Requirement: 1) Calculate the investment center's Sales Margin, Capital Turnover, Return on Investment (ROI) and Residual Income.

Requirement: 1) Calculate the investment center's Sales Margin, Capital Turnover, Return on Investment (ROI) and Residual Income.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 1.3AIC: Estimate the average total estimated useful life of depreciable property, plant, and equipment....

Related questions

Question

Please help me

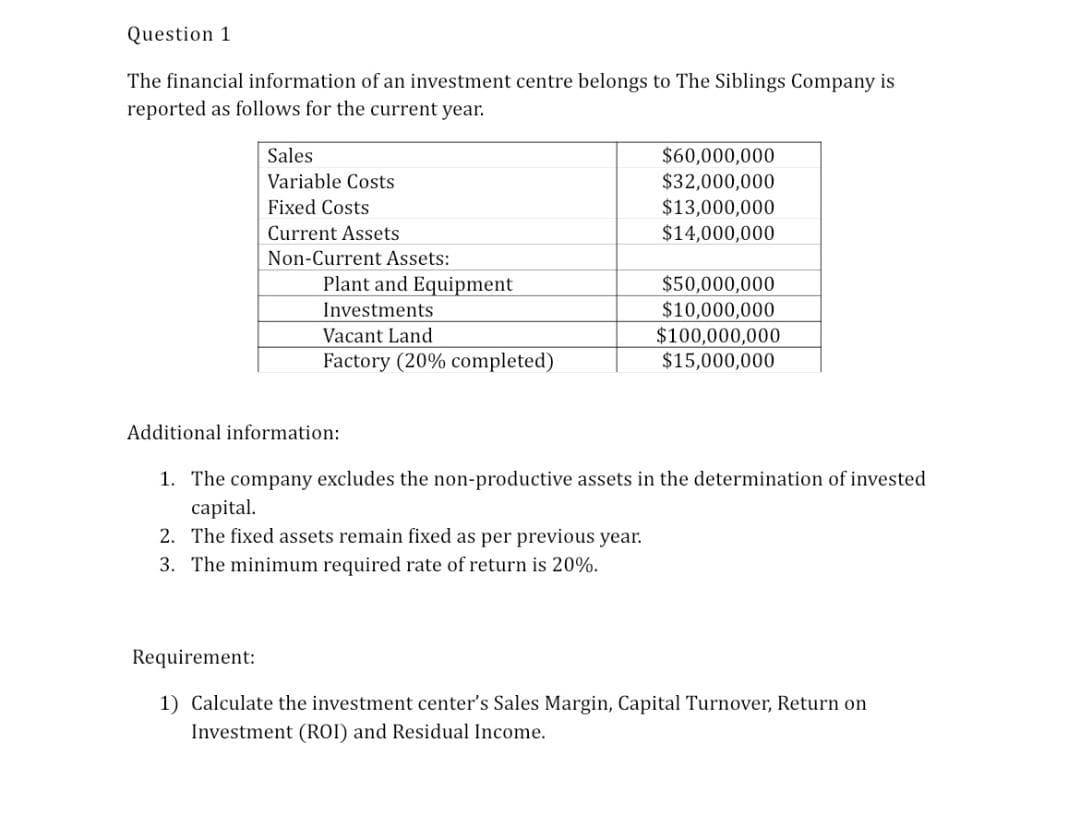

Transcribed Image Text:Question 1

The financial information of an investment centre belongs to The Siblings Company is

reported as follows for the current year.

Sales

$60,000,000

$32,000,000

Variable Costs

$13,000,000

$14,000,000

Fixed Costs

Current Assets

Non-Current Assets:

Plant and Equipment

$50,000,000

$10,000,000

$100,000,000

$15,000,000

Investments

Vacant Land

Factory (20% completed)

Additional information:

1. The company excludes the non-productive assets in the determination of invested

capital.

2. The fixed assets remain fixed as per previous year.

3. The minimum required rate of return is 20%.

Requirement:

1) Calculate the investment center's Sales Margin, Capital Turnover, Return on

Investment (ROI) and Residual Income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,