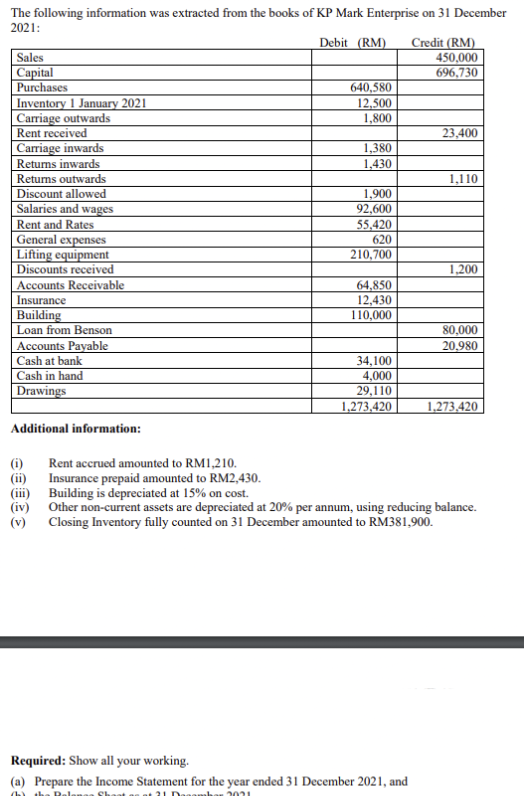

Required: Show all your working. (a) Prepare the Income Statement for the year ended 31 December 2021, and

Q: ABC Corporation has P10 par, 5,000,000 shares outstanding as of October 31, 2022. On November 15,…

A: The dividend is declared to the shareholders from the cumulative profits of the business. The share…

Q: The December 31, 2021, statement of financial position of Bordeaux Corporation includes the…

A: Bonds payable is a form of liability for the business, on which regular interest payments needs to…

Q: 1(a). Prepare journal entries to record the issuance of Frenza bonds on January 1, Year 1. 1(b).…

A: Requirement 1 a) :— Statement Showing Journal entry to record the issuance of Frenza bonds on…

Q: The bank reconciliation can be used to control cash in a bank account. A) True B) False

A: Lets understand the basics. Bank reconciliation statement is a statement prepared to match cash…

Q: ompute the ending balance of the Work-in-Process Inventory account for July. Job X14…

A: Ending inventory in WIP represents that the inventory remained at the end of the period in the…

Q: On May 30, Cecil Company purchased merchandise on account from Ricci Company as follows - List…

A: Journal entries are the basic method for recording financial transactions in the books of accounts.…

Q: On January 1, 2021, Dreamy Company issued 30,000 shares of $2 par value common stock for $150,000.…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Walmart sells a bike that cost $100 to a customer for $250 cash. Using a perpetual inventory system,…

A: Under a traditional periodic Inventory System, the inventories are recorded by physical counting on…

Q: On July 1, 2020, Chikadora Company issued P4M of 16% bonds to yield 14%. Interest is payable…

A: Issue price of the bonds = Present value of principal + Present value of interest payments where,…

Q: How much is the gain on debt restructuring?

A: Meaning Of Debt restructuring Debt Restructuring is opted to avoid risk of defaulting payment of…

Q: Use the following information for the Exercises 12-13 below. (Algo) Skip to question [The…

A: Introduction: In a corporation's accounting records, a journal entry is used to record a business…

Q: Molly Lincoln, a 25-year-old personal loan officer at First National Bank, understands the…

A:

Q: Preble Company manufactures one product. Its variable manufacturing overhead is applied to…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: How much dividends will be received by the preference shares holders?

A: There are various classes of preference shareholders, Non cumulative is one of the classes of…

Q: Exercise 9-4 (Algo) Prepare a Flexible Budget Performance Report [LO9-4] Vulcan Flyovers offers…

A: The flexible budget performance report analyzes the actual results, flexible budget data and…

Q: On July 1, 2021, Matiyaga Company purchased 1,000 shares of Masipag Corp. P100 par ordinary shares…

A: In the context of the given question, we are required to compute the carrying value of Matiyaga's…

Q: Question 4.4…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Your customer has paid their bill, yet the Accounts Receivable balance has not changed. Which of the…

A: answer

Q: Please help me fill in the last 6 cells and the last couple of questions if you can, all in bold!…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: The insufficient capacity of SHELLA Craft is due to the availability of manpower that the company is…

A: Cost evaluation in the recruiting process is significant because it determines the quality of the…

Q: Required: 1o. & 1b. Prepare journal entries to record the partners' initial capital investments and…

A: Partnership Firm :— When two or more Individuals Come together to form an business and share profit…

Q: A rich aunt has promised you 6000 one year from today. In addition, each year after that, she has…

A: This question can solved on the basis on Net Present Value Method (NPV)

Q: Find the periodic payments PMT necessary to accumulate the given amount in an annuity account. HINT…

A:

Q: What is the difference between job order costing and process costing? What types of companies use…

A: Costing is the Process of Computing cost of Manufacturing of goods or provision of services. Costing…

Q: Prepare a flexible budget for a monthly activity level of 8,000 and 9,000 direct labor hours only.

A: A budget is a statement of quantitative data. it contains estimated data related to future expenses…

Q: 2. Alliss Limited manufactures de-luxe juicing machines. Each machine has a wholesale price of £225.…

A: Workings: Budgeted Contribution Margin=Selling price-Variable cost per unit×Budgeted Units Net…

Q: NXP Corporation issues P15 par value ordinary shares during 2021. The company received subscription…

A: The subscription received for 25000 shares at P18 per share from Mr. Navarro. He paid 45% but fails…

Q: At the beginning of the period, the Fabricating Department budgeted direct labor of $120,400 and…

A: A flexible budget is prepared on the basis of the budgeted rate and on the basis of different…

Q: Careful Company sells goods that cost P600,000 to a customer for P800,000 on December 20, 2021. The…

A: Revenue will be recognise as and when performance obligation satisfied. It can be recognise at the…

Q: Exercise 11-6 (Algo) Calculate operating activities-indirect method (LO11-3) Gemstone Suppliers…

A: Cash Flow From Operating Activities :— It is the amount of cash flows related to operating of…

Q: Alan and Sara Winthrop are a married couple who file a joint income tax return. They have two…

A: The personal exemption for the tax year 2020 is $0 So, the taxable income for 2020 = $181,200 -…

Q: Which adjustments need to be recorded in the accounting records? Those that affected the bank…

A: Introduction: All the paperwork and books used to create financial statements or records necessary…

Q: Ms. Jampal is planning to open a laboratory for Covid-19 test in Chiang Mai on 1st October 2022 with…

A:

Q: Make-or-Buy Decision Fremont Computer Company has been purchasing carrying cases for its portable…

A: The alternatives available to business can be compared on the basis of costs incurred for both…

Q: Cost of Quality Report This year, Finn Corporation implemented programs designed to assess the…

A: Quality Control Activities Activity Cost Rework Internal Failure Costs $38,400 Inspecting…

Q: Saxon Products, Incorporated, is investigating the purchase of a robot for use on the company’s…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: Cyberdyne Systems and Virtucon are competitors focusing on the latest technologies. Selected…

A: The ratio analysis helps to analyze the financial statements of the business. Average total assets =…

Q: A stock has a required return of 7%, the risk-free rate is 2.5%, and the market risk premium is 3%.…

A: Required rate of return as per CAPM :— Expected Return = Rf + (Rm - Rf) beta of the…

Q: If your formules are correct, you should get the comect answers to the following questions. a. What…

A: Profit estimated :— The formula to calculate profit is: Total Revenue - Total Expenses = Profit.…

Q: Income statements for Siam Foods, Inc. from 2014 to 2016 appear below. Siam Foods, Inc. Annual…

A:

Q: 14 4

A: "Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Good Company has an overdue 8% notes payable to Better Company amounting to P8million and accrued…

A:

Q: Internal Growth Rate (IGR) Net Income ($) Total dividend paid ($) Retention ratio (%) Total assets…

A: Besides borrowing, the rate at which an organization can grow is known as the sustainable growth…

Q: Find the periodic withdrawals PMT for the given annuity account. (Assume end-of-period withdrawals…

A: PMT means periodic payments made of inflows and outflows at each period. It can be present value or…

Q: DEF Corporation currently have Ordinary Share Capital, P 20 par, 50,000 shares and replace it by…

A: No Par Value shares as its name suggests are shares that does not have par value associated with it.

Q: Dividends per share (PS is non cumulative, non participating, Supply the answer. Round off answer to…

A:

Q: Would the pandemic and shortages could cause some companies to decide to use a different method of…

A: The costing methods is the methods that helps the coampiens to identify the amount spent on the…

Q: Intemal Growth Rate (IGR) Net Income ($) Total dividend paid ($) Retention ratio (%) Total assets…

A: Internal Growth Rate (IGR) The purpose of calculating the Internal growth Rate is the maximum rate…

Q: FPJ Inc. received subscription for 5,250 Preference Shares at P 10 above par value of P 200 per…

A: Common shares and Preference shares are two type of shares being issued by the company for raising…

Q: A Corporation has 6,000 shares of P100 par value Ordinary Share Capital and reacquires 1,000 shares…

A: Treasury stock: Shares which are bought back by the company from the open…

Prepare

Step by step

Solved in 2 steps with 1 images

- The accounting records of Nettle Distribution show the following assets and liabilities as of December 31,2018 and 2019.December 31 2018 2019Cash . . . . . . . . . . . . . . . . . . . . . . . . $ 64,300 $ 15,640Accounts receivable . . . . . . . . . . . 26,240 19,100Office supplies . . . . . . . . . . . . . . . . 3,160 1,960Office equipment . . . . . . . . . . . . . . 44,000 44,000Trucks . . . . . . . . . . . . . . . . . . . . . . . 148,000 157,000December 31 2018 2019Building . . . . . . . . . . . . . . . . . . . . . $ 0 $80,000Land . . . . . . . . . . . . . . . . . . . . . . . . 0 60,000Accounts payable . . . . . . . . . . . . . 3,500 33,500Note payable . . . . . . . . . . . . . . . . . 0 40,000Required1. Prepare balance sheets for the business as of December 31, 2018 and 2019. Hint: Report only total equityon the balance sheet and remember that total equity equals the difference between assets and liabilities.2. Compute net income for 2019 by comparing total equity amounts for these…You are required to prepare a trial balance for Alina Ltd as at 31st December 2021 and assess the source and structure of the trial Balance of Alex Ltd. The following information should be used to prepare the trial balance; £000 Capital 200 - Source - General ledger Stocks 20 - Source - General ledger Sales 100 - Source - Sales ledger or accounts receivable Cash and cash equivalent 110 - Source - Cash book Bank loan 70 - Source - General ledger Furniture and Fittings 180 - Source - General ledger or nominal ledger Trade Receivables 30 - Source - Sales ledger or receivables ledger Trade Payables 20 - Source - Payable ledger or purchase ledger Wages 50 - Source - General ledger or nominal ledgerOn January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances:Accounts Debit CreditCash $ 11,200Accounts Receivable 34,000Allowance for Uncollectible Accounts $ 1,800Inventory 152,000Land 67,300Buildings 120,000Accumulated Depreciation 9,600Accounts Payable 17,700Common Stock 200,000Retained Earnings 155,400Totals $384,500 $384,500During January 2021, the…

- Incorporate the following data into Bank X's revenue statement. Each item should be labelled and placed in the proper category and order. Commission ,exchange and brokerage received.Income on InvestmentsInterest paid on depositsPayments to and provisions for employeesInterest paid on BBI/ interbank borrowingsInterest/discount received on advances/billsIncome from leasing/hire purchaseInterest paid-othersProfit on exchange transactionsRent, taxes, lightingInsuranceLaw chargesProfit on sale of land, buildings and other assetsMiscellaneous incomeAuditor’s fees and expensesPrinting and stationaryProfit on sale of investmentsDepreciation on bank’s propertyIncome by way of dividends and subsidiariesAdvertisement and PublicityInterest earned – othersDirector’s fees, allowances and expensesMiscellaneous incomeRepairs and maintenanceOther expensesPostage, telegram, telephone and other communication expensesInterest received on balances with RBI and interbank funds.Please try to answer accurately and accordance with requirements.Thank you!The general ledger of Emerates Traders Ltd includes the following accounts as at 30 June 2018:$000Sales Revenue 8,280Dividend Received 126Interest Received 65Cost of Sales 1,105Selling and Distribution expenses 450Administration expenses 1,550Finance costs 16Valuation loss on trading investments (considered a material item) 250Income tax expense charged to profit and loss 1,500Expenses classified by nature include:Auditors Remuneration:Audit of accounts 20Information technology controls advice 5 25Depreciation expense:Buildings 120Plant and Equipment 225 345Additional InformationThe valuation loss on investments held for trading is not tax deductible.Task 4a. Complete a Statement of Comprehensive Income showing expenses classified byfunction on the face of the Income Statement together with notes to the incomestatement including the material item.- Note that Emerates Traders Ltd discloses material items on the…An entity provided the following data on December 31, 2020: Checkbook balance ₱ 5,000,000.00 Check drawn on entity’s account, payable to supplier, dated and recorded on December 31, 2020 but not mailed until January 31, 2021 1,500,000.00 Cash in sinking fund 1,500,000.00 Treasury bills, purchased November 1, 2020 and maturing January 31, 2021 2,500,000.00 Time deposit, purchased October 1, 2020 and maturing January 31, 2021 3,500,000.00 What amount should be reported as cash and cash equivalents on December 31, 2020?

- The following are extracts from the financial records of ABC Ltd for the year ended31 August 2021.ABC LtdExtract from the Statement of financial statement as at 31 August 2021 31 August 2021 - R 30 August 2020 - R Bank Inventories - Trade Goods Trade Recievables Trade payables Prepaid Expenses Prepaid Expenses Accrued Expenses; interest Accrued Expenses; other SARS - income tax payable Dividens payable 50000 22000 77000 44000 1800 1000 5700 8000 1500 20000 30000 69000 46000 1200 2400 4400 3000 2700 ABC LtdExtract from the Statement of profit or loss and other comprehensive incomefor the year ended 31 August 2021 Sales 592000 Cost of sales (301000 Gross profit 291000 Profit on sale of Equipment 9000 Depreciation 41000 Interest Expense 2600 Income tax expense 15200 Profit for the year 110300 Additional information: 1. The dividends declared for the current year is R2 400 Required:Prepare only the “Cash flows from operating activities” section…Below is a trial balance of Ali Mamat Enterprise, extracted after one year’s trading. Ali Mamat EnterpriseTrial Balance as at 31 December 2019Particulars Debit (RM) Credit (RM)Sales 190,576Purchases 119,832Salaries 56,527Motor expenses 2,416Rent 1,894Insurance 372General expenses 85Premises 95,420Motor vehicles 16,594Account receivables 26,740Account payable 16,524Cash at bank 16,519Cash in hand 342Drawings 8,425Capital 138,066TOTAL 345,166 345,166 Required:i. Statement of Profit or Loss and Others Comprehensive Income for the yearended 31 December 2019.ii. Statement of Financial Position as at 31 December 2019.Identify whether the following payments and receipts of a resident company result inany franking credit or franking debit entries in its franking account, and state theamount of the credit or debit (if any):1. Payment of income tax of $3002. Payment of a PAYG instalment of $6003. Payment of GST of $1004. Payment of FBT of $5005. Receipt of a $700 dividend which has $100 of franking credits allocated to it

- The following trial balance has been extracted from the ledger of Mr. Cole, a sole trader:Trial balance as at 31 December, 2020Particulars Debit ¢ Credit ¢Sales 138,000Purchases 82,350Travel expenses 5,200Drawings 7,800Rent, rates & insurance 6,600Postage and stationery 3,000Advertisement 1,330Salaries and wages 26,420Bad debt 8,700Investment Income 15,890Debtors 12,120 Creditors 130Cash in hand 1,700Cash at bank 1,000Inventory as at 1 January, 2020 11,800Equipment at cost 58,000Loan 19,000Capital 53,000226,020 226,020Inventory at the close of business has been valued at ¢13,500Required;Prepare an income statement for the year ending 31st December 2020 and a balance sheet as at that date.Some selected balances of DD Co. for year ended Dec-31-2019 are as follows with theirnormal balances before adjustments:Cash and Cash Equivalent Br 20,000 Owners’ Capital 40,000Notes Receivables45,000Retained Earnings75,000Office Supplies12,000Sales Revenues640,000Prepaid Insurance72,000Interest Income12,000Inventory (Average Cost)24,000Cost of Goods Sold320,000Fixed Assets120,000Selling Expenses21,000Accum. Depr- Fixed assets36,000Salary and Wages Expense105,000Unearned Rent (Liability)56,000Rent Expense15,000Requireda. Prepare the necessary adjusting entries for the following items as not yet recorded on Dec-31-2019:i. The office supplies consumed during the year is Br 8,000ii. The Unexpired part of insurance is only Br 26,000iii. Br 30,000 is earned sales revenues from the unearned advance collectioniv. Salary and wages accrued as on 31-Dec-2019 amounts to be Br 18,000v. Depreciation Expenses allocated for the year amounts to be Br 15,000vi. There are accrued interest of Br 8,000 on…Company presents the following selected general ledger accountsshowing balances at October 1, 2017: CashFinished GoodsWork in ProcessRaw materialsPrepaid Insurance Accumulated Depreciation Accounts PayableBalances at October 31, 2017 include: Accrued payrollFinished goodsWork in ProcessRaw MaterialsP 40,000 592,000 164,000 128,0004,000 280,000 108,000P 12,000 608,000 188,000 120,000 A summary of transactions for the month of October follows: a. Cash salesb. Raw materials purchased on account c. Direct materials usedd. Direct Labore. Factory insurance expiredf. Depreciation for factory equipment g. Factory utility service on accounth. Accounts payable paidi. Factory payroll paidP420,000 168,000 156,00064,000 1,200 6,80012,000 196,000 88,000Required: Indirect materials used.Indirect laborTotal factory overhead Cost of goods manufa