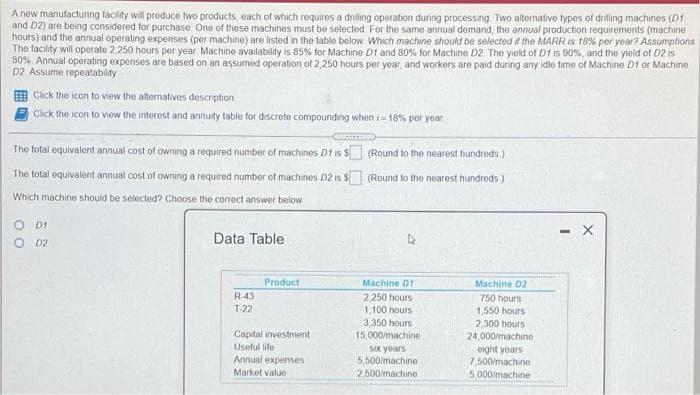

A new manutactunng facility will produce two products, each of which requires a dniling operation duning processing. Two alternative types of drilling machines (D1 and D2) are being considered for purchase Ono of these machines must be selected For the same annual demand, the annual production requirements (machine hours) and the annual operating expenses (per machine) are listed in the table below Which machine should be selected if the MARR is 18% per year? Assumptions The facility will operate 2,250 hours per year Machine availability is 85% for Machine 01 and 80% for Machine 02 The yiold of Df is 00%, and the yield of D2 is 80% Annual operating expenses are based on an assumed operabion of 2,250 hours per year, and workers are paid during any idle time of Machine Df or Machine D2 Assume repeatability Click the icon to view the allernatives description Click the icon to view the interost and annuty table for discrete compounding when 18% per year The total equivalent annual cost of owning a required number of machines 0f is $ (Round to the nearest hundreds) The total oquivalent annual cost of owning a required number of machines 02 is $ (Round to the nearest hundreds) Which machine should be selected? Choose the correct answer below O DI O D2 Data Table Product Machine 01 Machine D2 750 hours 1,550 hours 2,300 hours 24,000/machino eight yoars 7,500/machine 5,000/machine R-43 2,250 hours T-22 1,100 hours 3,350 hours 15,000machine Captal investment Useful life Annual expenses Sx years 5,500/machine 2,500/machine Market value

A new manutactunng facility will produce two products, each of which requires a dniling operation duning processing. Two alternative types of drilling machines (D1 and D2) are being considered for purchase Ono of these machines must be selected For the same annual demand, the annual production requirements (machine hours) and the annual operating expenses (per machine) are listed in the table below Which machine should be selected if the MARR is 18% per year? Assumptions The facility will operate 2,250 hours per year Machine availability is 85% for Machine 01 and 80% for Machine 02 The yiold of Df is 00%, and the yield of D2 is 80% Annual operating expenses are based on an assumed operabion of 2,250 hours per year, and workers are paid during any idle time of Machine Df or Machine D2 Assume repeatability Click the icon to view the allernatives description Click the icon to view the interost and annuty table for discrete compounding when 18% per year The total equivalent annual cost of owning a required number of machines 0f is $ (Round to the nearest hundreds) The total oquivalent annual cost of owning a required number of machines 02 is $ (Round to the nearest hundreds) Which machine should be selected? Choose the correct answer below O DI O D2 Data Table Product Machine 01 Machine D2 750 hours 1,550 hours 2,300 hours 24,000/machino eight yoars 7,500/machine 5,000/machine R-43 2,250 hours T-22 1,100 hours 3,350 hours 15,000machine Captal investment Useful life Annual expenses Sx years 5,500/machine 2,500/machine Market value

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1iM

Related questions

Question

100%

Transcribed Image Text:A new manutactunng facility will produce two products, each of which requires a dnilling operation during processing Two alternative types of drilling machines (D1

and D2) are being considered for purchase. One of these machines must be selected For the same annual demand, the annual production requirements (machine

hours) and the annual operating expenses (per machine) are listed in the table below Which machine should be selected if the MARR is 18% per year? Assumptions

The facility will operate 2,250 hours per year Machine availability is 85% for Machine D1 and 80% for Machine D2 The yield of Df is 90%, and the yield of D2 is

80% Annual operating expenses are based on an asşsumed operation of 2,250 hours per year, and workers are paid during any idle time of Machine D1 or Machine

D2 Assume repeatability

Click the icon to view the allternatives descrption

Click the icon to view the interest and annuity table for discrete compounding when i= 18% per year

The total oquivalent annual cost of owning a required number of machines Df is $

(Round to the nearest hundreds )

The total oquivalent annuai cost of owning a required number of machines D2 is $ (Round to the nearest hundreds)

Which machine should be selected? Choose the correct answer below

O Df

- X

Data Table

O D2

Product

Machine D1

Machine D2

R-43

2,250 hours

750 hours

1,550 hours

2,300 hours

24,000/machino

eight years

7,500/machine

5,000/machine

T-22

1,100 hours

3,350 hours

15,000/machine

Capital investment

Useful life

Annual expenses

Sx years

5,500/machine

2,500/machine

Market value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub