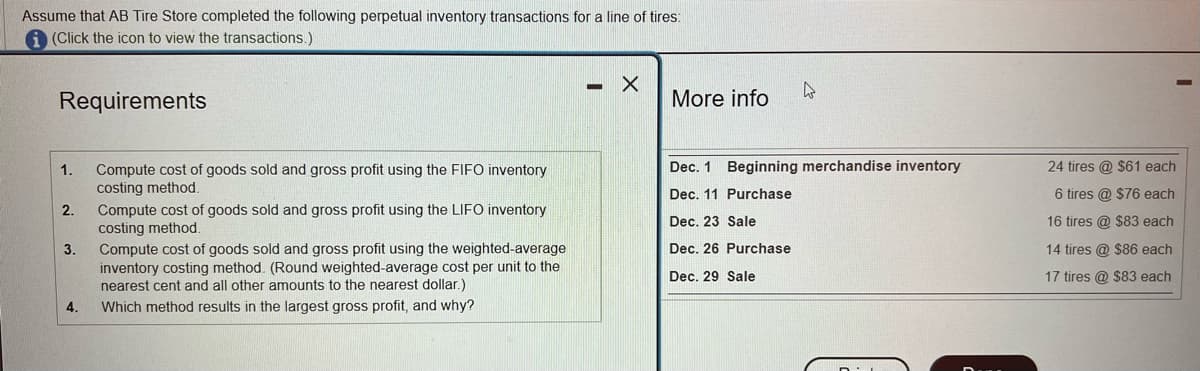

Assume that AB Tire Store completed the following perpetual inventory transactions for a line of tires: (Click the icon to view the transactions.) Requirements 1. 2. 3. Compute cost of goods sold and gross profit using the FIFO inventory costing method. Compute cost of goods sold and gross profit using the LIFO inventory costing method. Compute cost of goods sold and gross profit using the weighted-average inventory costing method. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) - X More info 4 Dec. 1 Beginning merchandise inventory Dec. 11 Purchase Dec. 23 Sale Dec. 26 Purchase Dec. 29 Sale 24 tires @ $61 each 6 tires @ $76 each 16 tires @ $83 each 14 tires @ $86 each 17 tires @ $83 each

Assume that AB Tire Store completed the following perpetual inventory transactions for a line of tires: (Click the icon to view the transactions.) Requirements 1. 2. 3. Compute cost of goods sold and gross profit using the FIFO inventory costing method. Compute cost of goods sold and gross profit using the LIFO inventory costing method. Compute cost of goods sold and gross profit using the weighted-average inventory costing method. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) - X More info 4 Dec. 1 Beginning merchandise inventory Dec. 11 Purchase Dec. 23 Sale Dec. 26 Purchase Dec. 29 Sale 24 tires @ $61 each 6 tires @ $76 each 16 tires @ $83 each 14 tires @ $86 each 17 tires @ $83 each

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 67APSA: Inventory Costing Methods Andersons Department Store has the following data for inventory,...

Related questions

Question

Transcribed Image Text:Assume that AB Tire Store completed the following perpetual inventory transactions for a line of tires:

(Click the icon to view the transactions.)

Requirements

1.

2.

3.

4.

Compute cost of goods sold and gross profit using the FIFO inventory

costing method.

Compute cost of goods sold and gross profit using the LIFO inventory

costing method.

Compute cost of goods sold and gross profit using the weighted-average

inventory costing method. (Round weighted-average cost per unit to the

nearest cent and all other amounts to the nearest dollar.)

Which method results in the largest gross profit, and why?

X

More info

4

Dec. 1 Beginning merchandise inventory

Dec. 11 Purchase

Dec. 23 Sale

Dec. 26 Purchase

Dec. 29 Sale

24 tires @ $61 each

6 tires @ $76 each

16 tires @ $83 each

14 tires @ $86 each

17 tires @ $83 each

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College