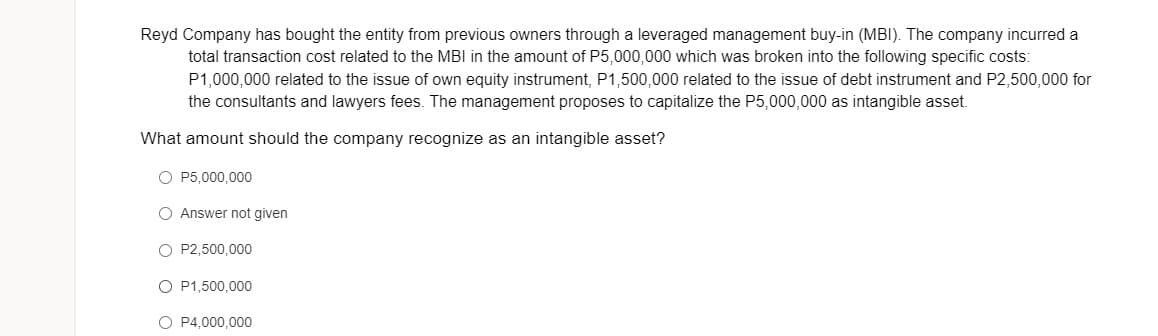

Reyd Company has bought the entity from previous owners through a leveraged management buy-in (MBI). The company incurred a total transaction cost related to the MBI in the amount of P5,000,000 which was broken into the following specific costs: P1,000,000 related to the issue of own equity instrument, P1,500,000 related to the issue of debt instrument and P2,500,000 for the consultants and lawyers fees. The management proposes to capitalize the P5,000,000 as intangible asset. What amount should the company recognize as an intangible asset? O P5,000,000 O Answer not given O P2,500,000 O P1,500,000 O P4,000,000

Reyd Company has bought the entity from previous owners through a leveraged management buy-in (MBI). The company incurred a total transaction cost related to the MBI in the amount of P5,000,000 which was broken into the following specific costs: P1,000,000 related to the issue of own equity instrument, P1,500,000 related to the issue of debt instrument and P2,500,000 for the consultants and lawyers fees. The management proposes to capitalize the P5,000,000 as intangible asset. What amount should the company recognize as an intangible asset? O P5,000,000 O Answer not given O P2,500,000 O P1,500,000 O P4,000,000

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:Reyd Company has bought the entity from previous owners through a leveraged management buy-in (MBI). The company incurred a

total transaction cost related to the MBI in the amount of P5,000,000 which was broken into the following specific costs:

P1,000,000 related to the issue of own equity instrument, P1,500,000 related to the issue of debt instrument and P2,500,000 for

the consultants and lawyers fees. The management proposes to capitalize the P5,000,000 as intangible asset.

What amount should the company recognize as an intangible asset?

O P5,000,000

O Answer not given

O P2,500,000

O P1,500,000

O P4,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you