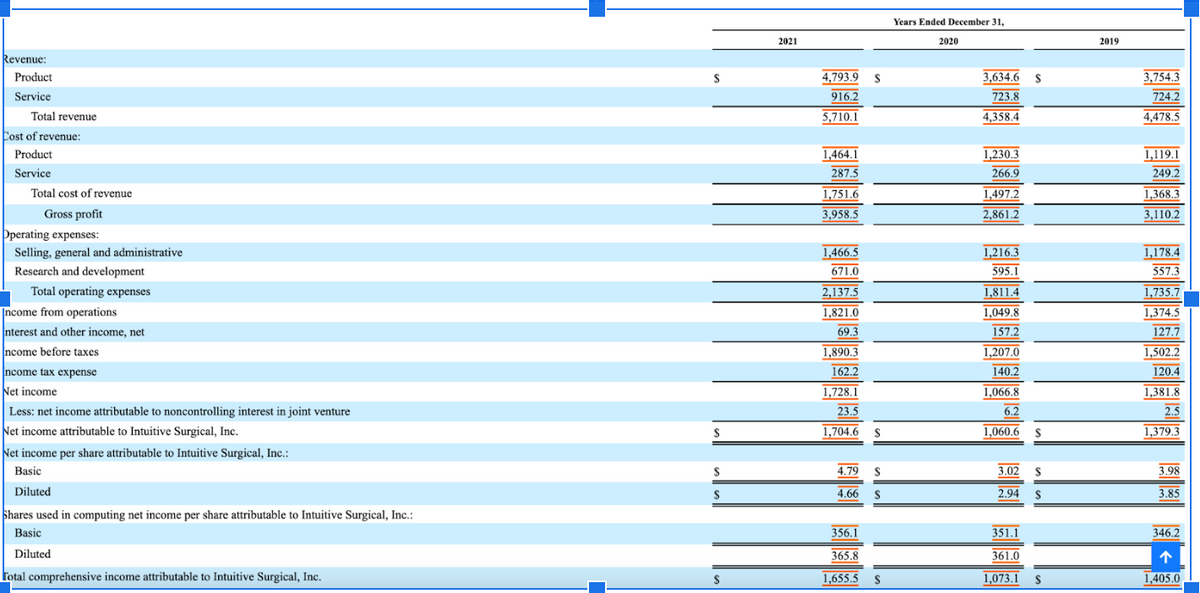

Revenue: Product Service Total revenue Cost of revenue: Product Service Total cost of revenue Gross profit Operating expenses: Selling, general and administrative Research and development Total operating expenses ncome from operations nterest and other income, net ncome before taxes ncome tax expense Net income Less: net income attributable to noncontrolling interest in joint venture Net income attributable to Intuitive Surgical, Inc. et income per share attributable to Intuitive Surgical, Inc.: Basic Diluted Shares used in computing net income per share attributable to Intuitive Surgical, Inc.: Basic Diluted ſotal comprehensive income attributable to Intuitive Surgical, Inc. S S S S 2021 4,793.9 916.2 5,710.1 1,464.1 287.5 1,751.6 3,958.5 1,466.5 671.0 2,137.5 1,821.0 69.3 S 1,890.3 162.2 1,728.1 23.5 1,704.6 S 4.79 S 4.66 S 356.1 365.8 1,655.5 S 2020 3,634.6 S 723.8 4,358.4 1.230.3 266.9 1,497.2 2,861.2 1,216.3 595.1 1,811.4 1,049.8 157.2 1,207.0 140.2 1,066.8 6.2 1,060.6 S 3.02 S 2.94 S 351.1 361.0 1,073.1 S 2019 3,754.3 724.2 4,478.5 1,119.1 249.2 1,368.3 3,110.2 1,178.4 557.3 1,735.7 1,374.5 127.7 1,502.2 120.4 1,381.8 2.5 1,379.3 3.98 3.85 346.2 ↑ 1,405.0

Revenue: Product Service Total revenue Cost of revenue: Product Service Total cost of revenue Gross profit Operating expenses: Selling, general and administrative Research and development Total operating expenses ncome from operations nterest and other income, net ncome before taxes ncome tax expense Net income Less: net income attributable to noncontrolling interest in joint venture Net income attributable to Intuitive Surgical, Inc. et income per share attributable to Intuitive Surgical, Inc.: Basic Diluted Shares used in computing net income per share attributable to Intuitive Surgical, Inc.: Basic Diluted ſotal comprehensive income attributable to Intuitive Surgical, Inc. S S S S 2021 4,793.9 916.2 5,710.1 1,464.1 287.5 1,751.6 3,958.5 1,466.5 671.0 2,137.5 1,821.0 69.3 S 1,890.3 162.2 1,728.1 23.5 1,704.6 S 4.79 S 4.66 S 356.1 365.8 1,655.5 S 2020 3,634.6 S 723.8 4,358.4 1.230.3 266.9 1,497.2 2,861.2 1,216.3 595.1 1,811.4 1,049.8 157.2 1,207.0 140.2 1,066.8 6.2 1,060.6 S 3.02 S 2.94 S 351.1 361.0 1,073.1 S 2019 3,754.3 724.2 4,478.5 1,119.1 249.2 1,368.3 3,110.2 1,178.4 557.3 1,735.7 1,374.5 127.7 1,502.2 120.4 1,381.8 2.5 1,379.3 3.98 3.85 346.2 ↑ 1,405.0

Chapter9: Responsibility Accounting And Decentralization

Section: Chapter Questions

Problem 6PA: Using the information from BDS Enterprises, prepare the income statement to include all costs, but...

Related questions

Question

How do I make a tabular format, to provide the revenues, gross profit, income from operations, net income, and earnings per share for the most recent three fiscal years. For the two most recent fiscal years, compute and indicate the annual percentage growth (or decline) in each of these numbers?

Transcribed Image Text:Revenue:

Product

Service

Total revenue

Cost of revenue:

Product

Service

Total cost of revenue

Gross profit

Operating expenses:

Selling, general and administrative

Research and development

Total operating expenses

Income from operations

Interest and other income, net

Income before taxes

Income tax expense

Net income

Less: net income attributable to noncontrolling interest in joint venture

Net income attributable to Intuitive Surgical, Inc.

Net income per share attributable to Intuitive Surgical, Inc.:

Basic

Diluted

Shares used in computing net income per share attributable to Intuitive Surgical, Inc.:

Basic

Diluted

Total comprehensive income attributable to Intuitive Surgical, Inc.

S

S

$

$

S

2021

4,793.9 S

916.2

5,710.1

1,464.1

287.5

1,751.6

3,958.5

1,466.5

671.0

2,137.5

1,821.0

69.3

1,890.3

162.2

1,728.1

23.5

1,704.6 S

4.79 S

4.66 $

356.1

365.8

1,655.5 S

Years Ended December 31,

2020

3,634.6 S

723.8

4,358.4

1,230.3

266.9

1,497.2

2,861.2

1,216.3

595.1

1,811.4

1,049.8

157.2

1,207.0

140.2

1,066.8

6.2

1,060.6 S

3.02

S

2.94 S

351.1

361.0

1,073.1

S

2019

3,754.3

724.2

4,478.5

1,119.1

249.2

1,368.3

3,110.2

1,178.4

557.3

1,735.7

1,374.5

127.7

1,502.2

120.4

1,381.8

2.5

1,379.3

3.98

3.85

346.2

个

1,405.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning