Concept explainers

The

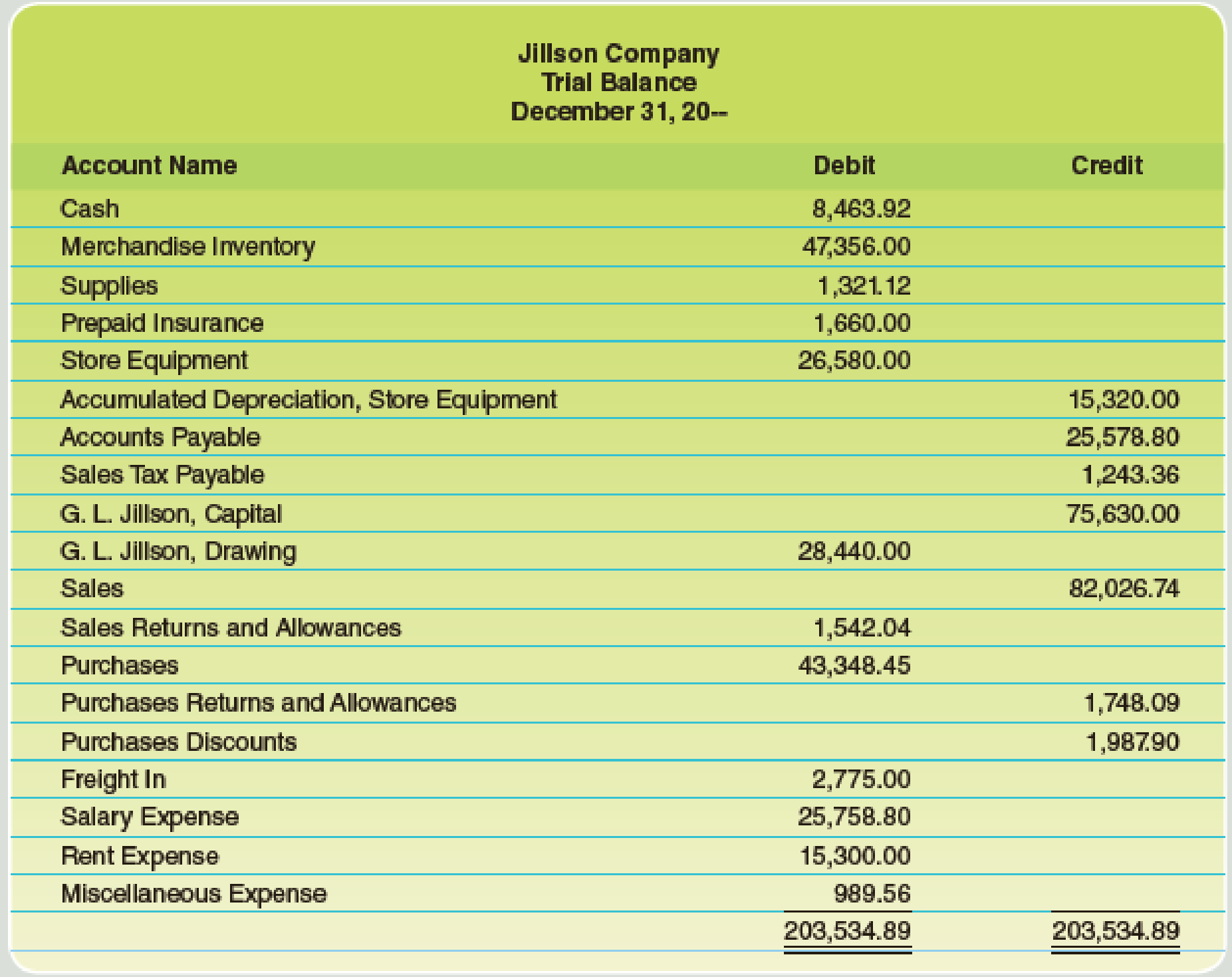

Here are the data for the adjustments.

a–b. Merchandise Inventory at December 31, $54,845.00.

c. Store supplies inventory (on hand), $488.50.

d. Insurance expired, $680.

e. Salaries accrued, $692.

f.

Required

Complete the work sheet after entering the account names and balances onto the work sheet.

Trending nowThis is a popular solution!

Chapter 11 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Financial Accounting, Student Value Edition (4th Edition)

Accounting for Governmental & Nonprofit Entities

- The balances of the ledger accounts of Beldren Home Center as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. Merchandise Inventory at December 31, 102,765. c. Wages accrued at December 31, 1,834. d. Supplies inventory (on hand) at December 31, 645. e. Depreciation of store equipment, 5,782. f. Depreciation of office equipment, 1,791. g. Insurance expired during the year, 845. h. Rent earned, 2,500. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 16.arrow_forwardHere are the accounts in the ledger of Mishas Jewel Box, with the balances as of December 31, the end of its fiscal year. Here are the data for the adjustments. Assume that Mishas Jewel Box uses the perpetual inventory system. a. Merchandise Inventory at December 31, 124,630. b. Insurance expired during the year, 1,294. c. Depreciation of building, 3,300. d. Depreciation of store equipment, 6,470. e. Salaries accrued at December 31, 2,470. f. Store supplies inventory (on hand) at December 31, 1,959. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 63.arrow_forwardThe following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forward

- The following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardThe trial balance of Hadden Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab.Merchandise Inventory at December 31, 64,742.80. c.Store supplies inventory (on hand), 420.20. d.Insurance expired, 738. e.Salaries accrued, 684.50. f.Depreciation of store equipment, 3,620. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forwardThe accounts and their balances in the ledger of Markeys Mountain Shop as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows. Assume that Markeys Mountain Shop uses the perpetual inventory system. a. Merchandise Inventory at December 31, 140,357. b. Store supplies inventory (on hand) at December 31, 540. c. Depreciation of building, 3,400. d. Depreciation of store equipment, 3,800. e. Salaries accrued at December 31, 1,250. f. Insurance expired during the year, 1,480. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 63.arrow_forward

- A merchandising company shows 8,842 in the Supplies account on the preadjusted trial balance. After taking inventory of the actual supplies, the company still owns 3,638. a. How much was used or expired? b. Write the adjusting entry.arrow_forwardThe Supplies account has a 1,400 balance. A physical inventory is taken at the end of the fiscal year, and the amount on hand is determined to be 300. What adjusting entry is required to record the supplies used? a. Supplies 300 DR, Cash 300 CR b. Supplies Expense 1,400 DR, Supplies 1,400 CR c. Supplies 1,100 DR, Supplies Expense 1,100 CR d. Supplies Expense 1,100 DR, Supplies 1,100 CR e. None of the abovearrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forward

- On December 31, the end of the year, the accountant for Fireside Magazine was called away suddenly because of an emergency. However, before leaving, the accountant jotted down a few notes pertaining to the adjustments. Journalize the necessary adjusting entries. Assume that Fireside Magazine uses the periodic inventory system. ab. A physical count of inventory revealed a balance of 199,830. The Merchandise Inventory account shows a balance of 202,839. c. Subscriptions received in advance amounting to 156,200 were recorded as Unearned Subscriptions. At year-end, 103,120 has been earned. d. Depreciation of equipment for the year is 12,300. e. The amount of expired insurance for the year is 1,612. f. The balance of Prepaid Rent is 2,400, representing four months rent. Three months rent has expired. g. Three days salaries will be unpaid at the end of the year; total weekly (five days) salaries are 4,000. h. As of December 31, the balance of the supplies account is 1,800. A physical inventory of the supplies was taken, with an amount of 920 determined to be on hand.arrow_forwardJournalize the required adjusting entries for the year ended December 31 for Butler Spa and Pool Accessories. Butler Spa and Pool Accessories uses the periodic inventory system. ab. On December 31, a physical count of inventory was taken. The physical count amounted to 22,624. The Merchandise Inventory account shows a balance of 21,696. c. On July 1 of this year, 2,400 was paid for a one-year insurance policy. d. On November 1 of this year, 420 was paid for three months of advertising. e. As of December 31, the balance of the Unearned Membership Fees account is 15,600. Of this amount, 9,200 has been earned. f. Equipment purchased on May 1 of this year for 8,000 is expected to have a useful life of five years with a trade-in value of 500. All other equipment has been fully depreciated. The straight-line method is used. g. As of December 31, three days wages at 250 per day had accrued. h. As of December 31, the balance of the supplies account is 4,200. A physical inventory of the supplies was taken, with an amount of 1,650 determined to be on hand.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College