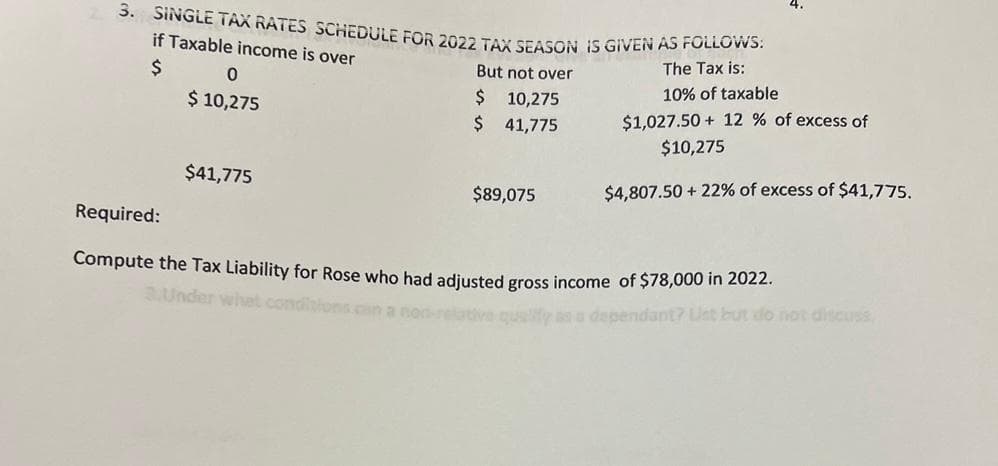

23. SINGLE TAX RATES SCHEDULE FOR 2022 TAX SEASON IS GIVEN AS FOLLOWS: if Taxable income is over $ But not over The Tax is: 10% of taxable $ $ $1,027.50 +12 % of excess of $10,275 $4,807.50 +22% of excess of $41,775. 0 $ 10,275 $41,775 10,275 41,775 $89,075 Required: Compute the Tax Liability for Rose who had adjusted gross income of $78,000 in 2022. 3.Under what conditions can a no dependant? Ust but do not discuss,

23. SINGLE TAX RATES SCHEDULE FOR 2022 TAX SEASON IS GIVEN AS FOLLOWS: if Taxable income is over $ But not over The Tax is: 10% of taxable $ $ $1,027.50 +12 % of excess of $10,275 $4,807.50 +22% of excess of $41,775. 0 $ 10,275 $41,775 10,275 41,775 $89,075 Required: Compute the Tax Liability for Rose who had adjusted gross income of $78,000 in 2022. 3.Under what conditions can a no dependant? Ust but do not discuss,

Chapter8: Consolidated Tax Returns

Section: Chapter Questions

Problem 35P

Related questions

Question

Please Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Please Thanks In Advance ?

Transcribed Image Text:3. SINGLE TAX RATES SCHEDULE FOR 2022 TAX SEASON IS GIVEN AS FOLLOWS:

if Taxable income is over

But not over

$

$

$

0

$ 10,275

$41,775

10,275

41,775

$89,075

The Tax is:

10% of taxable

$1,027.50 12 % of excess of

$10,275

$4,807.50 +22% of excess of $41,775.

Required:

Compute the Tax Liability for Rose who had adjusted gross income of $78,000 in 2022.

3.Under what cond

ndant? List but do not discuss,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT