Required: (a) Prepare Vanguard low Statement for the year ended 31 December 2019 with the following classifications using the direct method: (i) Cash flows from operations; (ii) Cash flows from investing activities; (iii) Cash flows from financing activities. (b) Discuss the importance of analysing the cash flow statement. (c) Explain why it is possible to have a negative cash flow from operations but a positive net income. Give an example of such a scenario.

Required: (a) Prepare Vanguard low Statement for the year ended 31 December 2019 with the following classifications using the direct method: (i) Cash flows from operations; (ii) Cash flows from investing activities; (iii) Cash flows from financing activities. (b) Discuss the importance of analysing the cash flow statement. (c) Explain why it is possible to have a negative cash flow from operations but a positive net income. Give an example of such a scenario.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 41E: Determining Cash Flows from Investing Activities Burns Companys 2019 and 2018 balance sheets...

Related questions

Question

100%

Required:

(a) Prepare Vanguard low Statement for the year ended 31 December 2019 with the following classifications using the direct method:

(i) Cash flows from operations;

(ii) Cash flows from investing activities;

(iii) Cash flows from financing activities.

(b) Discuss the importance of analysing the cash flow statement.

(c) Explain why it is possible to have a negative cash flow from operations but a positive net income. Give an example of such a scenario.

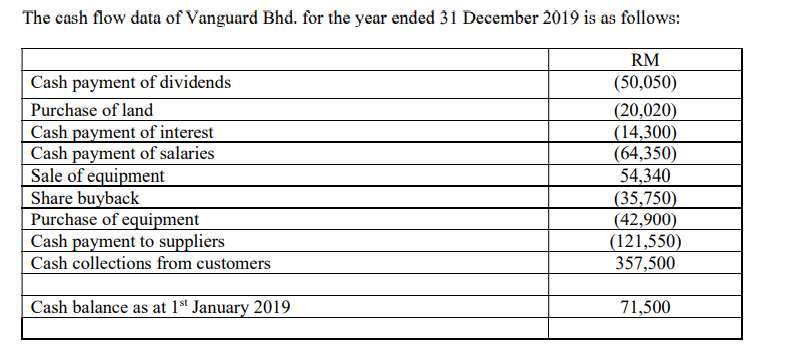

Transcribed Image Text:The cash flow data of Vanguard Bhd. for the year ended 31 December 2019 is as follows:

RM

Cash payment of dividends

(50,050)

(20,020)

(14,300)

(64,350)

54,340

(35,750)

(42,900)

(121,550)

357,500

Purchase of land

Cash payment of interest

Cash payment of salaries

Sale of equipment

Share buyback

Purchase of equipment

Cash payment to suppliers

Cash collections from customers

Cash balance as at 1st January 2019

71,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub