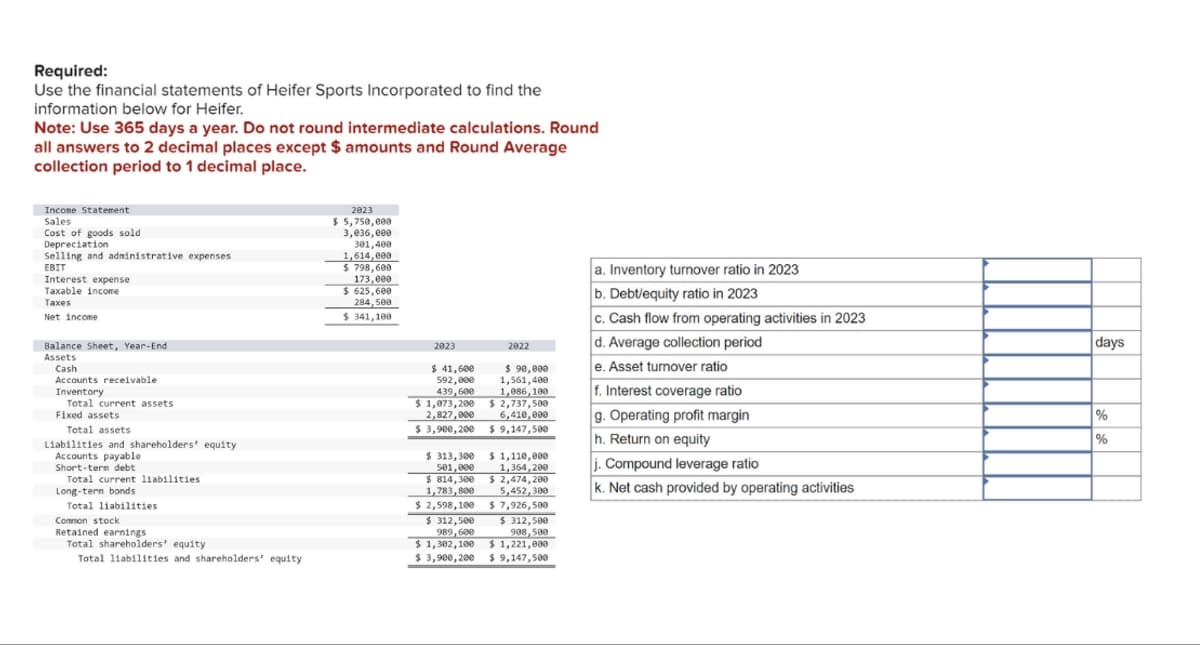

Required: Use the financial statements of Heifer Sports Incorporated to find the information below for Heifer. Note: Use 365 days a year. Do not round intermediate calculations. Round all answers to 2 decimal places except $ amounts and Round Average collection period to 1 decimal place. Income Statement Sales Cost of goods sold Depreciation Selling and administrative expenses EBIT Interest expense Taxable income Taxes Net income 2023 $5,750,000 3,036,000 301,400 1,614,000 $ 798,600 173,000 $ 625,600 284,500 $ 341,100 Balance Sheet, Year-End Assets Cash Accounts receivable Inventory Total current assets Fixed assets Total assets Liabilities and shareholders' equity Accounts payable Short-term debt Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2023 $ 41,600 592,000 439,600 $ 1,073,200 2,827,000 $ 3,900,200 $ 313,300 501,000 $ 814,300 1,783,800 $2,598,100 $ 312,500 989,600 $ 1,302,100 2022 $ 90,000 1,561,400 1,086,100 $2,737,500 6,410,000 $ 9,147,500 $ 1,110,000 1,364,200 $ 2,474,200 5,452,300 $ 7,926,500 $ 312,500 908,500 $ 1,221,000 $ 3,900,200 $ 9,147,500 a. Inventory turnover ratio in 2023 b. Debt/equity ratio in 2023 c. Cash flow from operating activities in 2023 d. Average collection period e. Asset turnover ratio f. Interest coverage ratio g. Operating profit margin h. Return on equity j. Compound leverage ratio k. Net cash provided by operating activities days % %

Required: Use the financial statements of Heifer Sports Incorporated to find the information below for Heifer. Note: Use 365 days a year. Do not round intermediate calculations. Round all answers to 2 decimal places except $ amounts and Round Average collection period to 1 decimal place. Income Statement Sales Cost of goods sold Depreciation Selling and administrative expenses EBIT Interest expense Taxable income Taxes Net income 2023 $5,750,000 3,036,000 301,400 1,614,000 $ 798,600 173,000 $ 625,600 284,500 $ 341,100 Balance Sheet, Year-End Assets Cash Accounts receivable Inventory Total current assets Fixed assets Total assets Liabilities and shareholders' equity Accounts payable Short-term debt Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2023 $ 41,600 592,000 439,600 $ 1,073,200 2,827,000 $ 3,900,200 $ 313,300 501,000 $ 814,300 1,783,800 $2,598,100 $ 312,500 989,600 $ 1,302,100 2022 $ 90,000 1,561,400 1,086,100 $2,737,500 6,410,000 $ 9,147,500 $ 1,110,000 1,364,200 $ 2,474,200 5,452,300 $ 7,926,500 $ 312,500 908,500 $ 1,221,000 $ 3,900,200 $ 9,147,500 a. Inventory turnover ratio in 2023 b. Debt/equity ratio in 2023 c. Cash flow from operating activities in 2023 d. Average collection period e. Asset turnover ratio f. Interest coverage ratio g. Operating profit margin h. Return on equity j. Compound leverage ratio k. Net cash provided by operating activities days % %

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.33E

Related questions

Question

Transcribed Image Text:Required:

Use the financial statements of Heifer Sports Incorporated to find the

information below for Heifer.

Note: Use 365 days a year. Do not round intermediate calculations. Round

all answers to 2 decimal places except $ amounts and Round Average

collection period to 1 decimal place.

Income Statement

Sales

Cost of goods sold

Depreciation

Selling and administrative expenses

EBIT

Interest expense

Taxable income

Taxes

Net income

2023

$5,750,000

3,036,000

301,400

1,614,000

$ 798,600

173,000

$ 625,600

284,500

$ 341,100

Balance Sheet, Year-End

Assets

Cash

Accounts receivable

Inventory

Total current assets

Fixed assets

Total assets

Liabilities and shareholders' equity

Accounts payable

Short-term debt

Total current liabilities

Long-term bonds

Total liabilities

Common stock

Retained earnings

Total shareholders' equity

Total liabilities and shareholders' equity

2023

$ 41,600

592,000

439,600

$ 1,073,200

2,827,000

$ 3,900,200

$ 313,300

501,000

$ 814,300

1,783,800

$2,598,100

$ 312,500

989,600

$ 1,302,100

2022

$ 90,000

1,561,400

1,086,100

$2,737,500

6,410,000

$ 9,147,500

$ 1,110,000

1,364,200

$ 2,474,200

5,452,300

$ 7,926,500

$ 312,500

908,500

$ 1,221,000

$ 3,900,200 $ 9,147,500

a. Inventory turnover ratio in 2023

b. Debt/equity ratio in 2023

c. Cash flow from operating activities in 2023

d. Average collection period

e. Asset turnover ratio

f. Interest coverage ratio

g. Operating profit margin

h. Return on equity

j. Compound leverage ratio

k. Net cash provided by operating activities

days

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning