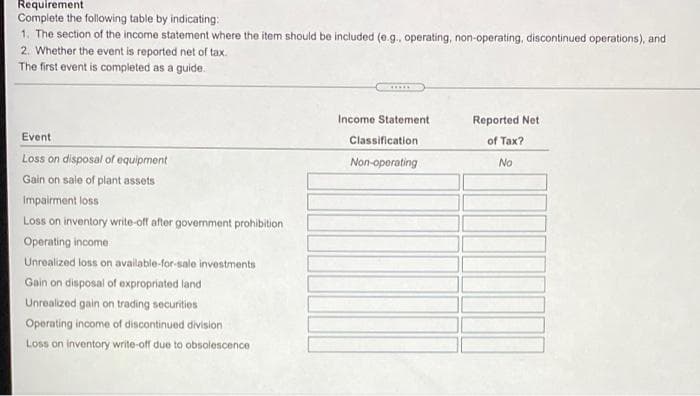

Requirement Complete the following table by indicating: 1. The section of the income statement where the item should be included (e.g., operating, non-operating, discontinued operations), a 2. Whether the event is reported net of tax. The first event is completed as a guide. Income Statement Reported Net Event Classification of Tax? Loss on disposal of equipment Non-oporating No Gain on sale of plant assets Impairment loss Loss on inventory write-off after government prohibition Operating income Unrealized loss on available-for-sale investments Gain on disposal of expropriated land Unrealized gain on trading securities Operating income of discontinued division Loss on inventory write-off due to obsolescence

Requirement Complete the following table by indicating: 1. The section of the income statement where the item should be included (e.g., operating, non-operating, discontinued operations), a 2. Whether the event is reported net of tax. The first event is completed as a guide. Income Statement Reported Net Event Classification of Tax? Loss on disposal of equipment Non-oporating No Gain on sale of plant assets Impairment loss Loss on inventory write-off after government prohibition Operating income Unrealized loss on available-for-sale investments Gain on disposal of expropriated land Unrealized gain on trading securities Operating income of discontinued division Loss on inventory write-off due to obsolescence

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 10MC: Which component of current income is not disclosed on the income statement net of tax effects? a....

Related questions

Question

1

Transcribed Image Text:Requirement

Complete the following table by indicating:

1. The section of the income statement where the item should be included (e.g., operating, non-operating, discontinued operations), and

2. Whether the event is reported net of tax.

The first event is completed as a guide.

Income Statement

Reported Net

Event

Classification

of Tax?

Loss on disposal of equipment

Non-operating

No

Gain on sale of plant assets

Impairment loss

Loss on inventory write-off after government prohibition

Operating income

Unrealized loss on available-for-sale investments

Gain on disposal of expropriated land

Unrealized gain on trading securities

Operating income of discontinued division

Loss on inventory write-off due to obsolescence

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning