets 334,100 216,500 $444,500 $337,100 Accumulated depreciation $20,200 $39,900 Current liabilities 39,600 22,200 Bonds payable 74,600 –0– Common stock 255,100 255,100 Retained earnings 55,000 19,900 $444,500 $337,100 Additional information: 1. Held-to-maturity debt securities carried at a cost of $42,700 on December 31, 2019, were sold in 2020 for $34,100. The loss (not unusual) was incorrectly charged directly to Retained Earnings. 2. Plant assets that cost $49,500 and were 80% depreciated were sold during 2020 for $8,100. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on…

- Question No.1 The following information is available on the Qazi Traders: BALANCE SHEET AS OF DECEMBER 31, 2020 (IN THOUSANDS)Cash and marketable securities Rs. 500 Accounts payable Rs. 400Accounts receivable ? Bank loan ?Inventories ? Accruals 200Current assets ? Current liabilities ?Long-term debt 2650 Net Fixed Assets ? Common stock and retainedearnings 3,750Total assets ? Total liabilities and equity ?..........................._________________________________________..................... INCOME STATEMENT FOR 2020 (IN THOUSANDS)Credit sales Rs.8,000Cost of goods sold ?Gross profit ?Selling and administrative expenses ?Interest expense 400Profit before taxes ?Taxes (44% rate) ?Profit after taxes ? OTHER INFORMATION ,Current ratio 3 to 1Depreciation Rs.500Net profit margin 7%Total liabilities/shareholders’ equity 1 to 1Average collection period 45 daysInventory turnover ratio 3 to 1Assuming that sales and production are steady throughout a 360-day year, complete the balancesheet and…E5.2B (L0 1,2) (Classification of Balance Sheet Accounts) Presented below are the captions of Chan Company’s balance sheet. (a) Current assets. (f) Current liabilities. (b) Investments. (g) Non-current liabilities. (c) Property, plant, and equipment. (h) Capital stock. (d) Intangible assets. (i) Additional paid-in capital. (e) Other assets. (j) Retained earnings. Instructions Indicate by letter where each of the following items would be classified. 1. Cash surrender value of life insurance. 11. Trading securities. 2. Prepaid insurance. 12. Preferred stock. 3. Taxes payable. 13. Allowance for doubtful accounts. 4. Bonds payable. 14. Accounts receivable. 5. Notes payable (due next year). 15. Goodwill. 6. Bond sinking fund. 16. Current portion of long-term debt. 7. Common stock. 17. Wages payable. 8. Merchandise inventory. 18. Buildings. 9. Office supplies. 19.…Rodriquez Corporation’s comparative balance sheets are presented below: RODRIQUEZ CORPORATIONComparative Balance SheetsDecember 31 2020 2019 Cash $16,500 $17,400 Accounts receivable 25,300 22,100 Investments 20,150 15,850 Equipment 59,950 69,850 Accumulated depreciation—equipment (13,850 ) (10,300 ) Total $108,050 $114,900 Accounts payable $14,850 $11,150 Bonds payable 10,600 30,100 Common stock 49,500 45,500 Retained earnings 33,100 28,150 Total $108,050 $114,900 Additional information: 1. Net income was $18,550. Dividends declared and paid were $13,600. 2. Equipment which cost $9,900 and had accumulated depreciation of $1,600 was sold for $3,300. 3. No noncash investing and financing activities occurred during 2020. Prepare a statement of cash flows for 2020 using the…