Reynolds buys building (10 year useful life ) on January 1, 2019 for $1,000,000. Straight line depreciation is used. On the same day, Reynolds s building to 90% owned subsidiary for $1,200,000. Subsidiary also uses a remaining useful life of 10 years. What is the appropriate worksheet emm for "excess depreciation" that must be prepared at December 31, 2019? O Dr. Depreciation Expense $120,000. Cr. Accumulated Depreciation $120,000 O Dr. Depreciation Expense $20,000. Cr. Accumulated Depreciation $20,000 O Dr. Accumulated Depreciation $20,000 Cr. Depreciation Expense $20,000

Reynolds buys building (10 year useful life ) on January 1, 2019 for $1,000,000. Straight line depreciation is used. On the same day, Reynolds s building to 90% owned subsidiary for $1,200,000. Subsidiary also uses a remaining useful life of 10 years. What is the appropriate worksheet emm for "excess depreciation" that must be prepared at December 31, 2019? O Dr. Depreciation Expense $120,000. Cr. Accumulated Depreciation $120,000 O Dr. Depreciation Expense $20,000. Cr. Accumulated Depreciation $20,000 O Dr. Accumulated Depreciation $20,000 Cr. Depreciation Expense $20,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 11E: On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated...

Related questions

Question

Transcribed Image Text:in

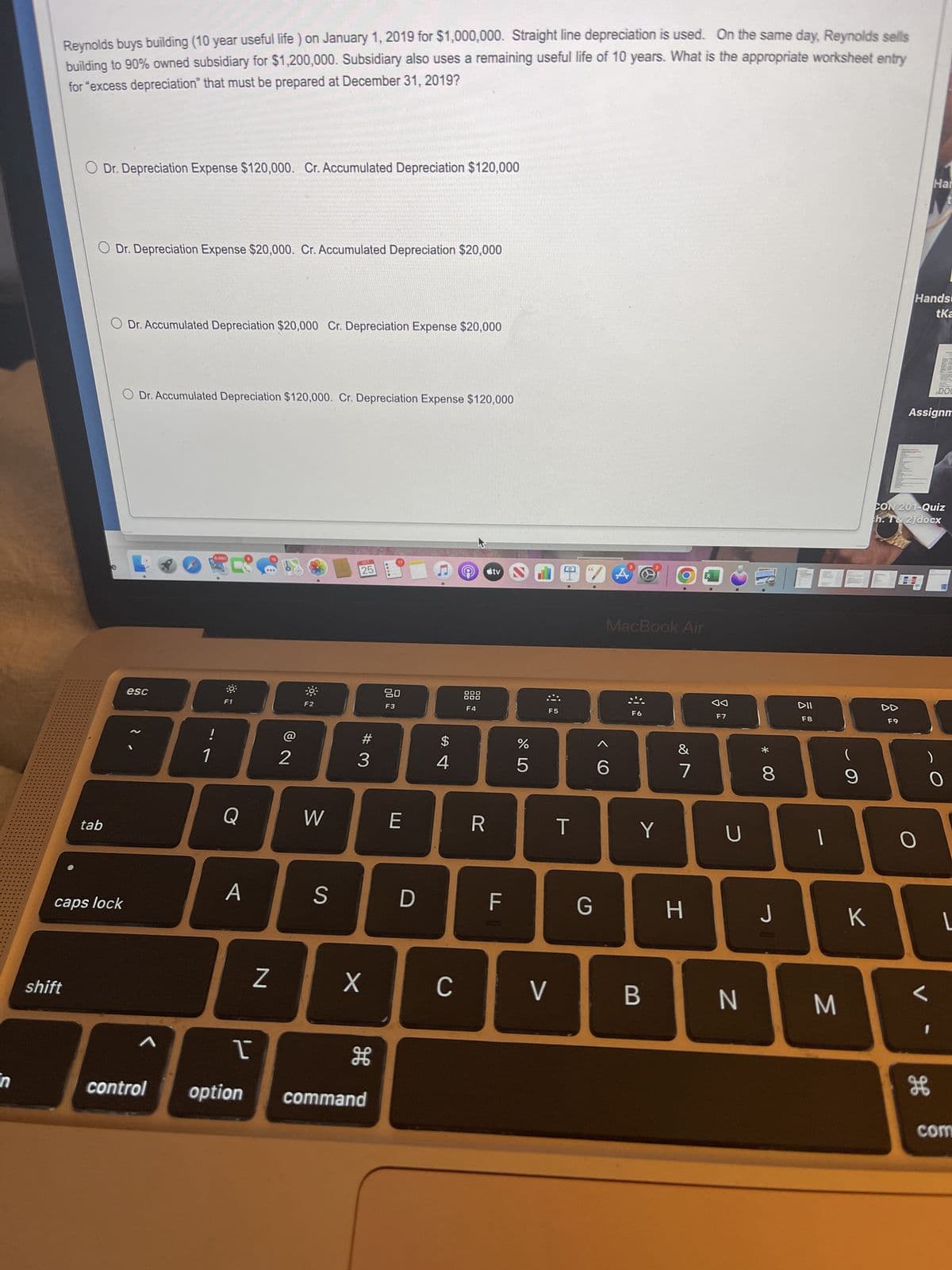

Reynolds buys building (10 year useful life) on January 1, 2019 for $1,000,000. Straight line depreciation is used. On the same day, Reynolds sells

building to 90% owned subsidiary for $1,200,000. Subsidiary also uses a remaining useful life of 10 years. What is the appropriate worksheet entry

for "excess depreciation" that must be prepared at December 31, 2019?

shift

O Dr. Depreciation Expense $120,000. Cr. Accumulated Depreciation $120,000

O Dr. Depreciation Expense $20,000. Cr. Accumulated Depreciation $20,000

tab

O Dr. Accumulated Depreciation $20,000 Cr. Depreciation Expense $20,000

caps lock

O Dr. Accumulated Depreciation $120,000. Cr. Depreciation Expense $120,000

esc

1

9,680

!

1

Q

A

T

control option

Z

72

W

S

OCT

25

#3

X

H

command

80

F3

E

D

$

4

с

160

000

000

F4

R

tv

F

175⁰

%

F5

V

T

G

<CO

A

MacBook Air

6

www

F6

Y

B

&

7

H

F7

U

N

* 00

8

J

DII

F8

M

(

9

K

DD

F9

Hands

tKa

Har

Assignm

CON 201-Quiz

h. T& 2)docx

O

)

DOC

L

K

0

L

com

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning