Reviewing GM's financial information in GM Exhibit 1 and its stock price in GM Exhibit 2, when do you first see signs of GM's impending financial distress? In referencing professional standards, what factors should auditors consider in evaluating potential going-concern uncertainties? Using you responses above, do you beleive that the going-concern uncertainty was warranted? Do you beleive that Deloitte & Touche should have issued a going-concern opinion prior to 2008?

Reviewing GM's financial information in GM Exhibit 1 and its stock price in GM Exhibit 2, when do you first see signs of GM's impending financial distress? In referencing professional standards, what factors should auditors consider in evaluating potential going-concern uncertainties? Using you responses above, do you beleive that the going-concern uncertainty was warranted? Do you beleive that Deloitte & Touche should have issued a going-concern opinion prior to 2008?

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 1A: Costco is the largest chain of membership warehouse clubs in the world based on sales volume, and it...

Related questions

Question

Reviewing GM's financial information in GM Exhibit 1 and its stock price in GM Exhibit 2, when do you first see signs of GM's impending financial distress? In referencing professional standards, what factors should auditors consider in evaluating potential going-concern uncertainties? Using you responses above, do you beleive that the going-concern uncertainty was warranted? Do you beleive that Deloitte & Touche should have issued a going-concern opinion prior to 2008?

Transcribed Image Text:GM: Running on Empty?

Founded in 1908, General Motors Corp. (GM) is truly an iconic American corporation. From 1931 through 2008, GM was the world's

largest automobile manufacturer, and in 1955, it became the first company in any industry to report more than $1 billion in revenues.

GM's market share peaked at 51 percent in 1962. GM's domination in the market was such that many recommended the company be

subject to scrutiny under antitrust laws. In 1971, former President Lyndon Johnson made the statement "now what's good for General

Motors really is good for America."1

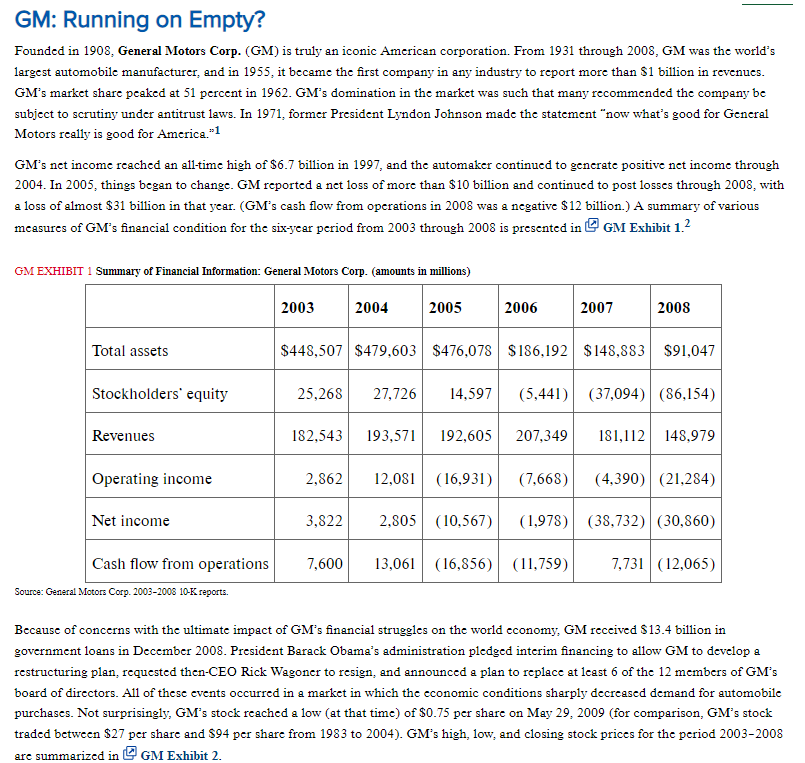

GM's net income reached an all-time high of $6.7 billion in 1997, and the automaker continued to generate positive net income through

2004. In 2005, things began to change. GM reported a net loss of more than $10 billion and continued to post losses through 2008, with

a loss of almost $31 billion in that year. (GM's cash flow from operations in 2008 was a negative $12 billion.) A summary of various

measures of GM's financial condition for the six-year period from 2003 through 2008 is presented in GM Exhibit 1.²

GM EXHIBIT 1 Summary of Financial Information: General Motors Corp. (amounts in millions)

2003

2004

2005

2006

2007

2008

Total assets

$448,507 $479,603 $476,078 $186,192 $148,883 $91,047

Stockholders' equity

25,268 27,726

14,597

(5,441) (37,094) (86,154)

Revenues

182,543 193,571 192,605

207,349 181,112 148,979

Operating income

2,862 12,081 (16,931)

(7,668) (4,390) (21,284)

Net income

3,822

2,805 (10,567)

(1,978) (38,732) (30,860)

7,731 (12,065)

7,600

13,061 (16,856) (11,759)

Cash flow from operations

Source: General Motors Corp. 2003-2008 10-K reports.

Because of concerns with the ultimate impact of GM's financial struggles on the world economy, GM received $13.4 billion in

government loans in December 2008. President Barack Obama's administration pledged interim financing to allow GM to develop a

restructuring plan, requested then-CEO Rick Wagoner to resign, and announced a plan to replace at least 6 of the 12 members of GM's

board of directors. All of these events occurred in a market in which the economic conditions sharply decreased demand for automobile

purchases. Not surprisingly, GM's stock reached a low (at that time) of $0.75 per share on May 29, 2009 (for comparison, GM's stock

traded between $27 per share and $94 per share from 1983 to 2004). GM's high, low, and closing stock prices for the period 2003-2008

are summarized in GM Exhibit 2.

![GM EXHIBIT 2 Annual High, Low, and Closing Stock Prices: General Motors Corp.

$60.00

$50.00

$40.00

$30.00

Close

High

$20.00

Low

$10.00

$0.00

2003

2004

2005

2006

2007

2008

Source: Wharton Research Data Services.

In its March 4, 2009, report on GM's financial statements, GM's auditors (Deloitte & Touche) concluded that GM's financial statements

were fairly presented in conformity with GAAP. However, Deloitte expanded its report to include the following paragraph to

recognize uncertainties regarding GM's ability to continue as a going concern:

Page C12

The accompanying consolidated financial statements for the year ended December 31, 2008, have been prepared assuming that the

Corporation [GM] will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Corporation's

recurring losses from operations, stockholders' deficit, and inability to generate sufficient cash flow to meet its obligations and sustain its

operations raise substantial doubt about its ability to continue as a going concern. Management's plans concerning these matters are also

discussed in Note 2 to the consolidated financial statements. The consolidated financial statements do not include any adjustments that might

result from the outcome of this uncertainty.

GM'S REORGANIZATION

In April 2009, GM's Chief Executive Officer Frederick "Fritz" Henderson (who succeeded Rick Wagoner) created a restructuring plan to

save GM. Under this plan, the debt owed to unsecured bondholders, the United Auto Workers, and the U.S. government (which totaled

$74.4 billion across the three groups) would be reduced by $44.6 billion in exchange for a 99 percent interest in the emerging company. In

addition, the terms of this plan called for the closure of 42 percent of GM's dealers.3

On June 1, 2009, the once unthinkable happened: GM filed for Chapter 11 bankruptcy. Under the terms of the bankruptcy plan, two

entities were created: an "old GM" (subsequently named Motors Liquidation Company), a public company that owns four brands in the

process of being phased out (Hummer, Saab, Pontiac, and Saturn), and a "new GM," a private company that is majority owned by the

U.S. government (a 60 percent stake), with the Canadian government (11.7 percent), United Auto Workers (17.5 percent), and GM's

unsecured bondholders (10 percent) owning large minority stakes. The new GM (known as General Motors Co.) received the Buick,

Cadillac, Chevrolet, and GMC brands. General Motors Co. emerged from bankruptcy and began its operations on July 10, 2009, just 40

days after the filing. A brief profile of GM (the combined entity prebankruptcy) and General Motors Co. (the new GM that emerged

postbankruptcy) is shown in GM Exhibit 3.4](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F2ff98869-5a35-463a-bd6f-a779c9c5b4fe%2F5434b002-6b72-4f74-a64f-7227de552e4d%2F8px560f_processed.png&w=3840&q=75)

Transcribed Image Text:GM EXHIBIT 2 Annual High, Low, and Closing Stock Prices: General Motors Corp.

$60.00

$50.00

$40.00

$30.00

Close

High

$20.00

Low

$10.00

$0.00

2003

2004

2005

2006

2007

2008

Source: Wharton Research Data Services.

In its March 4, 2009, report on GM's financial statements, GM's auditors (Deloitte & Touche) concluded that GM's financial statements

were fairly presented in conformity with GAAP. However, Deloitte expanded its report to include the following paragraph to

recognize uncertainties regarding GM's ability to continue as a going concern:

Page C12

The accompanying consolidated financial statements for the year ended December 31, 2008, have been prepared assuming that the

Corporation [GM] will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Corporation's

recurring losses from operations, stockholders' deficit, and inability to generate sufficient cash flow to meet its obligations and sustain its

operations raise substantial doubt about its ability to continue as a going concern. Management's plans concerning these matters are also

discussed in Note 2 to the consolidated financial statements. The consolidated financial statements do not include any adjustments that might

result from the outcome of this uncertainty.

GM'S REORGANIZATION

In April 2009, GM's Chief Executive Officer Frederick "Fritz" Henderson (who succeeded Rick Wagoner) created a restructuring plan to

save GM. Under this plan, the debt owed to unsecured bondholders, the United Auto Workers, and the U.S. government (which totaled

$74.4 billion across the three groups) would be reduced by $44.6 billion in exchange for a 99 percent interest in the emerging company. In

addition, the terms of this plan called for the closure of 42 percent of GM's dealers.3

On June 1, 2009, the once unthinkable happened: GM filed for Chapter 11 bankruptcy. Under the terms of the bankruptcy plan, two

entities were created: an "old GM" (subsequently named Motors Liquidation Company), a public company that owns four brands in the

process of being phased out (Hummer, Saab, Pontiac, and Saturn), and a "new GM," a private company that is majority owned by the

U.S. government (a 60 percent stake), with the Canadian government (11.7 percent), United Auto Workers (17.5 percent), and GM's

unsecured bondholders (10 percent) owning large minority stakes. The new GM (known as General Motors Co.) received the Buick,

Cadillac, Chevrolet, and GMC brands. General Motors Co. emerged from bankruptcy and began its operations on July 10, 2009, just 40

days after the filing. A brief profile of GM (the combined entity prebankruptcy) and General Motors Co. (the new GM that emerged

postbankruptcy) is shown in GM Exhibit 3.4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub