Requirements 1. Prepare the 2018 statement of cash flows, formatting operating activities by the indirect method. 2. How will what you learned in this problem help you evaluate an investment?

Requirements 1. Prepare the 2018 statement of cash flows, formatting operating activities by the indirect method. 2. How will what you learned in this problem help you evaluate an investment?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.10P

Related questions

Question

question 34

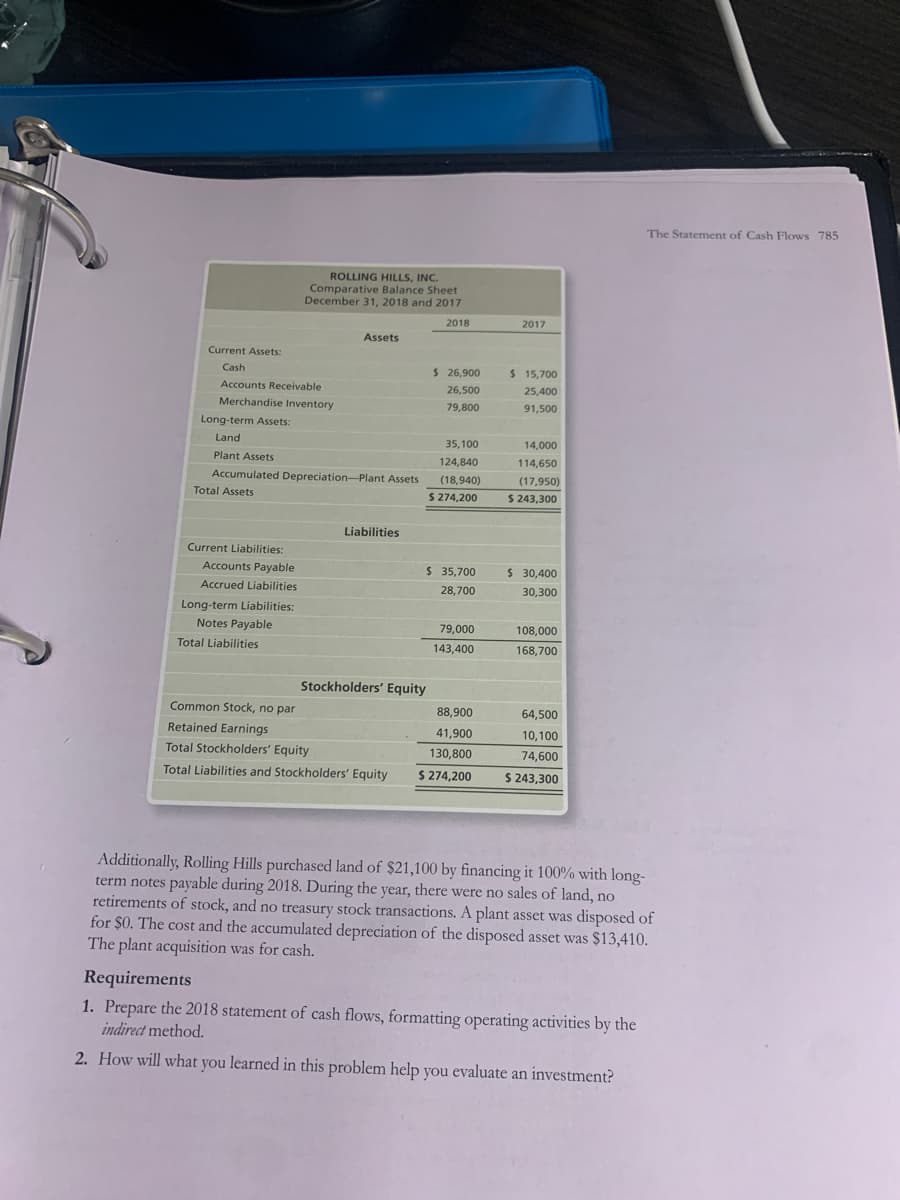

Transcribed Image Text:The Statement of Cash Flows 785

ROLLING HILLS, INC.

Comparative Balance Sheet

December 31, 2018 and 2017

2018

2017

Assets

Current Assets:

Cash

$ 26,900

$ 15,700

Accounts Receivable

26,500

25,400

Merchandise lInventory

79,800

91,500

Long-term Assets:

Land

35,100

14,000

Plant Assets

124,840

114,650

Accumulated Depreciation-Plant Assets

(18,940)

(17,950)

Total Assets

$ 274,200

$ 243,300

Liabilities

Current Liabilities:

Accounts Payable

$ 35,700

$ 30,400

Accrued Liabilities

28,700

30,300

Long-term Liabilities:

Notes Payable

79,000

108,000

Total Liabilities

143,400

168,700

Stockholders' Equity

Common Stock, no par

88,900

64,500

Retained Earnings

41,900

10,100

Total Stockholders' Equity

130,800

74,600

Total Liabilities and Stockholders' Equity

$ 274,200

$ 243,300

Additionally, Rolling Hills purchased land of $21,100 by financing it 100% with long-

term notes payable during 2018. During the year, there were no sales of land, no

retirements of stock, and no treasury stock transactions. A plant asset was disposed of

for $0. The cost and the accumulated depreciation of the disposed asset was $13,410.

The plant acquisition was for cash.

Requirements

1. Prepare the 2018 statement of cash flows, formatting operating activities by the

indirect method.

2. How will what you learned in this problem help you evaluate an investment?

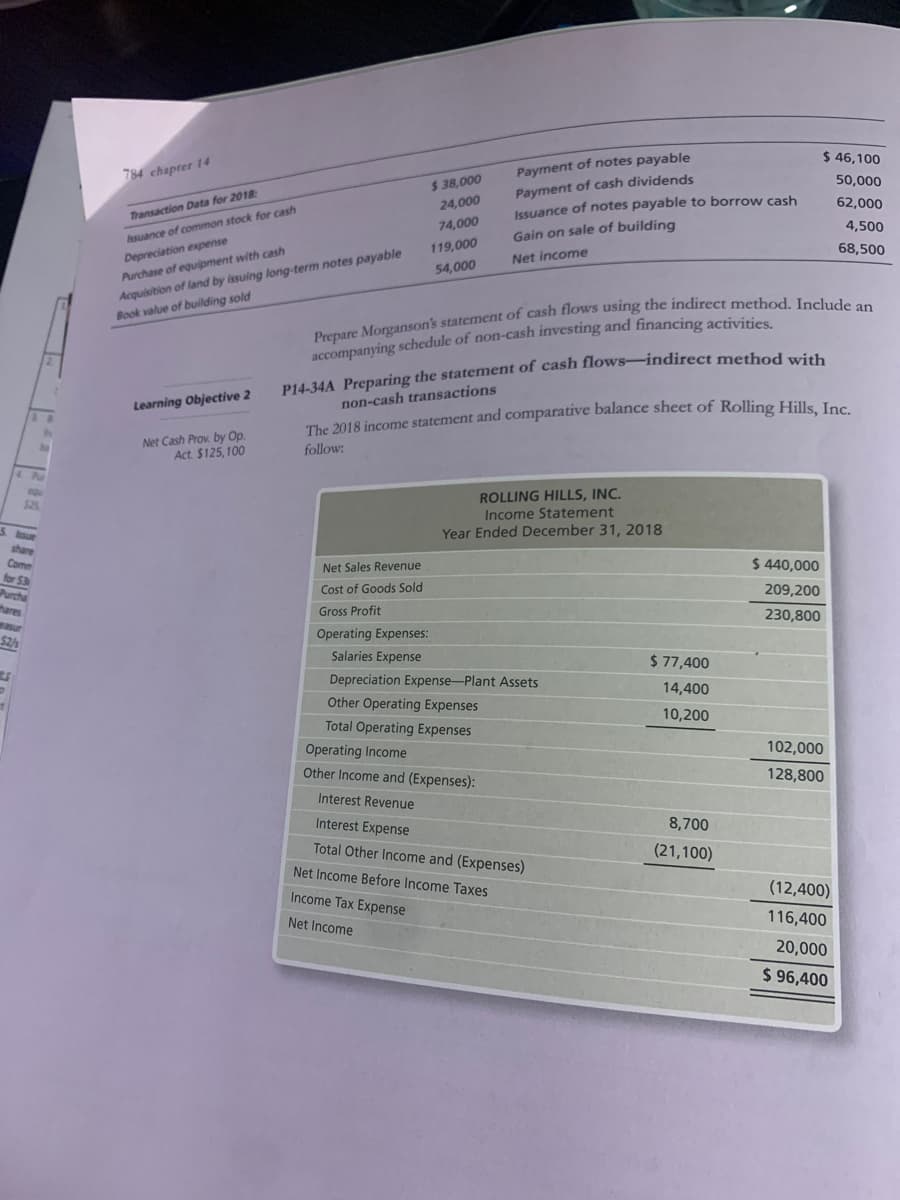

Transcribed Image Text:$ 46,100

784 chapter 14

Payment of notes payable

Payment of cash dividends

Issuance of notes payable to borrow cash

$ 38,000

50,000

24,000

62,000

Transaction Data for 2018

74,000

4,500

Issuance of common stock for cash

Gain on sale of building

119,000

68,500

Acquisition of land by issuing long-term notes payable

Book value of building sold

Depreciation expense

Net income

54,000

Purchase of equipment with cash

accompanying schedule of non-cash investing and financing activitics

P14-34A Preparing the statement of cash flows-indirect method wish

Learning Objective 2

non-cash transactions

The 2018 income statement and comparative balance sheet of Rolling Hills, Inc.

Net Cash Prov. by Op.

Act. $125, 100

follow:

ROLLING HILLS, INC.

Income Statement

S. sue

share

Year Ended December 31, 2018

$ 440,000

Comm

for $3

Purcha

thares

asur

Net Sales Revenue

Cost of Goods Sold

209,200

Gross Profit

230,800

Operating Expenses:

Salaries Expense

$ 77,400

Depreciation Expense-Plant Assets

14,400

Other Operating Expenses

10,200

Total Operating Expenses

102,000

Operating Income

Other Income and (Expenses):

128,800

Interest Revenue

Interest Expense

8,700

Total Other Income and (Expenses)

(21,100)

Net Income Before Income Taxes

(12,400)

Income Tax Expense

Net Income

116,400

20,000

$ 96,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning