Requlred Informatlon Parker Hannifin of Cleveland, Ohlo, manufactures CNG fuel dispensers. It needs replacement equipment to streamline one of Its production lines for a new contract, but It plans to sell the equipment at or before ts expected life is reached at an estimated market value for used equipment. Select between the two optlons using the corporate MARR of 15% per year and a future worth analysis for the expected use period. Option First Cost AOC. per Year Expected Market Value Expected Use E S-64,000 $-22.000 S-74,000 S-24,000 $8,500 6 years $7.500 3 years The future worth of option D I S The future worth of option E IS S Option E is selected.

Requlred Informatlon Parker Hannifin of Cleveland, Ohlo, manufactures CNG fuel dispensers. It needs replacement equipment to streamline one of Its production lines for a new contract, but It plans to sell the equipment at or before ts expected life is reached at an estimated market value for used equipment. Select between the two optlons using the corporate MARR of 15% per year and a future worth analysis for the expected use period. Option First Cost AOC. per Year Expected Market Value Expected Use E S-64,000 $-22.000 S-74,000 S-24,000 $8,500 6 years $7.500 3 years The future worth of option D I S The future worth of option E IS S Option E is selected.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 2E: Average rate of returncost savings Maui Fabricators Inc. is considering an investment in equipment...

Related questions

Question

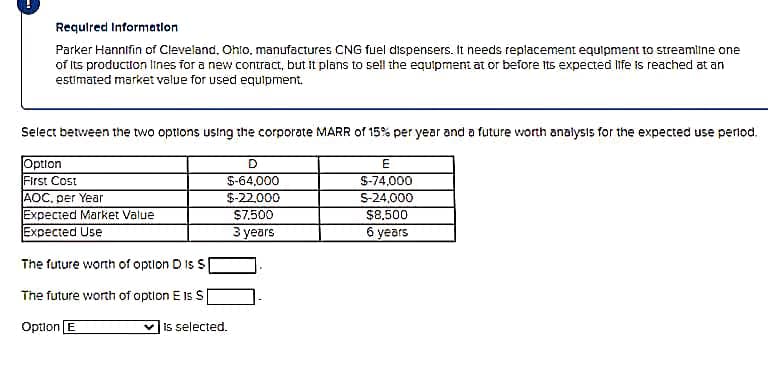

Transcribed Image Text:Required Information

Parker Hannifin of Cleveland, Ohto, manufactures CNG fuel dispensers. It needs replacement equipment to streamline one

of Its production lines for a new contract, but It plans to sell the equipment at or before its expected life is reached at an

estimated market value for used equipment.

Select between the two options using the corporate MARR of 15% per year and a future worth analysis for the expected use period.

Option

First Cost

AOC. per Year

Expected Market Value

Expected Use

S-64,000

$-22,000

S-74,000

S-24,000

$8,500

6 years

$7,500

З уears

The future worth of option D Is S

The future worth of option E 1s S

Option E

is selected.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning